Binance, the world’s largest cryptocurrency exchange, is moving to put a stop to trading of Terraform Labs’ Terra (Luna) and TerraUSD (UST) tokens on its platform following one of the industry’s biggest meltdowns.

The exchange indefinitely suspended the trading of Luna and UST across most of its spot pairs Thursday evening after the tokens lost nearly 100% of their value in a span of days. Additionally, it is freezing Luna trading across all of cross margins and isolated margins pairs.

The move, which follows the exchange pulling support for trading of futures contracts for the Luna token earlier on Thursday, comes as Terraform Labs has increased the circulating supply of Luna tokens to over 6.5 trillion, up from 386 million three days ago (according to Terrascope, a tool that tracks Terra stats) in an attempt to push its sister token, a supposed stablecoin, to regain its 1-to-1 peg to the dollar.

Update: Shortly after the publication of this story, Terraform Labs said it has halted the Terra blockchain and is working to “come up with a plan to reconstitute it.” It’s the second time the Terra blockchain has been frozen today. Earlier on Thursday, Terraform Labs briefly halted the network to prevent any hacks.

TerraUSD, a so-called algorithmic stablecoin, aims to be a substitute for the dollar by intertwining with Luna, which has no fixed value. The plan is that if the value of TerraUSD tumbles below $1, it could be “burned” and exchanged for a dollar’s worth of Luna, and vice versa.

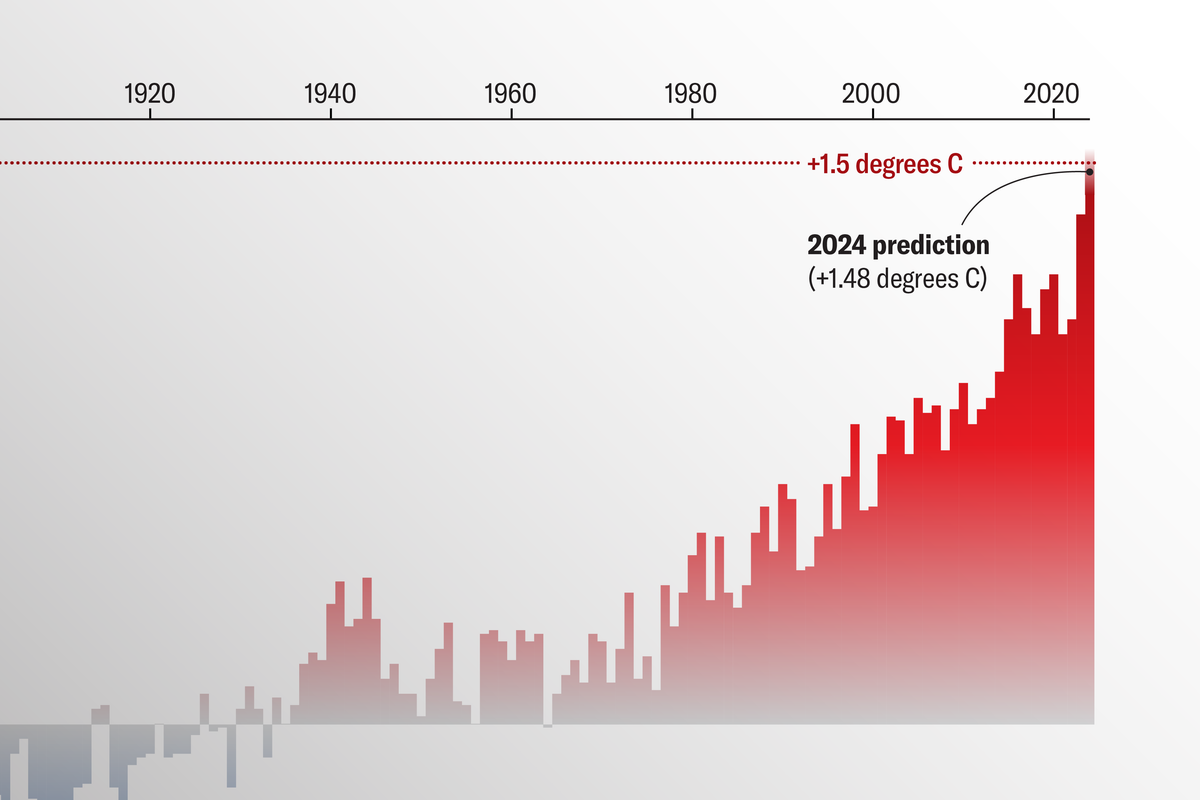

But when TerraUSD fell below $1 earlier this week, a reason of which is yet to be confirmed, that algorithmic plan was put to test and collapsed.

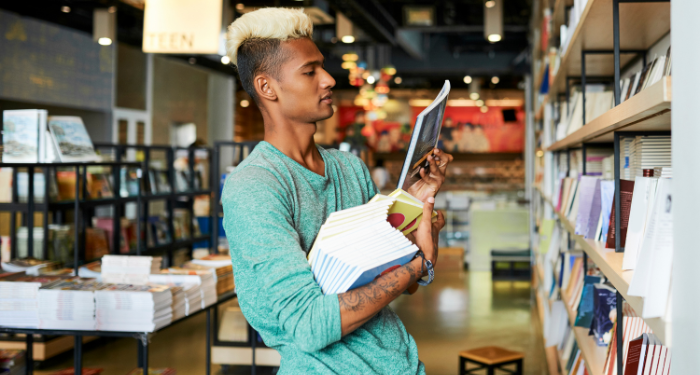

The loss of faith from the crypto community and aggressive panic selling prompted the price of Luna to nosedive to $0.0000011, from about $80 earlier this week. The value of UST was 3 cents at the time of publication.

Terraform Labs has been scrambling to find ways — including reportedly trying to raise money — to resolve the situation, but so far it has had no luck.

The change in value of UST this week. (Image and data: Binance)