There’s a lot of confusion in the private market right now. On the one hand, venture firms are still announcing new funds on a daily basis. They’re hosting catered sushi brunches. On the other, layoffs abound, and titans of industry sound worried. JPMorgan’s Jamie Dimon sees an economic hurricane ahead. For his part, Elon Musk reportedly told Tesla executives this week he has a “super bad feeling” about the economy. He’s also laying off 10% of Tesla’s salaried employees, he told them in a brief email this morning.

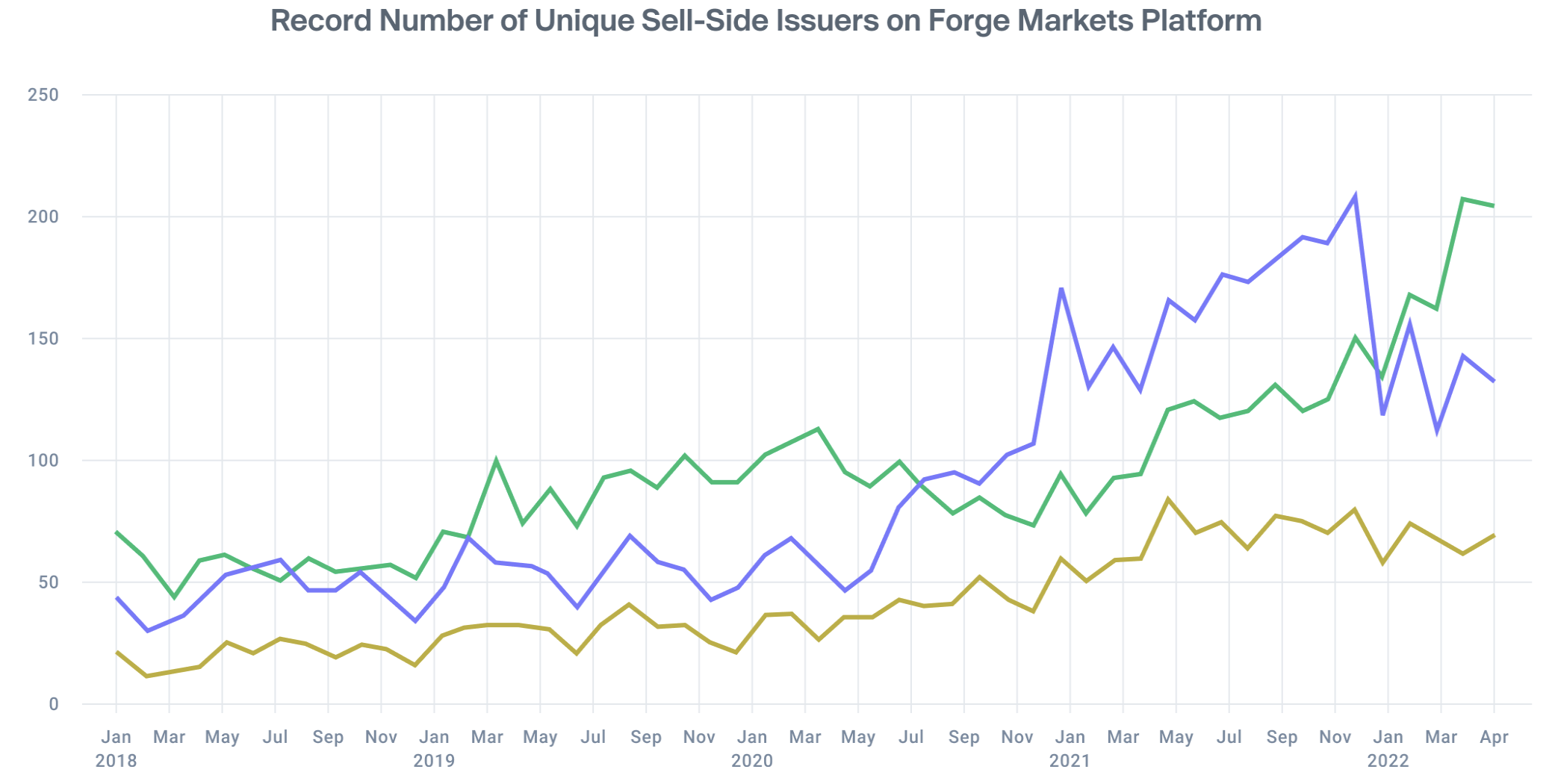

You could hardly blame people looking to sell their startup shares, or those looking to buy them, for feeling unsure about where to meet on price, and that’s exactly what’s happening right now, says secondary market experts like CEO Kelly Rodriques of Forge Global. In fact, Rodriques says, on Forge, a trading platform for private firms’ shares that went public earlier this year via a SPAC, the “supply of private shares right now is higher than it’s ever been in history — by a lot.”

Rodriques calls it “price disequilibrium. There’s a ton of seller interest, but the range between seller and buyer expectations is too wide for a lot of trading to happen.”

Image Credits: Forge Global

He’s not alone in seeing this pattern. Justin Fishner-Wolfson separately says the most remarkable thing about the secondary market right now is how stagnant it is. Fishner-Wolfson cofounded and oversees 137 Ventures, a San Francisco-based firm that offers loans to founders, executives, early employees and other large shareholders of private, high-growth tech companies in exchange for the option to convert their debt into equity, and he notes that valuations in the private markets are “slow to change” because “people are waiting to see what things are actually worth.”

You can hardly blame them, he suggests; the signals all around appear haywire. “If you look at the public markets, you’ve got even very large companies moving 5 to 10 percentage points a day, without specific news. Like, this isn’t an earnings call that’s driving the price.” Given that “people don’t really know what things are worth on any given day,” he says, “in the private markets, things are mostly just slowing down while people wait to see whether or not pricing is something [they] could sort of approximate today, whether or not it gets worse from here, [or] whether or not it gets better from here.”

