By Mark Hemingway and Ben Weingarten for RealClearInvestigations

The historic surge of illegal immigrants across America’s southern border is fueling a hidden crime spree few in Washington seem willing or able to address: widespread identity theft by migrants who need U.S. credentials to work.

An extensive review of government reports, think-tank research, news accounts, and interviews with policymakers and scholars suggests the problem involves millions of people – though measuring it with precision is difficult because of the lack of data provided by authorities.

A telling indication of the scope of the criminality is provided by a little-known government accounting book, the Social Security Administration’s Earnings Suspense File (ESF). It reflects the earnings of employees whose W-2 wage and tax statements have names and Social Security numbers that do not match official records. The total has increased tenfold from $188.9 billion at the dawn of the millennium to $1.9 trillion in 2021.

Officials have historically ascribed a “high proportion” of the file’s growth to wages reported by illegal immigrants, and it has swelled alongside their population, which stands at a conservatively estimated 11.5 million today, 7 million of whom are employed. Among those doing so on the books, federal authorities have found that well over 1 million are using Social Security numbers belonging to someone else – i.e. stolen or “shared” with a relative or acquaintance – or that are fabricated.

The data held in the ESF would enable authorities to pursue many of the fraudsters, but the IRS and other agencies responsible for enforcing the law have been reluctant to investigate, and regulations have prevented meaningful information-sharing among them. This identity-related crime is providing a windfall for the U.S. government.

A 2017 study from the conservative Federation for American Immigration Reform found that the federal government collects about $22 billion annually in tax receipts from illegal aliens, with the bulk going toward Social Security ($12.6 billion) and Medicare ($5.9 billion) – programs from which noncitizens are ineligible to receive benefits. FAIR estimated that illegal migrants also paid $3.3 billion in federal income tax – a smaller proportion primarily due to illegal aliens’ lower wage levels – and another $1 billion in state income taxes.

RELATED: After Giving Democrats Enough Gun Control Votes, Cornyn Reportedly Says Immigration Is Next

In other words, the fraud has the effect of bolstering financially shaky federal programs. In one of the agency’s rare direct statements on the issue, Social Security Administration Chief Actuary Stephen Goss told CNN in 2014 that without “undocumented immigrants paying into the system, Social Security would have entered persistent shortfall of tax revenue to cover payouts starting in 2009.

Support Conservative Voices!

Sign up to receive the latest political news, insight, and commentary delivered directly to your inbox.

” Leading progressive Rep. Pramila Jayapal echoed this observation in 2018, arguing that a “complication of [then-president] Trump’s plans to limit immigration is the effect to our Social Security Earnings Suspense File – money that keeps our Social Security system afloat,” including that provided by “undocumented immigrants.”

Another complication of Trump’s plans to limit immigration is the effect to our Social Security Earnings Suspense File – money that keeps our Social Security system afloat.

The tax money of undocumented immigrants goes to this file, which held $1.2 trillion at the end of 2012. pic.twitter.com/q6sz4ksxpE

— Rep. Pramila Jayapal (@RepJayapal) February 27, 2018

Given Washington’s bipartisan willingness to tolerate illegal immigration – whether driven by the multicultural left or businesses interests seeking cheap labor – authorities have focused on this apparent windfall to the U.S. Treasury. But they have largely ignored the costs. These include the significant strain illegal immigrant households place on public finances, which FAIR and others estimate vastly outweigh their tax contributions, their impacts on crime and the job market – and on the victims of identity theft.

Reports dating back over a decade show that hundreds of thousands of Americans are unknowingly “sharing” their Social Security numbers with illegal immigrants. Such victims may face tax bills for income they didn’t earn or depleted benefits.

Worse, some may experience the burden of bad credit histories and criminal records inaccurately attributed to themselves after being issued SSNs that illegal aliens had previously invented and used. The overall impact on American citizens is largely unknown because federal, state, and local governments as well as financial institutions have generally failed to notify them even when fraud is suspected.

