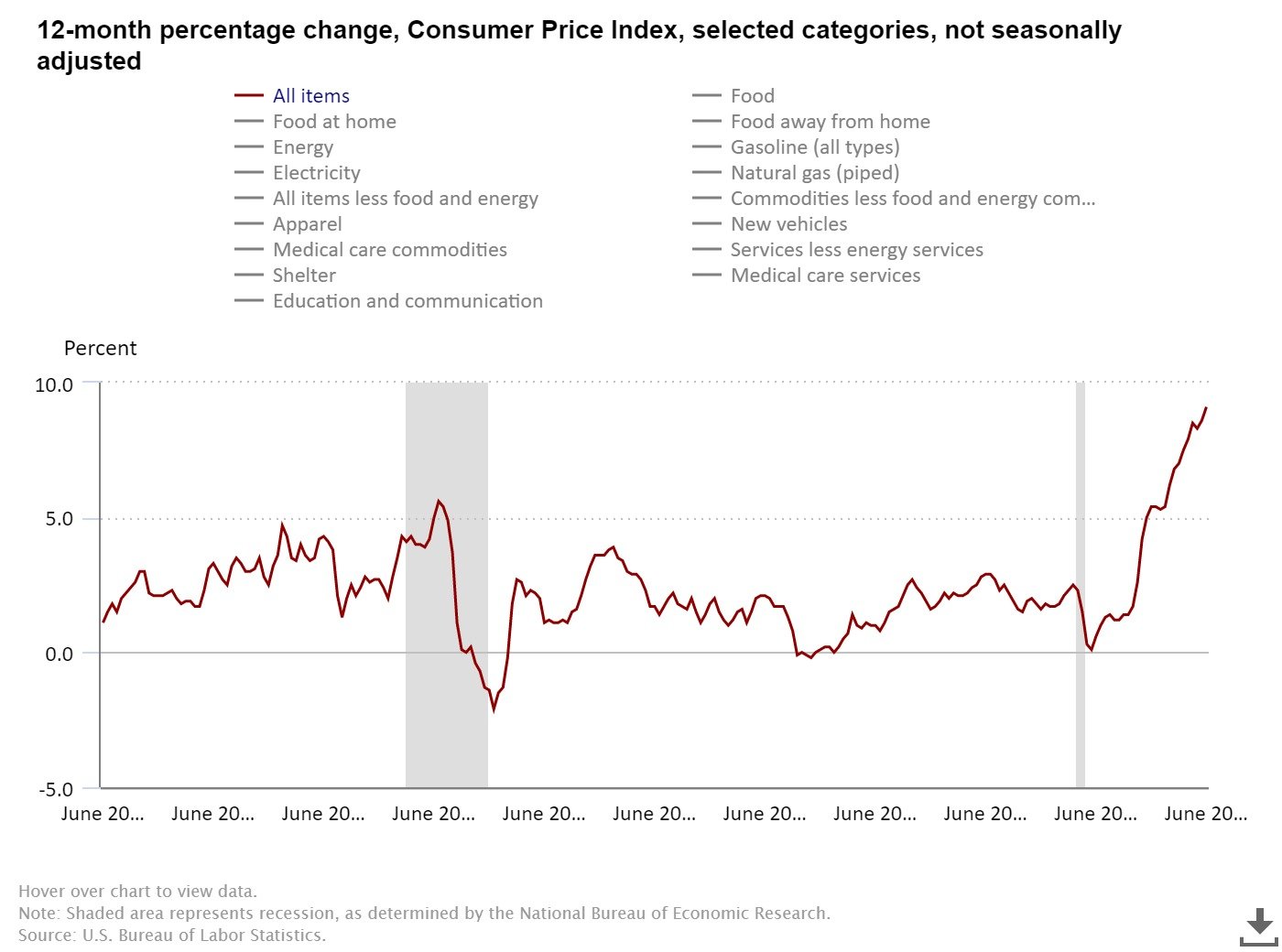

Inflation far outpaced economist expectations, spiking to a new 40-year high of 9.1% in June, a staggering number that helped drive down the real average hourly earnings for all employees from May to June by a full 1.0%.

The latest numbers from the Bureau of Labor Statistics (BLS) indicate the nation is deep into the throes of a financial crisis with little signs of letting up.

