Lyon, France-based precision fermentation startup Bon Vivant, which is using biotech techniques to reprogram yeast microorganisms to produce animal-free milk proteins with a substantially lower environmental footprint than traditional dairy, credits clarity of strategy and execution for keeping its investors enthused at a time when raising remains a challenge for many tech founders.

All the investors in its April 2022 pre-seed (€4M) followed on for the oversubscribed €15M (~$15.9M) seed it’s announcing today, according to CEO and co-founder, Stéphane MacMillan. The round is co-led by Sofinnova Partners and Sparkfood, with Captech Santé also participating. Other investors in Bon Vivant include Alliance for Impact, High Flyers Capital, Kima Ventures, Founders Future and Picus Capital.

MacMillan points to a decision he and his co-founder, Hélène Briand, made to focus exclusively on a b2b business model — meaning the novel protein startup is aiming to be a supplier for, not competitor to, the food industry — as something investors have especially appreciated.

“Since the beginning we’re focused — b2b oriented. And in Europe, in particular, almost all [competitors] are still b2c, b2b2c; [or have an] unclear strategy. That’s a big differentiator,” he tells TechCrunch. “I think that explains why, in only 19 months, we’ve attracted investors — because since the beginning we have a strategy that is clear and that we are executing on which helps a lot, obviously. Because there’s clarity. Then the team is structured this way. The processes are put in place… So that’s, I think, one of the key decisions why also we attracted Sofinnova, which is the biggest VC in biotech in Europe.”

“My view is when you are a startup you need to understand, pretty closely on the value chain, where are you good — and actually better than anyone else to do it?” he adds. “I consider that building the tech, building the process of fermentation, doing purification. All of that we can bring a lot… But when it comes to marketing, distribution and producing tonnes of final product, I don’t think I’m going to be better than any Danone or Nestlé.

“Honestly, I don’t want to compete with them… I would love to partner with them and then actually also if you’re serious about the [environmental] impact that you want to drive and… you are really serious about your mission then the only way to have the bigger impact is to help the guys that are doing tonnes of dairy products every single day. And so you don’t want to fight them on marketing, distribution and new product but help them with an ingredient that allows them to reduce their footprint.”

The dairy industry and other clients Bon Vivant is targeting to sell its yeast-grown milk proteins are interested in its ingredients to answer all sorts of “functionality needs”, per MacMillan — whether it’s creating a gelling effect, foaming, texturizing etc — and he says there’s no way to do that with only one type of milk protein coming out of the fermenting vats. Hence why it’s developing microbial yeast strains that can produce whey and casein to ensure broad versatility for the multinational “food industrials” it wants to sell to.

“Since the beginning, we have two workstreams: One is on whey; another one is on caseins. Because that’s just part of the strategy; we want to answer — and to be the one-stop-shop b2b leader for — dairy and food industrials,” he says.

