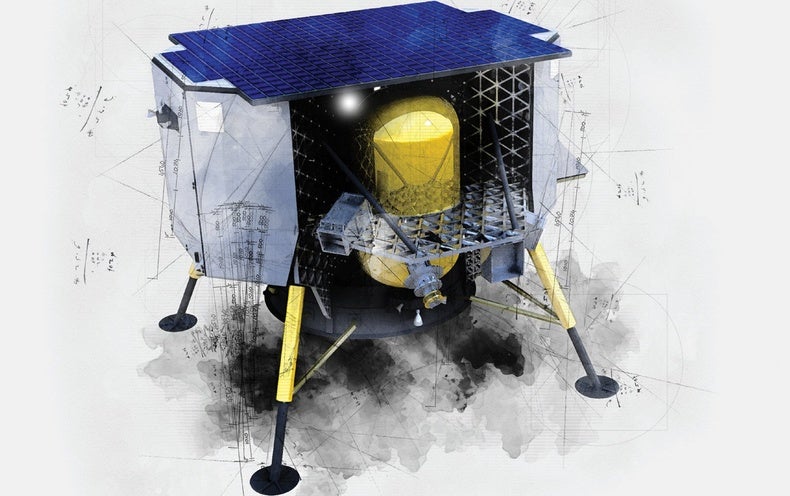

One day last December, John Walker Moosbrugger, a 25-year-old project manager for the lunar robotics start-up Astrobotic, sat in front of the company’s clean room and watched as an instrument older than him was attached to a moon lander. The vehicle, called Peregrine, was a four-legged, foil-wrapped canister as big as a hot tub. The instrument—Surface and Exosphere Alterations by Landers, or SEAL—was a shoebox-sized sensor designed to study how a spacecraft’s landing disturbs moon dust. Peregrine is scheduled to launch later this year—and it is just one of many missions that private companies are scrambling to send up after years of preparation. Since its founding in 2007 as a scrappy competitor for the now defunct Google Lunar XPRIZE, Astrobotic had been working on its lander and signing deals with companies that wanted to put instruments on it, planning for a launch eventually. But in 2018 NASA came calling with a funding scheme that would turn Astrobotic into one of several moon ferries by the middle of this decade. Since then, Walker has been readying payloads like SEAL. “All of a sudden, in late October, [NASA representatives] started showing up,” Walker says. “Everything got very real.”

Sometime in the next four or five months, the first American moon missions in half a century will make a return to Earth’s satellite. The arrivals won’t be human—at least not yet—and they won’t even be government-built. The coming lunar fleet will consist of private spacecraft carrying science experiments and other cargo for paying customers, including NASA. Astrobotic’s Peregrine lander is due to ride on United Launch Alliance’s new Vulcan Centaur rocket, scheduled to make its inaugural voyage before the end of 2022. Competing lunar start-up Intuitive Machines is set to launch its lunar lander, Nova-C, on a SpaceX Falcon 9 rocket, also by the end of this year. A dozen more firms are expected to follow in the next six years, carrying cargo that ranges from a magnetometer and supplies for a future lunar base camp to small amounts of cremated human remains.

These will be just the latest firsts in a gradual ramping up of the commercial space economy. SpaceX launched its first rocket in 2006, and since 2012 it and other private companies such as Northrop Grumman have been flying cargo to the International Space Station—and more lately, crew. In 2021 the long-delayed era of regular private space tourism arrived as billionaires and celebrity customers started riding rockets into near-Earth space.

But going to the moon is a much taller order. Rockets that can reach the moon must burn more fuel than normal launches to escape Earth’s orbit and enter a lunar trajectory, and the journey takes about three days, as opposed to a few minutes to reach Earth orbit. Although companies such as SpaceX have plans for crewed ships to the moon, none have made it past the prototype phase, so for now the new moon race is being pioneered by small companies such as Astrobotic.

NASA has not gotten out of the spacecraft business; its Artemis program, a sister to the Apollo missions, aims to return humans to the lunar surface by 2025. The agency has been working on its own new moon rocket, the Space Launch System, since 2011, and scientists still plan new missions under its planetary exploration programs. But outsourcing these smaller, near-term missions to industry is part of NASA’s modern strategy of paying private companies to take on some of the load. NASA officials say a commercial lunar market will increase competition, drive down prices and ensure people will keep going back to the moon regardless of who occupies the White House. For their part, the companies hope that their NASA-subsidized cargo deliveries will jump-start a new economic boom, the way the transcontinental railroad spurred Western development in 19th-century America. This time the rush would be for moon metals, water and helium—materials that could become precious if rockets were to start launching out into the solar system from a lunar base station.

