For the first time in more than a year, venture capital funding saw a decline last quarter. For founders, this drop may spark concerns around how to secure capital, making them more likely to bend to investors’ terms and ignore details they wouldn’t otherwise.

As founders bend over backwards to get backing, legal due diligence can sometimes go overlooked. Not wading through the fine print could mean ending up with an unfavorable deal early on, which future investors will often try to replicate. This results in a hard-to-break cycle of poor investment terms.

Negotiations can be daunting, especially when investors tend to have more experience, knowledge, and resources. Investors also know that negotiations don’t stop at the agreed upon term sheet — valuation caps, discount rates, matching rights, and board control all need to be reviewed and discussed.

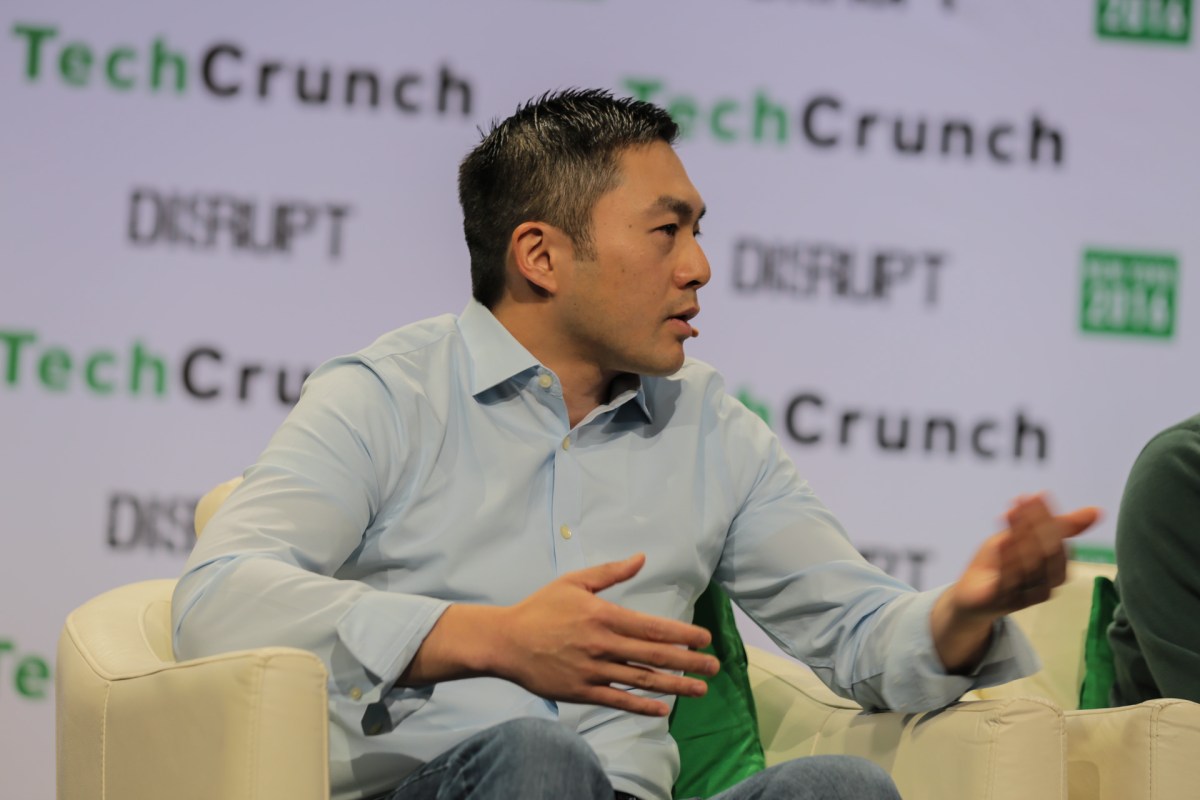

Before transitioning to investment, I was a partner at a law firm specializing in business issues. I’ve outlined below a few legal areas I recommend founders focus on, as well as some tips to finesse negotiation skills.

Take care to look beyond the immediate round and avoid creating problems for later because you don’t want to have a difficult conversation now.

Research industry rounds to determine valuation caps

A valuation cap is the maximum amount at which an investor can convert a SAFE (the equity contract between you and your investor) into equity. For example, if your investor’s valuation cap is $1 million and your company is valued at $1.5 million at your next fundraising round, your investor’s equity conversion would be limited to $1 million.

Your investor is going to want to set a low valuation cap because it gives them a potentially larger percentage of your company at the next round. However, a low valuation cap isn’t always good for a startup, as it can dilute the company’s value and deter new investors from participating.

You and your team drive the business, so you need to negotiate away from disproportionate future dilution. Look at companies that are at a similar maturity level and in the same industry. Research their funding rounds and understand the amount of growth (specifically, the KPIs) that led to their valuation increasing.