The relevant agencies were largely non-responsive to RealClearInvestigation’s requests for updated figures on the size, scope, and extent of the fraud. Nor have lawmakers recently given voice to the victims.

Congress seems to have last held a hearing spotlighting the defrauded over a decade ago. Related legislation aimed at reducing Social Security number fraud in employment has typically languished, and many lawmakers RCI contacted indicated only a passing knowledge of the issue.

One thing experts do agree on is that the problem is likely to get worse as more illegal immigrants cross the border and seek work.

Immigration Reform Spurs Fraud

The growth in illegal immigrant identity fraud, reflected in part by the booming Earnings Suspense File, serves as an ironic instance of regulation becoming the mother of criminal innovation.

In 1986, Congress for the first time made it explicitly unlawful for employers to hire illegal immigrants. The Immigration Reform and Control Act required those seeking employment to fill out I-9 forms attesting to citizenship or work-authorized immigrant status, and provide corroborating documentation and a valid Social Security number.

The law, signed by President Reagan amid great fanfare, was supposed to end the problem of illegal immigration, and as part of the grand bargain nearly 3 million undocumented immigrants, most of them from Mexico, were granted U.S. citizenship. But the law did not slow the pipeline of immigration as it was intended to do, and it would drive many illegal aliens – not only those crossing the border under cover but also those not allowed to work while awaiting court hearings that can take months or even years to take place – to fraud.

According to the libertarian CATO Institute, the 1986 law spurred the “creation of a large‐scale black market for legal documents in the United States. The value of document fraud increased after ICRA because false documents became necessary for illegal immigrants to fill out an I-9 form to work.”

RELATED: Texas Launches Operations Center To Oversee 15-Agency Effort To Thwart Illegal Immigration

Aliens can procure SSNs in several ways: Some simply conjure a nine-digit SSN out of thin air. Others use the numbers of their children who were born in the U.S. Still others steal them directly from individuals, purchase them from dealers for $80 to $200 along with a green card as can be done in Los Angeles, or via the dark web for as little as $4.

In a rare instance of enforcement, in June the Department of Justice announced that a joint operation between the IRS Cyber Crimes Unit and the FBI had seized the “SSNDOB marketplace” – a series of lucrative websites touted on the dark web that sold illegally obtained Social Security numbers of more than 20 million Americans. But “synthetic identity fraud” persists – the most common form of ID theft, where fraudsters create an entirely new identity by stealing the Social Security numbers of children or poor adults with little credit history.

While some illegal immigrants work off the books, the Social Security Administration has previously said that 75% are using fake or stolen numbers. By doing so, they gain access to broader employment opportunities. There is another powerful incentive for paying taxes as well.

By dint of their generally low income levels, illegals can receive reimbursements through making use of deductions and exemptions, as well as rebates via refundable credits – leaving many with tax liabilities of zero or even as net recipients of government largesse. Immigration proponents contend that many do so in the hope that paying their taxes through employer withholding will weigh in their favor in a future amnesty, reflecting good behavior.

Their fraud can be detected each year when employers submit W-2s. The Social Security Administration analyzes the W-2s to detect inaccuracies, such as mismatched names to the numbers it has on file.

This is where the Earnings Suspense File comes into play. ESF, established in 1937, was long an accounting for wayward tax and Social Security payments – for instance when a newly married woman changed her name but forgot to notify the SSA. Should a legitimate taxpayer find he didn’t get tax refunds or Social Security benefits because of a mix-up with his Social Security number, ESF records ideally would help him get what he was owed. Unreconciled filings would remain in the ESF.

