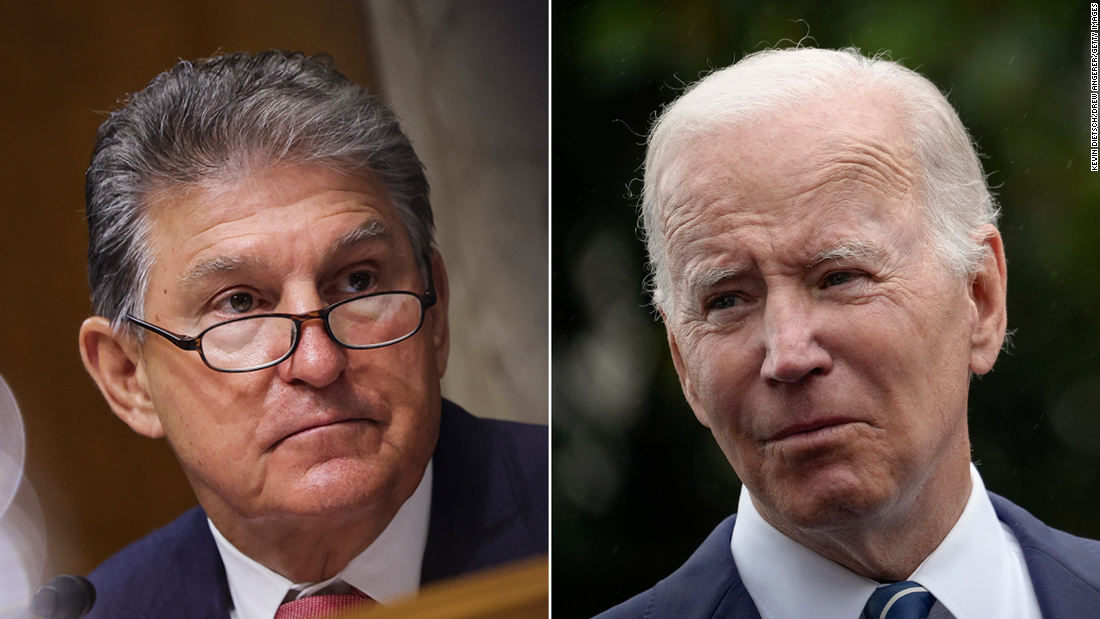

It won the critical support of Arizona Sen. Kyrsten Sinema, who demanded several changes be made. It now goes to the Democratic-controlled House for approval before President Joe Biden can sign it into law.

The latest version of the package would reduce the deficit by more than $300 billion over a decade, according to the Congressional Budget Office.

Here’s what’s in the bill:

The Congressional Budget Office had previously scored the drug price measures, saying they would reduce the federal deficit by a total of $288 billion over a decade.

However, Democrats are waiting on new cost estimates from CBO to see how the ruling affects their deficit projections. It’s likely that the parliamentarian’s decision would somewhat curtail the package’s deficit reduction.

Medicare drug price negotiation: The bill would empower Medicare to negotiate prices of certain costly medications administered in doctors’ offices or purchased at the pharmacy. The Health and Human Services secretary would negotiate the prices of 10 drugs in 2026, and another 15 drugs in 2027 and again in 2028. The number would rise to 20 drugs a year for 2029 and beyond.

This controversial provision is far more limited than the one House Democratic leaders have backed in the past. But it would open the door to fulfilling a longstanding party goal of allowing Medicare to use its heft to lower drug costs.

Inflation cap: The legislation would also impose penalties on drug companies if they increase their prices faster than inflation. However, the parliamentarian ruled that the provision could only apply to Medicare, not the private insurance market as well, as the Democrats had wanted.

Limit on Medicare out-of-pocket drug costs: The bill would redesign Medicare’s Part D drug plans so that seniors and people with disabilities wouldn’t pay more than $2,000 a year for medications bought at the pharmacy. Insurers and drugmakers would have to pick up more of the tab.