Once again, the data shows the biggest contributors to the rise in prices come from gasoline (11.2% in June, 59.9% year-over-year), shelter (0.6% in June, 5.6% year-over-year), and food (1.0% in June, 10.4% year-over-year) – all essential items necessary to simply exist.

The 1.3% spike on all items in June helped inflation hit 9.1% and far exceed the 8.8% Dow Jones estimate.

CNN’s John Berman: “Just look at that chart you can just see [inflation] go up and up and up” pic.twitter.com/FXk8rFET7k

— RNC Research (@RNCResearch) July 13, 2022

RELATED: Biden On How Long Americans Can Expect To Pay High Gas Prices – ‘As Long As It Takes’

Hourly Earnings Plummet Due to 9.1% Inflation Rate

And while the 9.1% inflation rate clearly demonstrates the cost of nearly everything is going up, a natural result is a decrease in how far your paycheck is going, creating a double whammy for American wallets and pocketbooks.

“Real average hourly earnings for all employees decreased 1.0 percent from May to June,” the BLS report states.

Support Conservative Voices!

Sign up to receive the latest political news, insight, and commentary delivered directly to your inbox.

That number is a result of average hourly earnings rising 0.3% but being beaten down by the increase of 1.3% in the Consumer Price

Index.

And that’s been a trend from well before Putin’s excursion into Ukraine.

“Real average hourly earnings decreased 3.6 percent, seasonally adjusted, from June 2021 to June 2022,” the BLS writes, adding that a year-over-year decrease in the average workweek “resulted in a 4.4-percent decrease in real average weekly earnings over this period.”

CNBC: “No relief” from inflation under Joe Biden pic.twitter.com/l67B1A2Tfi

— RNC Research (@RNCResearch) July 13, 2022

That’s a far cry from what the President told the public just seven months ago.

“Even after accounting for rising prices, the typical American family has more money in their pockets than they did last year,” Biden claimed this past December.

It is a statement that even then was disputed by fact-checkers.

RELATED: Report: Americans’ Retirement Accounts Have Lost Trillions – TRILLIONS – In 2022

Biden’s Economy Has Been a Disaster

You knew the inflation numbers were going to be devastatingly high when yesterday, White House press secretary Karine Jean-Pierre tried to stifle the blow by labeling today’s report as “backwards-looking data.”

“The President’s number one economic priority is tackling inflation,” she said. “And looking ahead, there are a number of reasons why we expect those high prices to ease over the coming months.”

Bear in mind that this is the same administration that claimed repeatedly about inflation being temporary or transitory.

— RNC Research (@RNCResearch) July 13, 2022

In January of 2022, President Biden was telling the American people that inflation was slowing.

“We are making progress in slowing the rate of price increases,” he said. “At the same time, this report underscores that we still have more work to do, with price increases still too high and squeezing family budgets.”

The progress was short-lived, as indicated by the 9.1% inflation rate.

— Rusty ????️ (@rustyweiss74) July 13, 2022

Jean-Pierre claims that lower gas prices mean inflation should be easing going forward. And indeed, gas prices have come down a bit over the past three weeks, but they remain exceptionally high compared to where they were when Biden took office.

The President recently said he expects Americans to continue paying higher gas prices due to the war in Ukraine.

“As long as it takes,” he predicted.

????: NY Times’ Jim Tankersley asks Biden, “How long is it fair to expect American drivers to pay that premium” for the war in Ukraine?

Biden: “As long as it takes.” pic.twitter.com/PnRX95xT48

— John Cooper (@thejcoop) June 30, 2022

Robert Frick, a corporate economist at Navy Federal Credit Union, says the blame can’t solely be placed on global prices either.

“Though CPI’s spike is led by energy and food prices, which are largely global problems, prices continue to mount for domestic goods and services, from shelter to autos to apparel,” Frick said according to CNBC.

While Biden has insisted that his policies have nothing to do with inflation – “most economists do not think it did” – CNBC lists a number of admin issues that have exacerbated the problem including “clogged supply chains” and “trillions of dollars in Covid-related stimulus spending.”

‘Putin’s price hike’ didn’t make their reporting.

Now is the time to support and share the sources you trust.

The Political Insider ranks #3 on Feedspot’s “100 Best Political Blogs and Websites.”