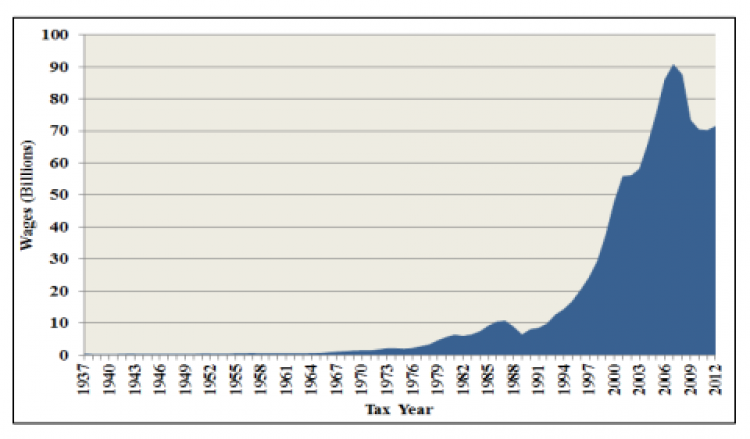

For decades relatively little money was recorded in the file. According to the Government Accountability Office, in the three decades between 1950 and 1980 just $33 billion in uncredited earnings were recorded.

Contributions to the ESF exploded after passage of the ICRA in 1986, as a Social Security Administration inspector general report providing a chart showing annual contributions to the fund makes clear:

Uncredited earnings rose to $77.3 billion in the 1980s, would double in the 1990s to $188.9 billion, and then grow by a factor of 10 over the next two decades to an accumulated $1.9 trillion today – surging by $409 billion between the years 2012 and 2016 alone, according to documents obtained by the mass migration-skeptical Immigration Reform Law Institute via FOIA request.

A 2015 audit from SSA’s IG reports that in a given year as many as one in 25 American workers supplied their employers with false information – “each year, SSA posts to the ESF 3 to 4 percent of the total W-2s and 1.4 to 1.8 percent of the total wages received from employers.”

A 2018 Treasury inspector general report documented more than 1.3 million cases of employment-related identity theft from 2011-2016, and 1.2 million cases in which illegal aliens used Social Security numbers that belonged to someone else or were fabricated in 2017 alone. The Social Security Administration projects this number will rise to 2.9 by 2040.

Private estimates of Social Security number theft have ranged substantially higher.

A 2020 GAO report on employment-related identity fraud identified more than 2.9 million Social Security numbers with “risk characteristics associated with SSN misuse.”

“There’s massive amounts of fraud, the SSA knows it’s happening, and they know it’s your Social Security numbers…being used. These IG reports make it explicitly clear,” said Jon Feere, a former Department of Homeland Security and U.S. Immigration and Customs Enforcement official now with the “pro-immigrant, low immigration” Center for Immigration Studies. “And they basically say that they believe that one of the main reasons for this fraud is because of the employment of illegal aliens.”

Known Fraud, Little Enforcement

The existence of the ESF means the Social Security Administration and the IRS, with which it coordinates, are sitting on a database containing a substantial population of fraudsters against American citizens. For the better part of two decades, government watchdogs have encouraged these agencies to put the data to use, but they have been reticent.

A 2005 Social Security Administration IG report stated: “Although SSA continues to coordinate with DHS on immigration issues, it does not routinely share information regarding egregious employers who submit inaccurate SSNs. In our opinion, any serious plan to address SSN misuse and growth of the ESF must allow SSA to share such information with DHS,” reads the report.

A 2006 GAO report similarly recommended that the SSA, IRS, and DHS share data to address this problem. However, federal law severely limits the SSA and IRS from sharing information from tax forms, in part on privacy grounds. The ACLU called attempts to coordinate information-sharing between the SSA and immigration enforcement authorities during the Trump administration an “all-out assault on our legal rights and our immigrant communities.”

Since SSA lacks enforcement authority, the George W. Bush-led Immigrations and Customs Enforcement agency proposed a rule setting forth potential penalties for employers who did not respond to SSA “no match letters” – notifications sent to employers informing them of employees whose SSNs don’t match government records.