In the meantime, science missions that have been lingering for years or otherwise had little chance of reaching space are poised to make it to the moon. The SEAL instrument, for example, is a spare copy of one built in 1996 for a different mission. It didn’t fly then, but now, thanks to this private-public moon rush, it should get its chance.

Lunar scientists are watching this activity with a mixture of skepticism and hope. “I’m still pretty early in my career, and this is the second or third time I’ve been told we’re going back to the moon,” says Angela Stickle, a planetary scientist at Johns Hopkins University’s Applied Physics Laboratory. “But I think it is real this time. The launches are on the books, they’ve been paid for, and that’s something we’ve never had before.”

Of course, the sustainability of any private enterprise depends on making money, and the prospects for a gold rush on the moon are still speculative. Is there really a lasting market for commercial lunar landers? That depends on who you ask—and on what the new fleet of robots is able to pull off.

Private moon missions are arguably the inevitable next step in a process that NASA set in motion 17 years ago, with the creation of the Commercial Orbital Transportation Services (COTS) program. COTS was NASA’s plan to pay private companies to develop ships that could fly to the space station after the retirement of the space shuttles. NASA spent $500 million over five years to help SpaceX and Orbital Sciences develop new rockets and cargo ships. The program was a success, leading to new reusable launchers and vehicles that reliably bring supplies to the space station. SpaceX has since completed 156 launches of Falcon 9 rockets, developed with NASA seed money, and in 2020 the company began flying human astronauts to the station, too.

The commercial cargo program’s legacy may have been on Thomas Zurbuchen’s mind in December 2017, when the Trump administration announced a program aimed at returning to the moon. Trump wanted to send astronauts there by 2024, and Zurbuchen, the astrophysicist in charge of NASA’s science mission directorate, saw an opportunity to add to NASA’s science budget at the same time. He began asking, “Whatever happened to the companies that competed in the ill-fated Google Lunar XPRIZE?”

The competition, which Google and the XPRIZE Foundation created in 2007, would have awarded $20 million to the first privately financed moon lander. The program ended after a decade without a winner; getting to the moon was just too difficult and expensive to make the comparatively meager purse worthwhile. One former competitor, an Israeli start-up called SpaceIL, eventually made it to the moon, albeit with an unplanned crash landing in April 2019. But in vying for the prize, several companies had built lander prototypes and rovers that could theoretically deliver all kinds of cargo to the moon, in some cases much more cheaply than a traditional NASA mission. They included Astrobotic, another outfit called Moon Express, and even smaller firms such as Micro-Space. After the competition ended, many of these companies continued working on their landers, rovers and instruments, in Astrobotic’s case even lining up customers for eventual trips.

Eyeing those companies and the success of COTS, NASA created the $2.6-billion Commercial Lunar Payload Services (CLPS) program in 2018, arguing that a high-risk, high-reward scheme would enable more science for NASA’s dollar while encouraging a fledgling lunar marketplace to take off. Under CLPS—usually called “clips”—NASA pays private companies to build landers, rovers and other instruments and to carry science experiments on them. This time, Zurbuchen figured, the odds were probably better than in 2007: lunar technology was more advanced, and there were more rockets capable of making the trip to the moon.

Geopolitics also helped CLPS get off the ground. Zurbuchen was able to secure that $2.6 billion in part because of Trump’s moon ambitions and in part because of American fears of China’s rise in space. In December 2020 a Chinese lander and rover arrived at the moon’s south pole, collecting samples that were later returned to Earth. “We have every reason to believe that we have a very aggressive competitor in the Chinese, going back to the moon with taikonauts,” NASA administrator Bill Nelson said in November 2021, referring to Chinese astronauts. “And it’s the position of NASA, and I believe the United States government, that we want to be there first.” Suddenly, Lunar XPRIZE competitors such as Astrobotic were back in the game, carrying the fire for American space interests. “In 2018 there was a Chinese lunar mission and zero U.S. lander missions on contract,” says Dan Hendrickson, vice president of business development at Astrobotic. “Fast-forward to 2021: there are now seven American lunar lander contracts in place. It’s a sea change.”

NASA missions typically fall into one of three classes. Flagship missions such as the Mars rovers or the James Webb Space Telescope take up the most money and the most attention. They are usually decades-long, multibillion-dollar projects run by teams of scientists and engineers from across the space agency and university partners. Missions that are slightly smaller fall into a class called New Frontiers, and they are capped at $850 million. The Discovery missions are the leanest, with a cost cap of $450 million. Launching any of these missions requires years of planning and preparation, and not every mission is chosen; scientists may try for a good portion of their career before landing a Discovery mission or getting an instrument on a New Frontiers spacecraft.