Free vaccines for seniors: Medicare enrollees would be able to get all vaccines at no cost. Right now, only certain vaccines, such as those for Covid-19, the flu and pneumonia, are free.

Affordable Care Act subsidies: Democrats are also looking at extending the enhanced federal premium subsidies for Obamacare coverage through 2025, a year later than lawmakers recently discussed. That way they wouldn’t expire just after the 2024 presidential election.

Enrollees pay no more than 8.5% of their income toward coverage, down from nearly 10%. And lower-income policyholders receive subsidies that eliminate their premiums completely.

Also, those earning more than 400% of the federal poverty level have become eligible for help for the first time.

If the enhanced federal assistance is allowed to expire at the end of the year, nearly all of the 13 million subsidized enrollees will see their premiums rise for 2023, according to the Kaiser Family Foundation. More than 3 million people could become uninsured, an Urban Institute analysis found.

Democrats are hoping to avoid the negative publicity of such premium increases. If Congress doesn’t act, consumers would learn in the fall just how much more they could have to pay. Open enrollment begins on November 1, a week ahead of Election Day.

Extending the enhanced subsidies would cost $64 billion, according to the CBO.

Cheaper insulin: Democrats added a provision to the bill that would cap what Americans pay for insulin at $35 a month in Medicare and the private insurance market. The parliamentarian ruled that including the private insurance market in the measure was not compliant with reconciliation rules. Democrats kept the provision in the bill, but Republicans raised a point of order to force a vote that struck the private insurance market limit. The Medicare insulin cap remains in place.

Climate provisions: The deal would be the biggest climate investment in US history. It would slash US greenhouse gas emissions 40% by 2030, Majority Leader Chuck Schumer’s office said.

The new agreement spans everything from electric vehicle tax credits to clean energy manufacturing to investments in environmental justice communities.

Extending tax credits for electric vehicles made it in, after previous opposition from Manchin. The tax credits would continue at their current levels, up to $4,000 for a used electric vehicle and $7,500 for a new one. However, the income threshold for eligibility would be lowered — a key demand of Manchin’s.

The bill also contains 10-year consumer tax credits to bring down the cost of heat pumps, rooftop solar, electric HVAC and water heaters. It includes $60 billion of funding for environmental justice communities and for the reduction of legacy pollution.

And it puts $60 billion towards domestic clean energy manufacturing and $30 billion for a production credit tax credit for wind, solar and battery storage.

The bill provides $4 billion in additional drought funding — a key negotiation point for Sinema amid the multi-year drought in the Southwest — Democrats confirmed on Thursday afternoon.

The tax credits will be technology neutral — meaning they won’t favor renewables over fossil fuels outfitted with carbon-reducing measures. However, they are designed to reward those who reduce their emissions the most, according to Senate Finance Chairman Ron Wyden, a Democrat from Oregon.

The deal also includes major provisions like a methane program that would levy a fee on oil and gas producers that emit methane above a certain threshold. It also includes $27 billion for a so-called clean energy accelerator — essentially a green bank that will leverage public and private funding to expand more green projects.

Tax provisions: To boost revenue, the bill would impose a 15% minimum tax on the income large corporations report to shareholders, known as book income, as opposed to the Internal Revenue Service. The measure, which would raise $258 billion over a decade, according to updated figures provided by Schumer, would apply to companies with profits over $1 billion.

Concerned about how this provision would affect certain businesses, particularly manufacturers, Sinema has suggested that she won changes to the Democrats’ plan to pare back how companies can deduct depreciated assets from their taxes.

However, Sinema nixed her party’s effort to tighten the carried interest loophole, which allows investment managers to treat much of their compensation as capital gains and pay a 20% long-term capital gains tax rate instead of income tax rates of up to 37%. The provision would have lengthened the amount of time investment managers’ profit interest must be held from three years to five years to take advantage of the lower tax rate. Addressing this loophole, which would have raised $14 billion over a decade, had been a longtime goal of congressional Democrats.