The proposed rule kicked off a firestorm of opposition from immigrant advocates. In 2008, U.S. Court of Appeals for the Ninth Circuit reinstated 33 employees who had been fired by their employer after receiving a no match letter. The court ruled a no match letter alone wasn’t sufficient to determine whether employees were in violation of the law.

The Obama administration put an end to no match letters altogether. Jason Hopkins, the investigations manager for the IRLI, told RCI that the Obama administration did so in service of its Deferred Action for Childhood Arrivals (“Dreamers”) program, which allowed illegal immigrants brought to the U.S. as children exemption from deportation and eligibility for work permits.

“If they went in [and] applied for a DACA application, and they had to actually admit they put in fake social security numbers, they’d be essentially admitting to perjury,” Hopkins says. “So that would have scared them off, and Obama wanted them to apply for this program.”

In 2019, the Trump administration-led Social Security Administration resumed sending out no match letters, delivering 1.6 million notices across 2019 and 2020. The Biden administration again discontinued the practice.

RELATED: Americans More Concerned As Illegal Immigration Soars To Highest In Two Decades

The SSA did not respond to RCI’s multiple attempts to contact it regarding related policies.

The IRS has enforcement powers the SSA lacks, but has historically disavowed responsibility for dealing with illegal alien ID theft. In 2016 then-IRS Commissioner John Koskinen, who faced impeachment hearings for defying congressional subpoenas and the destruction of evidence, told Congress, “We have Social Security and immigration authorities and others who enforce that part of the law, and if we start looking behind the system and doing their job for them, we’re going to discourage a lot of people from paying the taxes they owe.”

Consistent with this view, a 2020 GAO report on employment-related identity fraud found that the IRS was not tracking numerous forms of employment-related identity fraud.

The IRS’ Internal Revenue Manual, which governs employees’ policies and practices, refers to those engaged in ID fraud as “borrowers,” defending this language as neutral, given that some may be “borrowing” an SSN from another family member to work, rather than engaging in “actual identity theft.”

When CNS News asked the IRS in 2018 how many taxpayer accounts it had referred for criminal prosecution, of the 1.3 million Treasury’s inspector general had flagged for identity fraud, the agency said “We do not have this information.” Similarly, the IG report recommended that the IRS notify the 458,658 victims of ID theft identified in 2017 – and the IRS does not appear to have notified anyone.

When RCI asked the IRS about its policies for handling ID theft, the agency did not confirm it had done anything in response to the IG’s findings or identity fraud specifically related to illegal immigration. A spokesman said that “in recent years, we’ve referred people” – that is, from the general U.S. population – “for prosecution all the time, and where appropriate, we work with other law-enforcement agencies.”

The IRS’s guide to employment-related identity theft highlights notices it might send to taxpayers indicating potential fraud, but it is not clear how many such letters it sends out, and the burden overwhelmingly falls on the victims to be vigilant and take steps to clear their names.

Meanwhile, DHS Secretary Alejandro Mayorkas has curtailed worksite enforcement. Between halting no match letters and DHS’ leniency, Spencer Raley, a researcher with FAIR, told RCI, “From a strictly immigration-enforcement standpoint, nothing is being done to combat the issue of illegal aliens committing document fraud in order to obtain employment.”

RCI asked a series of questions of ICE, which leads criminal investigations into both document fraud and worksite enforcement, on the nature and extent of its targeting of those engaging in ID theft/fraud in employment, and whether and to what end it coordinated with other agencies on identifying such individuals for investigation. As of the time of publication, it had not responded to the questions.

Law enforcement agencies have periodically made illegal alien ID fraud busts in recent years, but not at meaningful levels relative to the previously reported number of fraudsters.

Given that Medicare is a beneficiary of the fraud, RCI posed a series of questions to the Centers for Medicare and Medicaid Services pertaining to ESF, and whether it was aware of, or did anything to contact those whose SSNs might have been fraudulently used associated with Medicare contributions. A CMS spokesperson referred RCI to the Social Security Administration.

