Disney+ Hotstar lost nearly a fourth of its customer base, or 12.5 million subscribers, in the quarter ending June, Disney disclosed in its earnings Wednesday, the ongoing setback at the India-focused streamer that’s reeling from the lack of cricket content.

This is the third consecutive quarter in which Disney has lost subscribers. Hotstar had 40.4 million subscribers at the end of June, down about 21 million since October 2022. The fall in subscribers comes at a time when Disney is rumored to be exploring a sale or forming a joint venture for the broader India business.

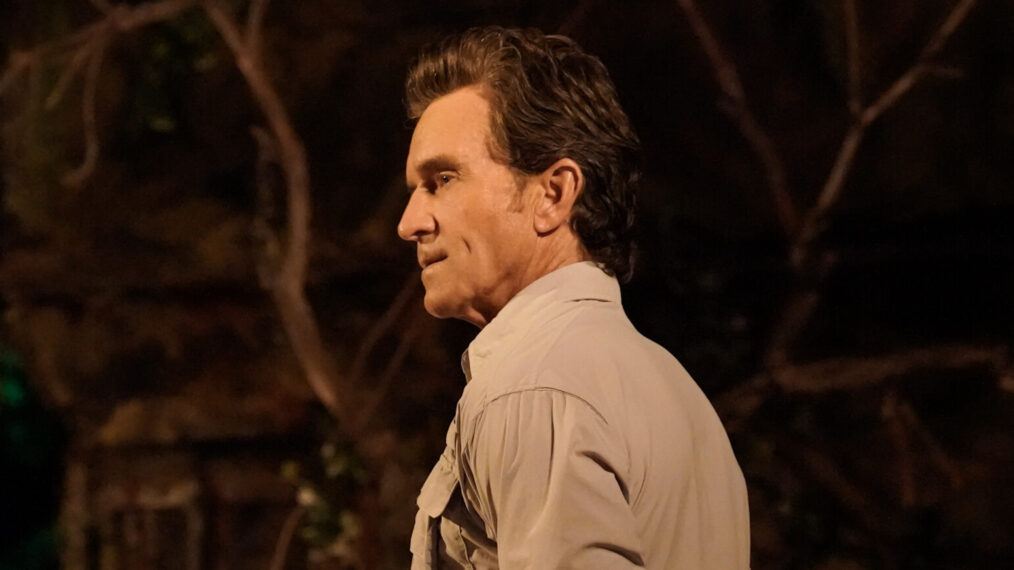

Bob Iger, Disney CEO, didn’t necessarily offer a strong India outlook on the earnings call. Asked how Disney+ Hotstar was shaping the company’s view on long-term international streaming strategy, and whether Disney was mulling exiting some markets, Iger said:

“We actually have been looking at multiple markets around the world with an eye toward prioritizing those that are going to help us turn this business into a profitable business. What that basically means is there are some markets that we will invest less in local programming but still maintain the service. There are some markets that we may not have a service at all. And there are others that we’ll consider, I’ll call it, high-potential markets where we’ll invest nicely for local programming, marketing and basically full-service content in those markets. Basically, what I’m saying is not all markets are created equal. And in terms of our march to profitability, one of the ways we believe we’re going to do that is by creating priorities internationally.”

Iger said Wednesday that Disney is considering “strategic options” for the company’s portfolio of TV networks. It also raised the price of its ad-free versions of Disney+ and Hulu by more than 20%, in what is the second cost hike this year.

Hotstar, a crown jewel in Fox’s portfolio to become part of Disney with the acquisition, attracted tens of millions of customers in the past decade in part by providing livestreaming of cricket matches, particularly the local IPL tournament.

That changed when Disney was outbid for the last season’s IPL digital rights by Viacom18, a company backed by billionaire Mukesh Ambani’s Reliance Industries. To aggressively win customers, JioCinema streamed this year’s IPL for free in India.

“In essence, this outcome allowed the new entrance of the country’s largest mobile telecom operator (backed by one the wealthiest men in the world) into a market once dominated by Disney. The defense of the linear business through securing IPL rights by Disney made little sense once Reliance introduced their IPL mobile product for free. As mobile operators in India like Vodafone have learned over the years, it has hard to compete with a local champion hellbent on disrupting the market with cut-rate or free offerings,” wrote boutique research house MoffettNathanson in a report last month.