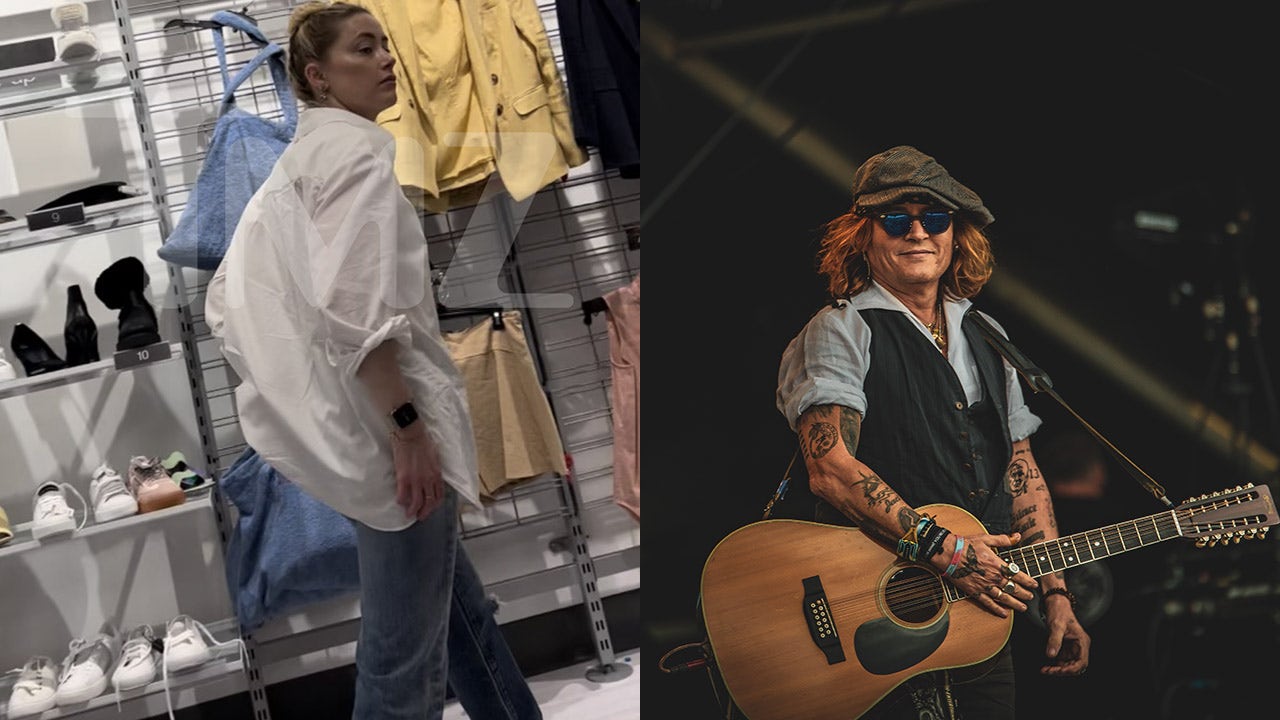

Bon Vivant co-founders: Hélène Briand and Stéphane MacMillan (Image credits: Bon Vivant)

MacMillan suggests this also gives Bon Vivant an edge vs rivals that have focused more narrowly, at least initially — saying he doesn’t think anyone else in the cow-free milk space is (currently) working on both milk proteins. But he concedes the field is moving quickly and says he expects competitors will converge on the same strategy (so he’s anticipating more pivots to b2b). Bon Vivant’s 19-month head-start on this road means it has a good chance to establish a lead, though, he believes.

Alt protein startups have faced some challenges in recent times — especially those cooking up products that aim to disrupt the traditional meat industry. But when it comes to producing non-animal based dairy the field is less crowded. Though there are some big names too, such as US-based Perfect Day.

Setting aside plant-based alternatives to milk, which are ten-a-penny these days (but don’t offer the same nutritional qualities, properties or taste as cow’s milk), MacMillan says there are far fewer alt protein startups going after dairy. Yet with so many potential products that could make use of cow-free milk proteins as an ingredient — from drinks like milkshakes, to yogurts and cheese spreads (or indeed hard cheese, though that’s clearly a bigger R&D challenge), confectionary and baked goods, to ice-cream, and plenty more besides — he’s not sweating about the competition right now. Indeed, the potential pie (cheesecake?) looks big enough for many players to grab a slice.

The team’s focus is rather on executing its plan to scale production and obtain the necessary regulatory clearances so its precision fermented proteins can find their way into all sorts of food products intended for human consumption.

Bon Vivant’s milk proteins are indistinguishable from cow’s milk proteins so could — technically — be used to produce ‘vegan’ cow’s milk products since no cows were harmed in the production process. (The cow’s DNA that’s combined with the yeast comes from a cell bank.) But as a b2b supplier Bon Vivant isn’t going to be a producer of vegan milk — or any other specific foodstuff. Its ambitions are broader: It wants to supply the food industry’s giant need for more sustainable dairy proteins.

“The market we all have to serve is enormous. It’s just massive,” he says. “And when you look at it, how many startups are we working on it right now, I think we are maybe like 30 something, 35 maybe… and that’s really a small number. Compared to, take for example cell-based meat — which is a brand new technology, amazing one, and I mean it’s still a real moonshot — [where] you have maybe 300 startups? Well-financed in the world. It’s crazy. So, I don’t think there is so much, to be honest, competition between all of us [non-animal dairy startups]. We really have all to be focused on the big food industrials that are waiting on us to produce 1,000s of tonnes. That is the focus.”

Bon Vivant is anticipating the US market will be where it obtained its first regulatory clearance — and it’s hoping to be able to commercialize its milk proteins there as soon as 2025.

MacMillan tells us he expects the process of obtaining regulatory clearance in the European Union to take longer (he suggests two to three years), on account of the bloc’s more stringent food safety rules.

The new funding is being poured into scaling its production capacity towards, down the line, the commercial scale production needed to be a supplier to food giants. But there are still a number of stages on the road to get there. And MacMillan confirms it will be continuing to use third parties to help with production for the foreseeable future (he suggests this is an advantage of being able to leverage an existing technique, i.e. precision fermentation, to make a novel food product — whereas lab-grown meat startups have to tackle setting up novel production methods too).

Bon Vivant will use the seed funding to open a new lab in Lyon so it can produce more samples for its target clients in the food industry (“partners” is how it refers to them currently; but, it hopes, clients in the future if/when it secures contracts). The lab will be able to produce 40 litres of product so still way below commercial scale. It will also enable the startup to dial up testing and product development, per MacMillan.