RCI posed similar questions to tax authorities in both California and Texas – states dominated by opposing political parties but each with substantial illegal alien populations – to ascertain whether they, like the federal government, were tracking taxes paid by those potentially using fraudulent IDs, including illegal aliens, and doing anything to pursue them.

California’s Franchise Tax Board told RCI that it does not have a state Earnings Suspense File, nor does it track how much tax revenue annually is attributable to individuals misrepresenting themselves on filings. It did note, “If we suspect identity theft on an individual tax return, we send a notice to the taxpayer to let them know they may be a victim and how to verify the authenticity of the tax return on file.” With respect to enforcement, the board indicated “Fraudulent claims and suspected ID theft cases may be sent to” its Criminal Investigations Bureau, which partners with other state law enforcement authorities. The board emphasized that California further partners with “state, city, federal and industry partners” to “protect the entire tax ecosystem,” with a focus on “widespread fraudulent schemes and threat groups,” rather than those filing and paying taxes.

As of the time of publication, Texas had not responded to RCI’s inquiries.

Banks and credit agencies also have their own extensive “sub-files” for people who share the same Social Security number, but privacy laws make it impossible to get information on someone who has stolen one’s SSN from a third party, even though the behavior of the person stealing one’s number may end up affecting one’s ability to get government benefits or credit.

Credit rating agencies Equifax, Experian, and Transunion did not respond to RCI’s queries around illegal alien identity fraud.

What Victims Face

Marcus Calvillo, a father of six from Grand Prairie, Texas, experienced one of the more harrowing episodes of identity fraud on record, at least in the eyes of the prosecutor who helped bring him justice. Calvillo’s life was upended after an illegal immigrant named Fernando Neave-Ceniceros was first arrested on drug trafficking charges in Kansas in 1993, then a slew of other ones, including a sex crime involving a minor, and his twice failing to register as a sex offender.

The criminal activity was recorded under Calvillo’s stolen identity – Neave-Ceniceros’ fingerprints were linked to Calvillo’s name in national criminal databases – making it difficult for the innocent Calvillo to pass the cursory background checks required to hold a job and support his family.

At one point, Calvillo was working as a cable installer when he was abruptly fired. When asked why, he told the Associated Press he was only told, “You know what you did.” Calvillo also had disputes with the IRS over taxes on wages that had been paid to Neave-Ceniceros but recorded under his name.

After years of struggling to get help – a struggle similarly encountered by other victims – Calvillo contacted Assistant U.S. Attorney Brent Anderson, who had been pursuing another identity theft case, who helped him get justice. In 2016, Neave-Ceniceros was convicted on a series of charges including aggravated identity theft and misuse of a Social Security number. “I don’t know of a case where the theft of an identity had a more devastating impact than this one,” Anderson told the Associated Press.

Despite wreaking havoc on Calvillo’s life, Neave-Ceniceros was only sentenced to one year and a day in prison for his crimes.

Horror stories such as Calvillo’s still abound. “I’ve been fired from jobs and have been accused of crimes I didn’t commit because my identity was stolen,” identity theft victim Adrian Gonzalez told the Fort Worth Star-Telegram last year. “I don’t know what to do anymore, I think I might need to change my name.”

Linda Trevino, a Chicago suburb resident, was another victim, one of the hundreds of thousands NBC News cited in a report from over a decade ago. She had been denied a job at a local Target because someone using her SSN also worked there. Her number, in fact, had been used to obtain employment at 37 other employers, leaving her haunted by the IRS with letters asking her to pay others’ taxes, and facing creditors.

Children are victims of fraud too, and in fact may be prime targets given the clean records their IDs provide for thieves, and that conduct engaged in in their names may go undetected for years. Former California congressman Elton Gallegly wrote in The Hill in 2012 of a number of child victims of illegal immigrant fraud, including among them:

- A 3-year-old issued an SSN already in use for years by a twice-arrested illegal alien, impacting the child’s credit, medical, and work history.