Some sellers are plowing forward at prices they might not like out of necessity. “The only transactions you’re seeing are the ones that people desperately need to have happen,” says Fishner-Wolfson. It’s true of companies; it’s also true of individuals, he says. “Companies with strong balance sheets aren’t going to raise money in this environment; they’re going to try to put off [a new round] as long as they can.” He sees the same with founders and executives. “If your company is doing really well, why do you want to take a price that’s not a great price, or at least a reasonable price, if you can wait a few quarters, see how things settle out, and get a better deal later?”

There is some good news for sellers, says Rodriques. For one thing, Rodriques says he’s seeing signs that sellers are growing “more realistic” about their expectations, which should bring more buyers — who want the biggest discount possible — to the table.

He also says that while prices appear to be falling almost uniformly, companies that were venture-backed and went public somewhat recently are still trading at premiums to where they were valued in their last private funding rounds. Specifically, according to Forge, they’re trading at roughly a 24% premium to their pre-IPO valuations.

That’s way down from the fourth quarter, when companies on Forge were trading at a 58% premium over their last private round, but that cushion is keeping buyers, and sellers, in the market who might disappear otherwise.

Rodriques points, for example, to the buy-now-pay-later startup Affirm, a company that Forge had previously tracked and traded on its platform and which went public through a traditional IPO process early last year. Currently, Affirm’s shares are down 56% from their IPO price, but they’re up more than 70% from the value that Affirm’s private market investors assigned them during the outfit’s last, pre-IPO round, meaning its private market investors are still very much in the black.

How much that really means is, of course, a question mark. Asked if he would himself buy Affirm’s shares at their current price, Rodriques talks at length about Affirm being a ” highly sought after businesses that has a significant sustainable gross margin profile and a growth rate.”

“You can say, ‘Well, it’s not worth 28 times [revenue].’ And maybe [the shares] don’t go back up to 28 times [revenue], maybe they settle in at 20,” he continues. “But people are still going to pay premiums — good market or bad market — for a company that’s throwing up organic growth of 50% to 100% a year and gross margins in the 70% to 90% [range].

Asked again: would he buy it right now or would he wait, Rodriques says he’s not so unlike his own customers. “Am I a buyer of Affirm right now? I’m like everybody else. I’m waiting and watching. But I think it’s a great company, and I would invest in it. I’m wanting to see where the market shakes out.”

Image Credits: Forge Global