“We are building our own lab. It’s still only pre-production. We’re going to be able to produce only samples — but they will allow us to accelerate tests and trials, innovation, IP production, all that,” he notes, adding that the seed will also be spent on working towards regulatory clearances — paving the way for commercializing its novel milk proteins in a few years’ time if all goes to plan.

While food startups that are cooking up alternatives to meat — whether lab-grown or plant-based — continue to face attacks from the traditional meat industry, such as suggestions their products are unhealthily ultraprocessed or unnatural ‘frankenmeat’ (or even attempts to sew doubt they have a lower carbon footprint than meat from farming animals), MacMillan sees a far more collaborative relationship blossoming between alt dairy producers and the traditional dairy industry.

Indeed, he doesn’t like the term “alternative” being applied to Bon Vivant’s milk proteins as he argues its products will be “complementary” to traditional dairy, rather than a complete replacement for animal-based milk — at least certainly not for the foreseeable future. The assumption is changes to how established food systems operate won’t happen overnight. So being a supplement, rather than trying to supplant, is the best strategy.

He argues precision fermented milk proteins could be a boon to the supply-constrained dairy industry by helping it tackle the challenge of rising demand for milk-based products while simultaneously providing a way for it to reduce its carbon footprint and align itself with a pressing, global sustainability agenda.

He even suggests we may see dairy products appearing on supermarket shelves in the future that contain a blent of both types of proteins: precision fermented and those squeezed directly from a cow’s udder.

“We are really at the beginning of all this — we you only start to understand exactly the power of biotechnology and precision fermentation. So I think that at the end of the day, I would say the idea is not to replace the milk at all. It’s more complimentary,” he suggests. “So if already we could reduce — by 30% — greenhouse emissions of dairy products, so make a hybrid product, you’d use milk and some of the proteins that we’re producing, for example, you would reduce the use of [cows] that would work already — because that’s the whole point, right?

“So, to me, I really see it as a complementary technology, rather than replacing [traditional dairy] — because we won’t replace all milk. I mean, that’s not the objective. So yeah, so assume at some point here, soon enough, you will be able to have animal proteins, old dairy products. I don’t see why not.”

“You also have to be realistic here and see what we’re talking about,” he continues. “It’s a massive industry. [Big reductions in traditional dairy production] will not happen overnight. No way actually… Demand [for dairy] is growing, like a lot. At the same time, milk production is decreasing. So there is already a gap that we need to fill with our technology.

“The only way to really achieve what we want to achieve — which is reduce the carbon footprint, reduce the water consumption and all that; everyone wants to do that — we need to work all together on that to make it happen sooner rather than later. In any case, I mean, it’s not going to happen overnight. We’re not in the digital world where you can just [blitz-scale a new product]. It’s the real world.”

On the environmental credentials side, Bon Vivant recently published an early LCA (aka, Lifecycle Assessment Report), which was undertaken by a third party — comparing production of 2,160 tonnes/year of its fermented, animal-free whey protein against the same quantity of cow’s milk. The study also factored in the production of the additional carbohydrates, lipids, minerals etc required to combine with its whey proteins to make an equivalent product to cow’s milk.

Results from this early LCA look very promising — suggesting Bon Vivant’s precision fermentation process could reduce greenhouse gas emissions by 97%; drinking water consumption by 99%; and energy usage by 50% compared to obtaining the same amount of milk from cows.

“Even though those figures, most probably, will move — because the process will change; and we will have to do a new version of the LCA probably once a year — still when you are at those type of figures — and if it’s not 99%, it’s going to be, what, 95? 92%? — it’s still massive. And that’s why it’s really important,” he adds. “It still means that you have a tremendous impact. That’s why it’s really, really cool.”

Starting a business that could have an impact was one of the fixed criteria MacMillan set himself when, towards the end of 2020, he was casting around to come up with his next big startup idea. (One of two prior startups he co-founded was the e-scooter firm Circ, which was acquired by Bird in 2020; the other was a food delivery firm). Also on his wish-list was a business he could be building over the longer term — for “the next ten years”. With precision fermented milk proteins he seems to have found the sweet spot.

Commenting on Bon Vivant’s seed raise in a statement, Michael Krel, partner at Sofinnova Partners, added: “Bon Vivant’s pioneering work in animal-free dairy proteins through precision fermentation aligns perfectly with Sofinnova’s mission to promote sustainable solutions for a healthier planet. We are delighted to support Stéphane, [co-founder] Hélène and the team as they continue to transform the dairy sector and contribute to a more sustainable agri-food era”.