The CLPS program is different. A single commercial lander might carry a dozen payloads that have nothing to do with one another. Scientists who would otherwise spend years preparing a Discovery mission proposal could instead submit a simple science instrument for a CLPS mission, meaning faster scientific return for less money. “You don’t have to spend 15 years building a spacecraft when you can do it in two,” Stickle says.

As of April 2022, CLPS had awarded contracts for seven deliveries from four companies: Astrobotic, Intuitive Machines, Firefly Aerospace and Masten Space Systems. Astrobotic’s Peregrine and two Intuitive Machines Nova-C landers are up first, scheduled to launch in late 2022.

“We went from 50 years of nothing going to the moon to seven deliveries scheduled over the next three and a half years,” Chris Culbert, who manages the CLPS program at the NASA Johnson Space Center, said at a panel discussion in November 2021.

Experiments won’t be the only cargo on the first private lunar missions. Astrobotic’s manifest includes items from, among others, the Mexican Space Agency, which is launching the first lunar instruments from Latin America; a Japanese company called Astroscale, sending a time capsule of messages from children around the world; and two firms promising to fly cremated human remains to the lunar surface on behalf of family members who want a celestial send-off for their loved one.

But if the missions land safely, they will also pull off a lot of science, possibly answering some of the most urgent questions we still have about the moon. Researchers debate how exactly our satellite formed, and when. They question the nature of moonquakes, weathering by the solar wind, and the extent and nature of lunar water. Scientists don’t know for sure why the moon’s near side and far side appear so different. Solving these riddles about the moon would help us understand how people might live and work there someday. But even more broadly, investigating these questions will help us understand how Earth and its companion formed, how the sun evolved, and perhaps even whether a body like the moon is vital for the eventual origin of life.

The first few CLPS experiment awards went to scientific instruments that were simple and cheap. In some cases, NASA looked for spares like SEAL that were sitting on a shelf, maybe canceled from previously proposed missions or left over from other spacecraft. Robert Grimm, a planetary scientist at the Southwest Research Institute, who is building multiple instruments to fly on different landers, says one agency official joked with him, “We’re so desperate for payloads, we’ll send rocks back to the moon.”

On its first mission, set for the fourth quarter of 2022, Astrobotic’s Peregrine Lunar Lander will carry two dozen payloads—including the SEAL instrument—to Lacus Mortis, a hexagonal lava plain on the northeastern face of the moon’s near side. One of Intuitive Machines’ Nova-Cs will carry six payloads to Oceanus Procellarum, a vast dark plain on the western edge of the moon. The other is set to bring a mass spectrometer and a drill called PRIME-1 that will extract and sample lunar ice from the south pole region. Later missions will attempt more daring sites with more interesting geological features and will bring instruments to study the moon’s magnetic field and geology, among other goals. Astrobotic even won a $199.5-million contract to deliver a large rover called VIPER, a major science mission that will prospect for water at the south pole in 2023.

David Blewett is a planetary scientist at the Johns Hopkins University Applied Physics Laboratory whose mission was selected in June 2021 for a 2024 flight. His project, called Lunar Vertex, will investigate the magnetic anomaly in a region called Reiner Gamma, which contains a bright surface marking shaped like a tadpole. The swirl has been known since the Renaissance, but scientists debate how it formed. Some theories suggest the moon’s magnetic field changed the motion of the surface dust, whereas another postulates that a collision with a comet’s tail modified the lunar surface. Lunar Vertex will study the paisley-pattern area for about one lunar day—13 Earth days—to determine the swirl’s magnetic properties, origin, and more.

Under the traditional NASA mission-selection process, Lunar Vertex would have been part of a $450-million spacecraft. Instead it’s flying for $30 million as one of a handful of instruments onboard the scrappy Intuitive Machines lander. The hardware itself is also cheaper and simpler than a typical planetary science mission—Nova-C is a slender five-footed hexagon about the size of a British telephone booth. Brett Denevi, a planetary scientist at the Applied Physics Laboratory, is overseeing the design of the mission’s camera. “For Lunar Vertex, the detectors are literally like cell-phone camera detectors,” she says.

Grimm has instruments heading to the Schrödinger basin, an impact crater on the far side that features a peak ring—a plateau or secondary ring inside a crater’s rim that is a hallmark of large impacts. The Schrödinger mission will carry a lunar seismometer—the first to land on the moon since Apollo and the first on the far side—along with a drill, to study the inside of the moon. Grimm says they will provide a fuller picture of the moon’s interior heat and structure, helping to resolve how the satellite came to be.

