Silkhaus, a Dubai-based platform for short-term rentals coming out of stealth, has raised $7.75 million in seed funding, money it plans to use for expansion across South Asia, Southeast Asia and the MENA region.

Venture capital firms that participated in the round include Nuwa Capital, Nordstar, Global Founders Capital, Yuj Ventures, Whiteboard Capital and VentureSouq. A few international family offices and proptech founders also joined this round.

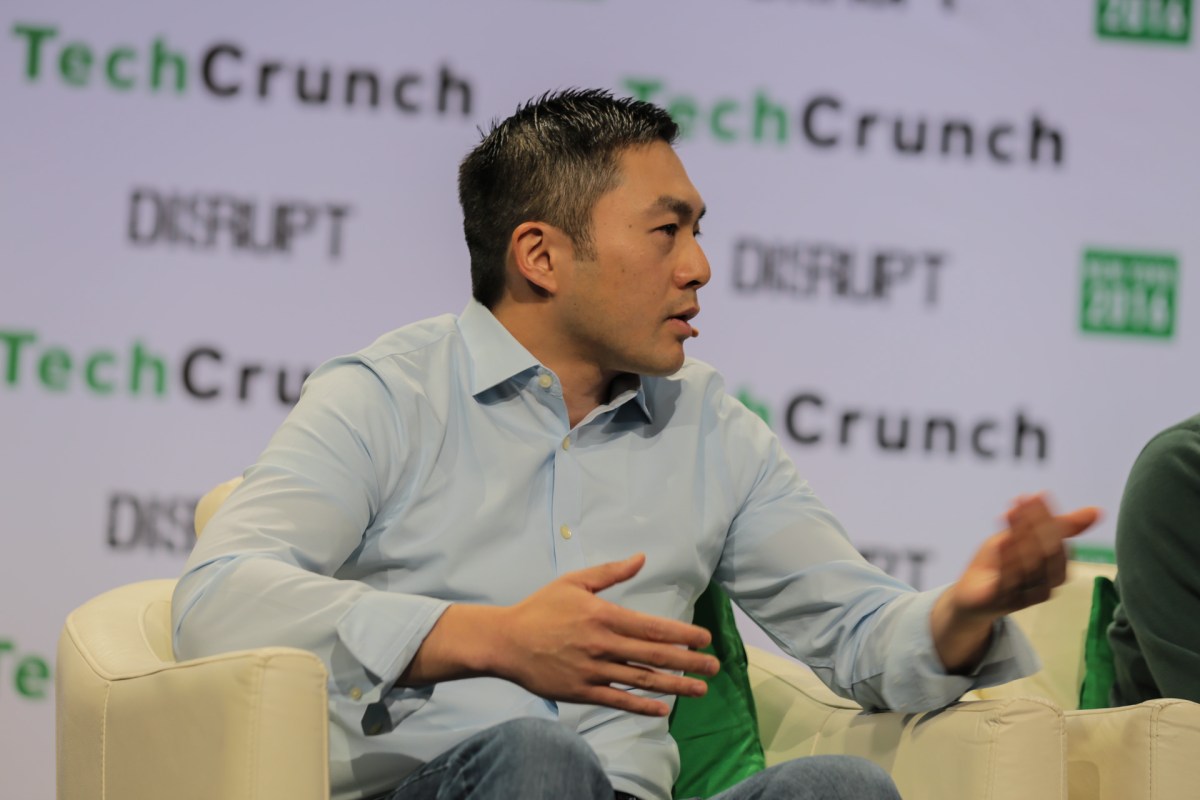

CEO Aahan Bhojani and Ashmin Varma founded Silkhaus last year after identifying a $13 billion market opportunity for asset owners across emerging markets, particularly MENA, South Asia and Southeast Asia. In an interview with TechCrunch, Bhojani, an HBS and Yale College graduate who had previously worked across roles that required extensive travel, such as management consulting and investment banking, said what spurred him to launch Silkhaus was the change in the travel behavior of small-business owners post-pandemic.

“At some point when I was building software for SMBs to book and manage travel globally, I saw businesses were beginning to do something different,” the chief executive said to TechCrunch over a call. “Businesses had traditionally always stayed in hotels. But interestingly, they were now beginning to ask for short-term rentals as well, you know, basically the Airbnbs of the world. And that’s when I started scratching my head and thinking about this entire space from a demand and supply problem.”

The pandemic had changed the nature of travel, he said. According to him, while the frequency of leisure and business travel trips declined, the average duration of these trips skyrocketed. His interpretation of this event was that these trips were becoming more nomadic and long-term thinking. But while platforms like Airbnb have fantastically aggregated demand to meet supply in the U.S. and Europe, it’s a different experience in emerging markets where supply isn’t sufficiently pooled together to meet Airbnb-pulled demand. That’s where Silkhaus comes in. It’s digitizing the process of operating short-term rentals for large and small property owners by providing an operating system that includes tools needed to monetize and manage their properties. The company claims that it allows property owners to list multiple or single units on the platform with an average revenue yield increase between 20-40%.