- A 9-year-old denied Medicaid due to wages reported on his SSN.

- A 13-year-old denied as a dependent on her family’s return for supposedly making too much money.

Immigration advocates downplay the criminality involved. “Most workers are buying documents they believe to be false,” a representative of the National Immigration Law Center told the Los Angeles Times. “There isn’t really any intention of stealing someone’s identity.” But even when immigration-related identity theft lacks specific criminal intent, the confusion that ID theft creates when dealing with tax bills, receiving government benefits, facing ruined credit, and other problems can upend a person’s life.

Citizens who discover someone else is using their Social Security number will quickly learn there’s little they can do about it. According to the Social Security Administration, proof that one’s SSN has been stolen and is being used by someone else isn’t sufficient reason to change one’s Social Security number. One must prove significant harm as a result, and the process is onerous – in 2014 the agency only permitted a total of 250 people to change their Social Security number. The Federal Trade Commission details the numerous steps those who believe they might have been defrauded should take to get their lives back.

The problem is so extensive that Mike Chapple, a professor of information technology at the University of Notre Dame’s Mendoza College of Business, told Forbes, “It’s totally reasonable to assume that your Social Security number has been compromised at least once, if not many times.”

Little Legislative Relief

One of the seminal victories for proponents of ID integrity in the workplace was the passage of the Illegal Immigration Reform and Immigrant Responsibility Act in 1996, which launched the E-Verify system.

That its author, Rep. Ken Calvert, another California Republican, was still struggling 15 years later to move legislation making the program mandatory, illustrates the uphill battle the limited number of immigration hawks in Washington face.

The DHS-run program, which compares employment eligibility information from I-9 forms to government records, remains required solely of federal contractors. Only a small minority of states have mandated its use by employers. Republican senators Mitt Romney and Tom Cotton tried to pass a federal law that would simultaneously mandate E-Verify and raise the federal minimum wage to $10 an hour, but with the Senate controlled by Democrats, that legislation died.

On the House side, Georgia Republican Buddy Carter has sought to pass legislation multiple times that would require the IRS to produce a report on whether it could use proprietary information to identify illegal aliens fraudulently working in the U.S., to no avail.

At the state level, even Republican red Texas, mired in problems pertaining to illegal immigration, has had difficulty finding the political will to police the workplace. “At least 30 bills mandating E-Verify have been introduced in Texas in the past decade,” the Fort Worth Star-Telegram reported last year. “Only one has passed, and none addressed undocumented workers, employers or temporary employment agencies using fraudulently obtained identities.”

Until recently, it wasn’t clear whether states even had the authority to prosecute identity theft by illegal immigrants. In March of 2020, the Supreme Court ruled in a 5-4 decision that at least in some circumstances, they do, overturning a Kansas Supreme Court ruling that had voided the convictions of three illegal immigrants under the state’s identity theft law who had used stolen SSNs to obtain jobs.

The rapidly changing political landscape may be the only thing that could impact the broader trajectory of illegal immigration from which the fraud springs. The populist turn of the post-Donald Trump Republican Party is appealing to working class voters with a strong interest curbing illegal immigration to put upward pressure on wages.

Recent elections also show Hispanics voting for Republicans in significantly higher numbers, in part because of the Democrats’ more liberal border policies.

In the meantime, the illegal immigrant population continues to swell. The Biden administration has released over one million illegal immigrants into the U.S., in addition to the more than 700,000 “got-aways” who evaded apprehension, and over 190,000 unaccompanied minors released into the interior – for a total of nearly two million people. “To put it bluntly, the Biden administration, and other Democratic administrations, they just don’t care,” says Jason Hopkins.

Syndicated with permission from Real Clear Wire.

The opinions expressed by contributors and/or content partners are their own and do not necessarily reflect the views of The Political Insider.