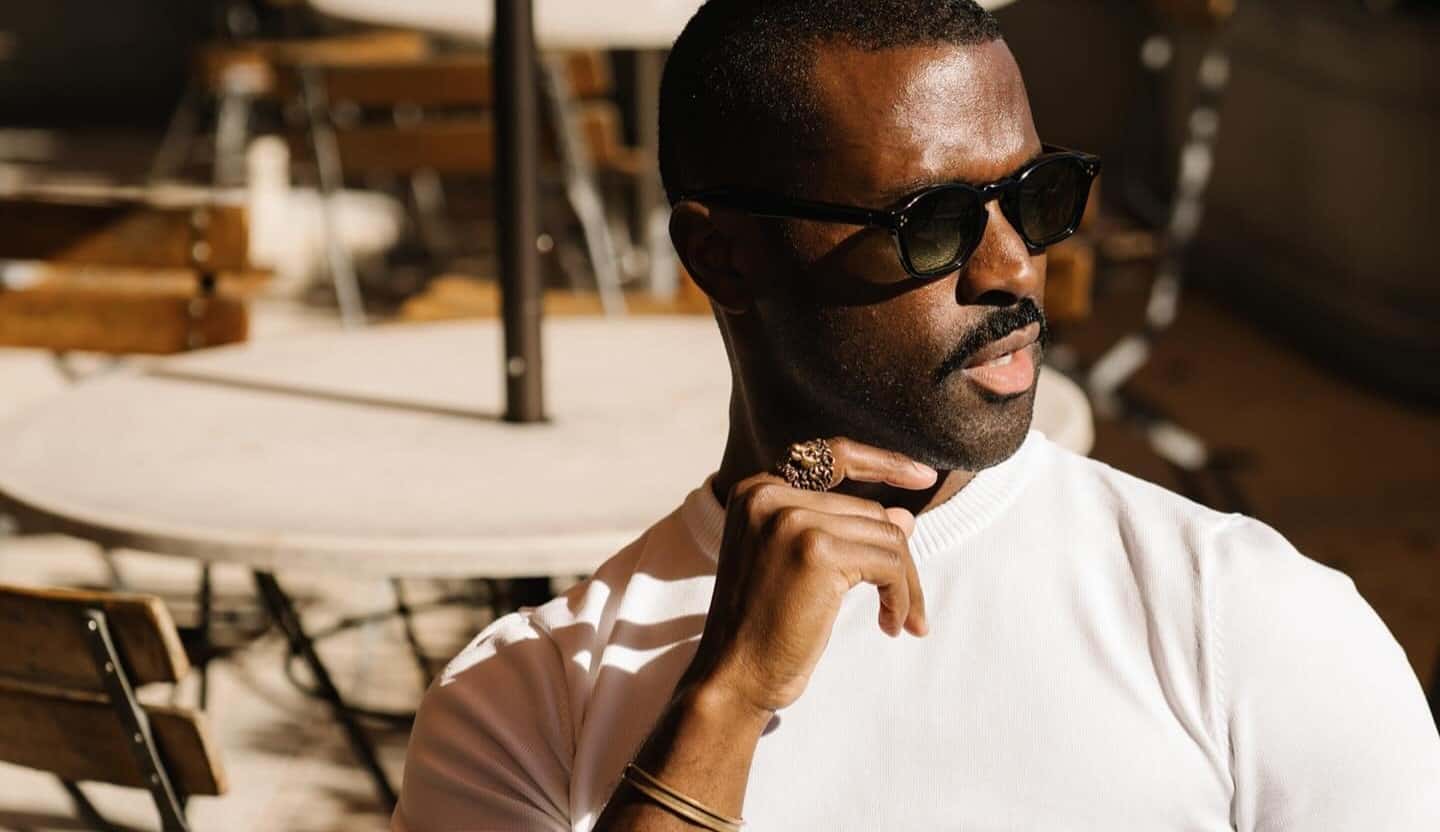

Dorothy K. Butler Lawrence is a top female lawyer in Texas. She is a very humble person, both with her clients and her colleagues. Dorothy makes herself available to both clients and colleagues whenever needed, which is what helped her maintain her Texas Rising Star status for seven consecutive years. Dorothy has incredible knowledge about every minute detail of bankruptcy, taxes, estate planning, business, and family and divorce law. It’s no wonder that Dorothy is officially, as per the New York Weekly Times, on the list of the top 10 most impactful females in 2022! Her sole reason for becoming a lawyer was to make a difference in the world. She launched her own law firm, the Dorothy Butler Law Firm, 11 years ago with the intention to help people attain and maintain functional lives.

One of the ways in which Dorothy continues helping people is by helping them deal with financial issues. This year her firm filed 186 property tax appeals, served 5 counties, and protested properties of over $100 million. For Dorothy working as a lawyer is what gives her life meaning and makes it colorful. She is very active when it comes to guiding parents about financial planning. She continuously educates parents about financial planning on her Instagram and Facebook pages.

Dorothy believes that parents make several mistakes when it comes to financial planning. The biggest mistake, she believes, is that parents don’t teach their kids financial literacy. Learning budgeting skills and using credit responsibly is not optional. She believes that parents should teach these skills to their kids as early as possible so that they can use these skills when they enter adulthood. The second most serious mistake, Dorothy highlights, is that parents fail to set up any sort of estate planning documents for the future. She strictly advises parents to create a comprehensive estate plan (including a Will, Powers of Attorney, and other important documents) to make sure that their assets pass on to their kids.

As a lawyer and financial expert, Dorothy believes that the best plan for long-term care is to consult with expert financial planners and maximize retirement savings. Apart from that, she believes that parents must have their financial and medical powers of attorney in place. These are very important documents that allow loved ones to assist parents (or guardians) in making decisions if they are not able to or do not want to make those decisions on their own. As parents reach retirement, they must have a competent financial planner and/or tax advisor by their side. She says that consulting financial planners and tax advisors on time is not only a great way of maximizing savings but also a great way of bringing them additional tax savings each year! Every parent should save for their children’s education, she says, and 529 college savings accounts are the best way to do so.

Retiring parents should try to maintain financial stability for themselves and their kids. Dorothy encourages parents to have their estate planning documents prepared so that they can enjoy retirement without worrying about the future. She offers estate planning services to all parents at the Dorothy Butler Law Firm. Dorothy also encourages parents to review the beneficiary designations on all of their financial accounts, including life insurance, bank, investment, and retirement accounts, to ensure that everything complies with their wishes. If you don’t do that, she says, your kids will be left paying much higher attorney fees to handle the final passing of assets.