“Frankly speaking, finding a good Airbnb in these markets is like pulling a needle out of a haystack. And that’s what we’re solving for,” Bhojani said. “We’re aggregating some of the most successful short-term rental operators and building the highest quality supplier of that inventory to our partners, of which Airbnb is one. Our big vision is to bring quality, control and technology into the space. We exist to ensure that more people can experience high-quality short-term rentals.”

Image Credits:

Essentially, Silkhaus takes rental units from asset owners (in Dubai, at the moment) and manages distribution, pricing, revenue management and full coverage from a digital perspective; Airbnb is one of approximately 60 different distribution channels Silkhaus uses. Meanwhile, the company has built tools on the back end, including a marketplace for third-party vendors to access these rentals and handle operations.

According to the CEO, Dubai was the ideal market for launching Silkhaus because its infrastructure presents one of the most advanced setups for short-term rentals, embodies a progressive government regulation for proptech and welcomes varying demands from different consumer types. Silkhaus’s engineering team, split across the UAE city and Bangalore, is currently building out its technology stack, the company said in a statement. Chief operating officer Varma leads the team, which is part of a 20-man workforce with professionals from Microsoft, Airbnb, Careem and Deliveroo.

Bhojani claims that Silkhaus is currently part of the top 3% of operators in the city in terms of units under management. He said the proptech startup, which has grown over 10x in revenue over the last 12 months, is planning to enter the top 1% in the next two months by growing the supply of properties on its platform.

Silkhaus estimates its market opportunity might grow to $18 billion in the next four years. With operations planned for Asia’s leading economic hubs and the MENA region, providing guests with high-grade accommodation options and letting enterprises choose extended stays for their employees on Silkhaus will be pivotal to capturing a significant chunk of this market share.

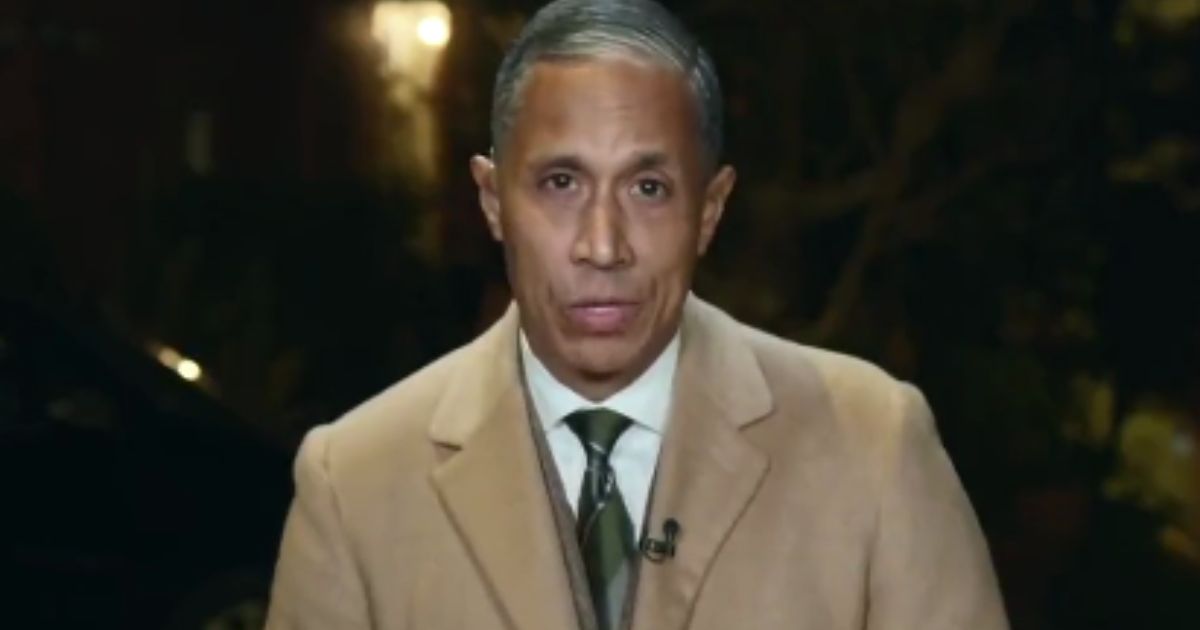

“We are excited to see Silkhaus emerge as the leading platform for short-term rentals across Asia, and in particular excited to partner with Aahan and his team, who in a short time have proven their ability to disrupt two large and fragmented industries: real estate and hospitality,” Ole Ruch, managing partner at Nordstar, said in a statement.