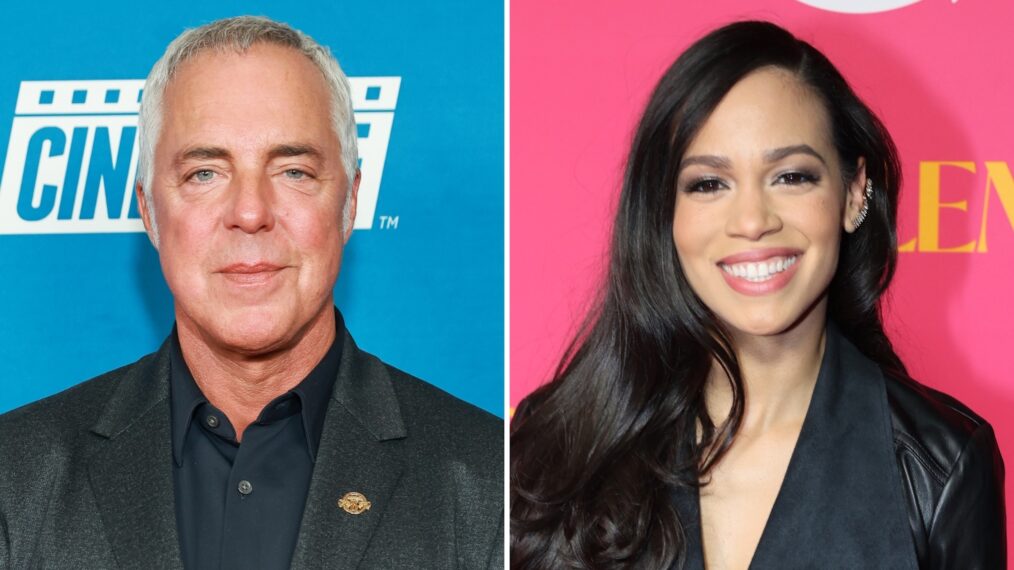

BMG CEO Thomas Coesfeld says taking his company’s digital distribution in-house and operational changes — two initiatives launched during his first year at the helm — are paying off.

The Berlin-based music company reported on Wednesday (Aug. 28) that it generated 459 million euros ($491.7 million) in revenue in the first half of 2024, marking an 11.1% increase from the year-ago period thanks to strong growth in digital income streams. Digital revenue, which contributed nearly 70% of BMG’s overall revenue for the period, rose 20.3% in the first half 2024 compared to 2023, as BMG exited a contract with Warner Music Group (WMG) and moved oversight of its digital distribution business in-house.

“This move is paying off,” Coesfeld tells Billboard of taking control of BMG’s 80-billion stream digital business. BMG now has greater insight into its streaming data, which enables it to provide “better marketing insights, more timely campaigning and iterations of that campaign [and] better tools around fandom” to its artists, who include Jelly Roll, Kylie Minogue and Mustard, Coesfeld says. Also, BMG saves money not paying fees to WMG’s ADA.

“One or two years ago we had this plan, we said this is what will happen,” Coesfeld adds. “And [these earnings] show it works.”

BMG’s first-half organic revenues grew by 12.5% while operating earnings before interest, taxes, depreciation and amortization (EBITDA) — a closely watched measure of growth — rose by 35.5% to 122 million euros ($130.7 million). EBITDA margin was 26.5%, up from 21.7% in the first six months of 2023. BMG’s catalogs again underpinned that margin figure, as the company acquired 10 catalogs during the first half of the year. Details of those deals were not disclosed.

The close of the first six months of 2024 coincided with the end of Coesfeld’s first year as CEO. After taking the reins of BMG from longtime CEO Hartwig Masuch on July 1, 2023, Coesfeld has set a tone that communicates BMG is open to change, even if it means taking advantage of artificial intelligence and collaboration with historic rivals.

“We figured only if we anticipate trends a little earlier do we have a chance to win in this very competitive market,” Coesfeld says. “We are looking at a fundamentally attractive market that is growing. It is driven by tech and if we adopt it and don’t fight it there is huge opportunity for BMG and artists.”

One example of this approach is BMG’s partnership with a generative AI lab at Munich’s Technical University, through which they have successfully launched a pilot program that uses gen-AI to market BMG’s deep catalog. Students at the lab generated short videos that have proven to be more cost efficient and effective at getting the audience to engage with the music.

Last fall, BMG also began a structural reorganization that included letting go of around 40 employees. It was a “tough period… but a business necessity” and part of a broader strategy meant to help the company respond quickly to industry trends, Coesfeld says.

“The operational changes, which we enacted — digital distribution, better able to monetize our repertoire and catalogs and our reorg, which is complete, is making us way more agile and faster in delivering our service and making decisions,” he adds. “We are much more agile on a day-to-day.”