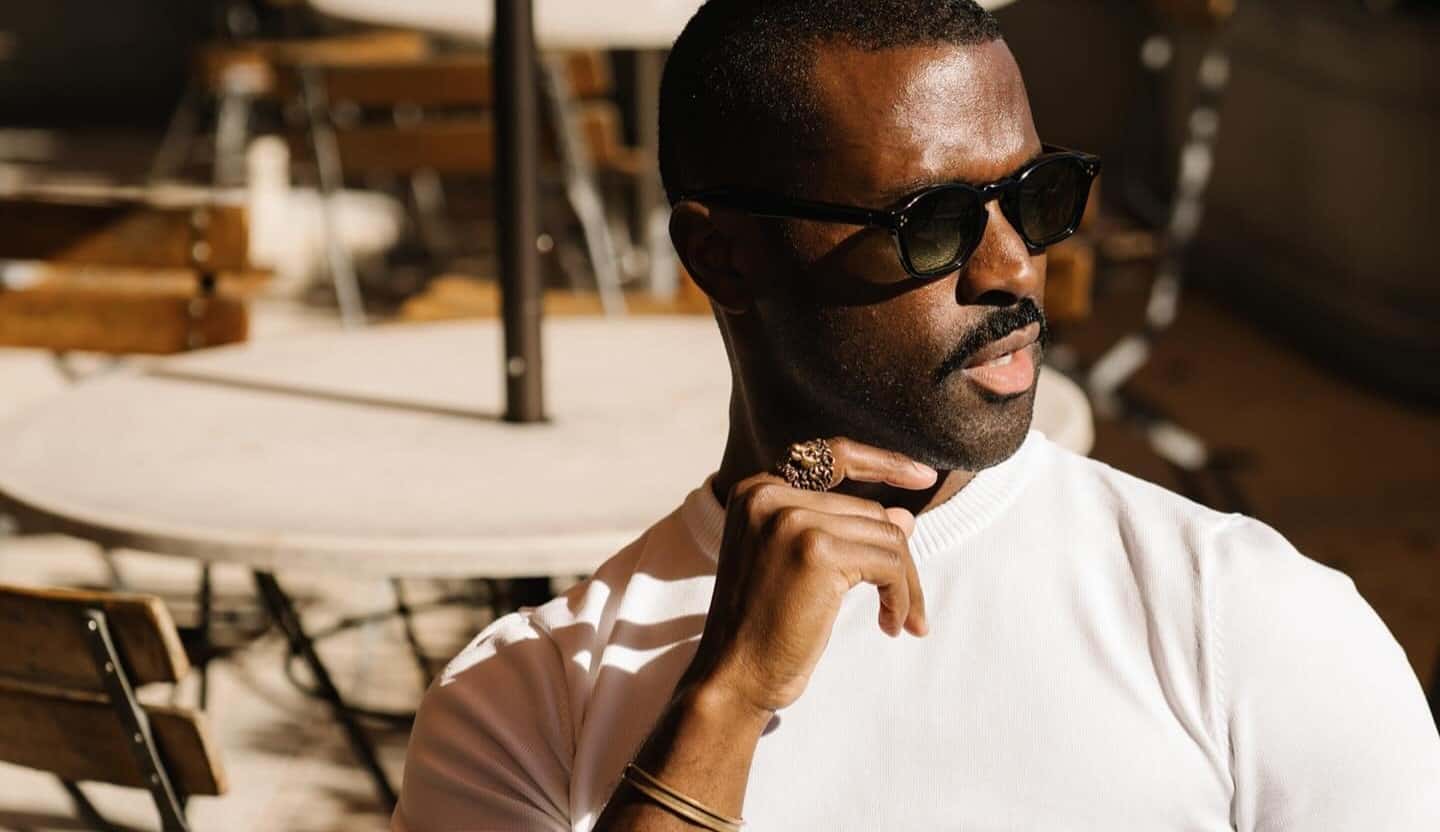

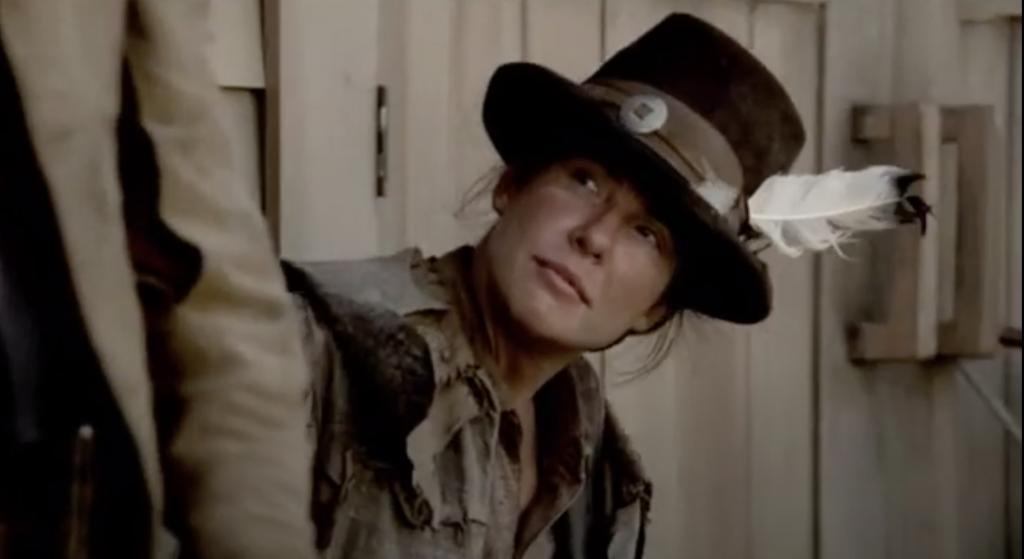

Brad Garlinghouse, chief executive officer of Ripple Labs Inc., speaks during the Token2049 conference in Singapore, on Wednesday, Sept. 13, 2023.

Joseph Nair | Bloomberg | Getty Images

The CEO of blockchain company Ripple has some strong words for the U.S. Securities and Exchange Commission.

Brad Garlinghouse told CNBC’s Dan Murphy at the company’s Ripple Swell conference in Dubai that he thinks the agency has lost sight of one of its key tasks as a regulator.

“I think the SEC, in my opinion, has lost sight of their mission to protect investors. And the question is, who are they protecting in this journey?” Garlinghouse said Thursday. The SEC was not immediately available for comment when contacted by CNBC.

The SEC in 2020 accused Ripple and its executives of conducting a $1.3 billion securities fraud via sales of XRP to retail investors. Ripple, the regulator alleged, failed to register an ongoing offer and sale of billions of XRP tokens to investors, depriving them of adequate disclosures about XRP and Ripple’s business.

In July, Ripple was handed a pivotal victory as a judge ruled that XRP is not in and of itself a security. Following this, the SEC was denied a request for an interlocutory appeal. Then, in October, the SEC dropped its securities law violation charges against Garlinghouse and Ripple executive Chris Larsen.

The next key step in the case is the remedies discovery process. The SEC has 90 days from Nov. 9 to conduct remedies-related discovery, according to a proposed schedule submitted by the SEC.

“I think it is a positive step for the industry, not just for Ripple, not just for Chris and Brad, but for the whole industry, that the SEC has been put in check in the United States. And I’m hopeful this will be a thawing of the permafrost in the United States for really seeing an amazing industry that has immense potential thrive in the largest economy in the world,” Garlinghouse told CNBC.

Garlinghouse hopes that the U.S. will move beyond a situation where crypto regulation is dictated by a constant stream of litigation to a point where federal laws governing digital currencies are introduced by Congress.

“One of the things that people talk about is, one of the definitions of insanity is doing the same thing over and over again, and thinking you’ll get a different outcome, the SEC is doing the same thing over and over again. And they think, I guess, they’re gonna get a different outcome at some point,” Garlinghouse continued.