In its place, a 1% excise tax on companies’ stock buybacks was added, raising another $74 billion, according to Schumer’s office.

The package also calls for providing more funding to the IRS for tax enforcement, which would raise $124 billion.

Also, there would be no new taxes on small businesses.

Manchin also threw cold water on one of Schumer’s priorities — addressing the $10,000 cap on state and local tax deductions, known as SALT, that was part of the GOP tax cut package in 2017 and affects many states in the Northeast and on the West Coast.

The deal also leaves out tax surcharges on wealthy individuals, which was part of the House bill last year.

Here’s what was left out

Universal pre-K and lower child care costs: The House bill would have provided free pre-K for 3- and 4-year-olds, expanding access to 6 million children a year. It would have also limited child care costs for families with children younger than age 6 to no more than 7% of income for those earning up to 250% of the state median income, expanding access to about 20 million children. Funding for these programs would have lasted for six years, costing an estimated $381.5 billion, according to the CBO.

The previous enhancement, which was part of the coronavirus relief package, was only in place for 2021.

Heads of households earning up to $112,500 a year and joint filers making up to $150,000 annually would have qualified for the full enhanced credit. But, unlike in 2021, only these families would have received the funds in monthly installments this year. Eligible parents with higher incomes would have had to claim the credit on their tax return next year.

The credit would have been made permanently refundable so the lowest income families would continue to qualify.

This credit, along with the earned income tax credit, would have cost about $203 billion, according to the CBO.

Earned income tax credit: The expanded earned income tax credit, which was also part of the coronavirus relief package, would have been extended through 2022 as well, helping 17 million low-wage childless workers.

The House bill would have nearly tripled the maximum credit childless workers can receive, extended eligibility to more people, reduced the minimum age and eliminated the upper age limit. This credit, along with the enhanced child tax credit, would have cost about $203 billion, according to the CBO.

Home health care: Biden’s original plan called for permanently improving Medicaid coverage for home care services for seniors and people with disabilities, with the goal of reducing the more than 800,000 people on state Medicaid waiting lists.

The plan also aimed to improve the quality of caregiving jobs. The measure would have cost nearly $158 billion, according to the CBO.

Affordable housing: The legislation would have funneled $25 billion into the construction, rehabilitation or purchase of affordable homes for low-income people and for the creation and preservation of affordable rental housing. It would have provided $65 billion to address the capital needs backlog of public housing and would have bolstered rental assistance for hundreds of thousands of families.

The measure would have also invested in down payment assistance and in community-led redevelopment projects in under-resourced neighborhoods. And it would have provided $24 billion to fund housing vouchers and supportive services.

The effort would have cost about $148.1 billion, according to the CBO.

It would have invested in historically Black colleges and universities and other institutions that serve underrepresented communities. And it would have increased funding for workforce development.

These provisions would have cost a total of $39.8 billion, according to the CBO’s estimate.

Biden initially also called for making tuition free for two years at community colleges, but that provision was dropped from the House bill.

Medicaid coverage gap: Democrats had called for providing Affordable Care Act premium subsidies for low-income Americans in the 12 states that have not expanded Medicaid, which would have enabled them to buy Obamacare policies with no monthly premiums, through 2025.

Doing so would have cost about $57 billion, the CBO estimated.

Medicare hearing benefits: Hearing services would have been covered under Medicare, starting in 2023, under the bill that passed the House.

Only 30% of seniors over age 70 who could benefit from hearing aids have ever used them, the White House said.

This measure would have cost $36.7 billion, according to the CBO.

Extending Medicare solvency: Senate Democrats said in early July that they had finalized a deal to extend the solvency of Medicare by a few years by closing a tax loophole. The proposal would have ensured that owners of certain “pass-through” businesses, who include business income on their personal tax returns, would pay the 3.8% net investment income tax. It would have applied to individuals who earn more than $400,000 annually and to joint filers who earn more than $500,000.

But that agreement was then also scuttled by Manchin.

This story has been updated with additional developments.

CNN’s Ella Nilsen contributed to this report.