Other experiments scheduled for launch in the next six years will study how spacecraft landings affect lunar regolith, scouring spacecraft and habitats. They will investigate the radiation environment on the moon; study its carbon dioxide, methane and other volatile substances; search for water ice; and monitor radio waves at the surface, informing plans for radio telescopes to be built on the moon in the future. All these missions will answer key research questions, demonstrate new technologies, prepare scientists and astronauts for eventual human arrivals, and, if industry partners get their wish, stimulate a new kind of lunar economy.

The investors and entrepreneurs working in this iteration of the private space industry aren’t all motivated by scientific curiosity, of course. They’re out to make money, from lunar resources and the proliferation of people and businesses interested in those resources. But the value of that lunar material is still hypothetical.

Take lunar water, which may be plentiful inside permanently shadowed craters. With time and effort, the water theoretically could be split into its constituent parts, oxygen and hydrogen, to be used for rocket fuel. Yet mining lunar water will be profitable only if the moon eventually hosts an active launch pad that allows a solar system exploration economy to arise. Furthermore, creating the infrastructure to convert water to rocket fuel on another celestial body will be difficult, even if the market for it exists.

Most investors say there’s money to be made on the moon long before it becomes a mining outpost, though. “If that was the whole story, then I’d be very nervous,” says Chad Anderson, managing partner at venture capital firm Space Capital, which invested in Astrobotic in 2016. Anderson tracks investment in space-related enterprises and says that $258 billion has been poured into 1,688 such companies since 2013, evidence that venture capitalists see ample opportunity beyond the bonds of Earth.

Anderson says this wave of experiments could lead to a profitable cycle in which the first instruments make promising finds, leading to more questions and ultimately to new interest from prospectors who want to locate and extract whatever the moon has to offer. “The CLPS program is a very elegant way of stimulating a market and stimulating multiple companies in a market,” he says. “In a mining analogy, an economy builds around people going out to look for gold, and you’re going to start selling them picks and shovels and overalls.” In the moon’s case, the shovels are things like communications capability and solar power, which are commodities a lander provider can sell for a fee.

Hanh Nguyen, a graduate student at the London School of Economics who studies public policy with an interest in the commercial space industry, says government funding might spur a new market. “I think as the government provides opportunity for some companies to develop their products,” she says, “other companies will see a need for services or products they can fill in.”

SpaceX had a built-in customer base, however, including other countries’ governments—Nguyen noted that one of its early clients was Malaysia—and American agencies such as the Defense Department. For the moon, potential commercial customers are not quite so obvious, says Matthew Weinzierl, a professor at Harvard Business School who studies the economics of space. “What’s the big upside?” he says. “Where is the big demand going to come from, for visions of a marketplace on the moon with people walking around? That’s exactly the tension I wrestle with and, I’m guessing, people in the industry wrestle with. There are definitely people hoping that tourism, manufacturing, things like that will pan out.” Yet Weinzierl adds that Earth is full of unfettered capital, and space offers one new place to park it.

Lunar scientists tend to be of two minds about the prospect of cheap, frequent private flights to the moon. Several leading lunar researchers are calling for more transparency and better planning. “I think there are mixed feelings,” Stickle says.

Since Apollo, lunar exploration has relied on a sometimes awkward symbiosis between the jingoism and swagger inherent in human spaceflight and the more goal-oriented, pragmatic approach of scientific exploration. “The interesting thing about lunar science is that it often does get caught up in these bigger issues that are not necessarily driven by science,” Denevi says. Even those who are excited to get their experiments on the first private flights acknowledge that CLPS could undercut big, bold NASA lunar missions. Some scientists I spoke with pointed to this as the elephant in the room, noting that the numerous small CLPS missions might not allow for the kind of science that can be done best with a larger mission.

Community leaders are trying to prepare their colleagues for the opportunities CLPS poses while remaining aware of possible pitfalls, says Amy Fagan, chair of the Lunar Exploration Analysis Group and a lunar scientist at Western Carolina University. Some lunar scientists are thinking a few steps ahead of CLPS, either because they’re concerned about hurting their chances for a NASA Discovery mission or because they’re just eager to do more.

The flip side, Fagan says, is that CLPS may be more resilient in the face of budget cuts or politics than larger and more expensive purely governmental projects. So far the Biden administration has adopted the Artemis program begun under Trump and has continued funding CLPS contracts, which surprised some lunar scientists who are accustomed to shifting political winds whenever a new president takes office. “It’s tremendous that we had an administration change and yet Artemis is still there,” Fagan says. “Clearly, there’s a recognition that it’s important to go back to the moon.”

Whereas Apollo was a demonstration of American brainpower and geopolitical might, these new missions half a century later will showcase the country’s present version of government-subsidized capitalism, ultimately sharing the control—and the credit—with entrepreneurs. Scientists who just want to understand more about Earth’s companion world should get their answers no matter who launches the ships. The moon, silent and foreboding as ever, will not discriminate.