“[Digital asset manager] Grayscale also had, I think, an important victory in the United States about the bitcoin ETF, where the judge had to get, a federal judge talking about a federal agency, the SEC, saying the SEC is being arbitrary and capricious,” he added, referencing an appeals court ruling that said the SEC was wrong to reject an application from Grayscale to create a bitcoin ETF.

“Generally, judges tend to be pretty down the middle and try to not be dramatic — those are damning words. So I think at some point, the SEC has to step back and realize that their approach of regulation through enforcement, let’s just bring lawsuits, that has to break.”

What is Ripple?

Ripple is a payments company that specializes in cross-border money transfers through the blockchain, a distributed database that records transactions across multiple computers. The company’s RippleNet network is used by financial institutions to send funds from one country to another.

Ripple also leverages XRP, a cryptocurrency, to make cross-border payments. The XRP token, which has become commonly associated with Ripple the company, is meant to act as a kind of “bridge” currency between one fiat currency and another as those transactions flow across countries.

So, say you want to send some money from the U.S. to Mexico. Ripple’s technology lets you do that by converting the U.S. dollars into XRP, transferring the XRP over to Mexico, and then converting it into Mexican pesos on the other side.

By doing so, Ripple says, you don’t need to have pre-funded accounts on the other side of a cross-border transaction in order to get that money.

That’s the business case for XRP from Ripple’s point of view. But XRP in its most common usage is ultimately a token that investors speculate on. And when its price dropped like a stone — like other cryptocurrencies — in the 2018 crypto bear market, regulators got concerned about the impact of these digital currencies on retail investors.

In Ripple’s case, unlike bitcoin, the cryptocurrency is predominantly owned by Ripple, which holds a huge amount of XRP in an escrow account and releases tokens on a quarterly basis to a mix of institutional investors and retail investors via sales on cryptocurrency exchanges. This is a big part of how Ripple makes money.

That has been a big point of contention for the SEC as it pursues its case against Ripple. Ripple, for its part, maintains that XRP shouldn’t be considered a security and is more akin to a currency or commodity. Being designated a security would mean Ripple having to file lots of paperwork and disclosures with regulators, a process that could prove costly.