Relationships are complicated — however, thanks to some fintech companies, mingling the finances of these modern couples can be easy.

Plenty, a one-year-old company that helps couples discuss, manage and invest their money together, is the latest to launch its platform, focused on millennials who want access to wealth-building opportunities that take into account their relationship status.

Co-founders Emily Luk and Channing Allen met while working together at Even, which was acquired by One in 2022. They got engaged to each other in late 2021, and got the idea for Plenty as they looked for products to help them plan their finances together, Luk told TechCrunch.

Luk recalls finding options for growing wealth when you’re already wealthy, but when it came to people not in that category, she said options were limited for products that didn’t have high upfront fees or ones that provided potentially predatory advice.

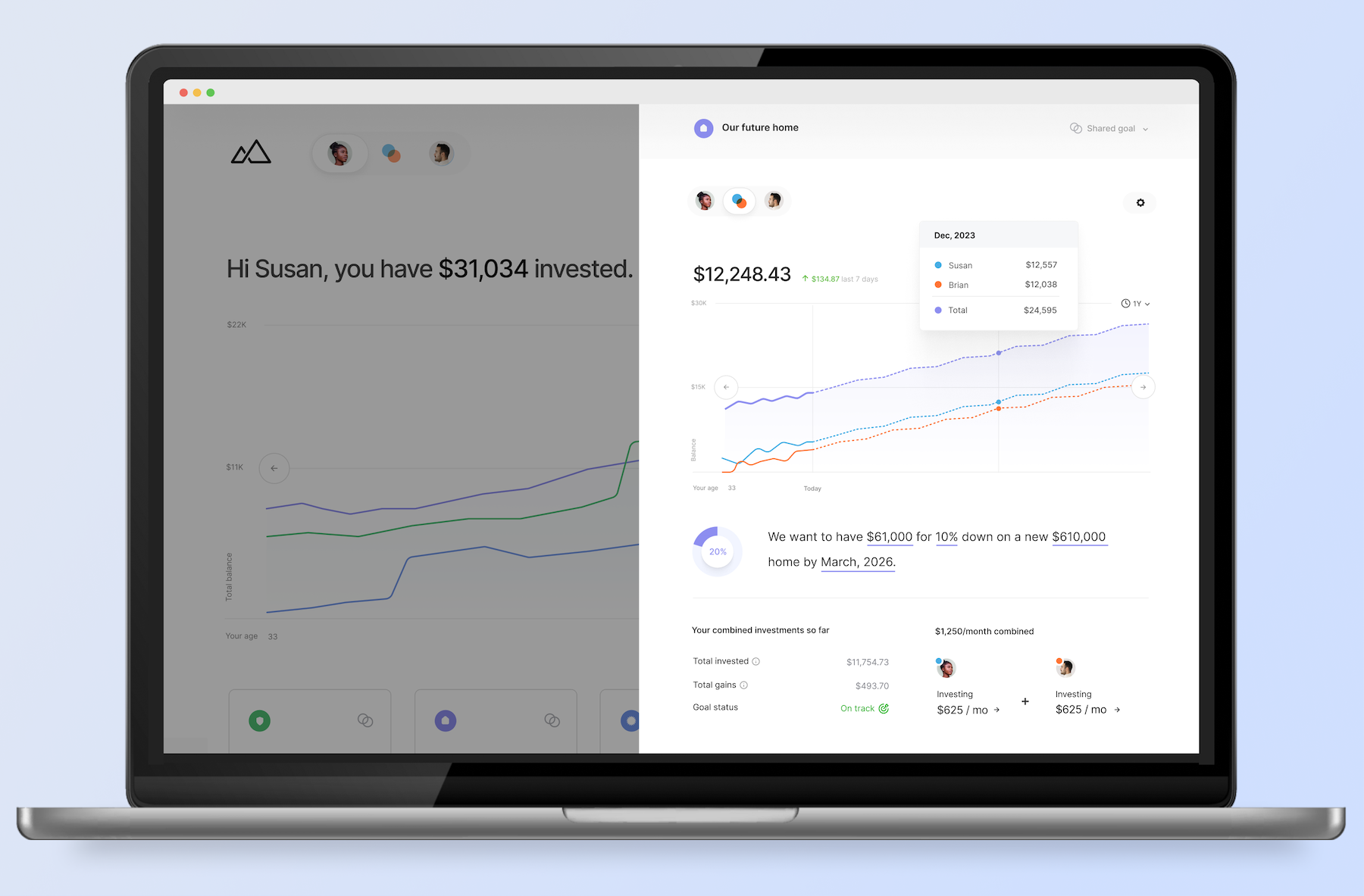

After leaving One last year, they set out to build Plenty as an SEC-registered Investment Advisor with a goals-based approach to investing. There is also automated forecasting so that couples can plan for milestones they want to achieve together, like paying off student debt, buying a house or having a child.

Here’s how it works: The wealth-building platform enables users to join as individuals or couples. Users connect their financial accounts and then can choose which accounts to share with their partner. There is also a cash management product — a portfolio backed by money market funds currently offering 4.83% annual percentage yield. In addition, users get an AI-powered direct indexing strategy that Luk said has historically required a $500,000 investment minimum.

Plenty requires an initial $100 deposit and charges a $150 annual membership fee for individuals or $200 per couple, with both people getting their own Plenty account.

View of goals on Plenty. Image Credits: Plenty

The company is among a crowded space currently that includes companies like Honeydue, Zeta, Ivella and Ensemble, which is tailored to divorced people who co-parent.

Luk said many of Plenty’s competitors tailor their offerings to “a much younger, less mature relationship” and are more focused on budgeting and transaction-splitting.

“Where we play is a focus on a median household earning over $90,000 or even in the low $100,000s a year,” Luk said. “For most of these individuals, it is thinking about why we have these really big life milestones. Buying a house or building toward retirement requires more medium-term and long-term planning, and is much more analogous to what financial planners could support someone with instead of the budgeting solutions of other platforms.”

Zeta, Ivella and Ensemble started within the past three years, and Plenty joins them in attracting venture capital. The company today announced $2.75 million in pre-seed capital from an investor group that includes Phenomenal Ventures, Kevin Durant and Rich Kleiman’s 35V, former Wealthfront CEO Adam Nash, Xtripe Angels and Inovia Capital.

Much of the new capital will be used for hiring and product development.

Plenty is still early, but is generating revenue already. Luk and Allen have been using the product themselves since January and have a waitlist that is growing, though Luk declined to go into specifics on how long it is. With the announcement of the raise, Plenty is also announcing its “early access” period for users.

Next up, the goal is to roll out some new savings offerings, like treasury bills and to help 1 million households add $1 million dollars to their retirement.

“We still have a lot more to build before we get to that point,” Lux said. “It’s about bringing more people into the product and thinking about some of the other goals that people have right now, like getting a pet, egg freezing, in vitro and other things that are relevant for our generation.”