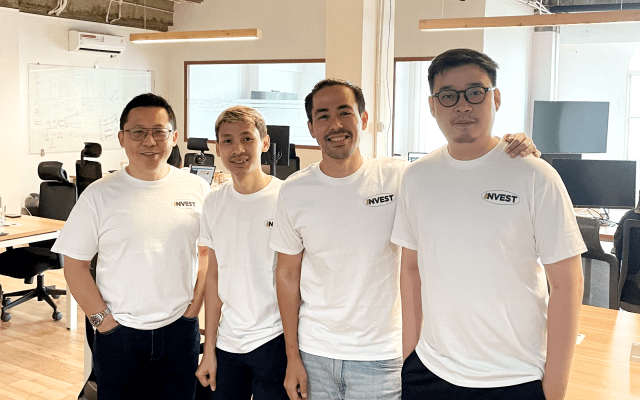

Real returns are being eroded as inflation soars — but fund manager Brian Arcese has a number of stock picks he thinks are effective inflation hedges. U.S. inflation rose again in April , with the consumer price index increasing 8.3% from a year ago — higher than expected, but a slight ease from March’s peak. Meanwhile, the Federal Reserve’s preferred inflation gauge rose 4.9% in April from a year ago, a slower pace than March’s 5.2%, suggesting that price pressures c ould be showing signs of easing . Nevertheless, inflation remains at an elevated level, and continues to be a source of volatility for investors. “Our expectation would be for inflation to moderate from here, but in a base case to remain meaningfully above where it has been for the past 15 years,” Arcese said. Arcese is a portfolio manager at Foord Asset Management, a boutique investment firm with $8 billion of assets under management. He manages the Foord International Fund — a multi-asset portfolio that aims to deliver returns in excess of U.S. inflation over five years or more — as well as the Foord Global Equity Fund, an equity-only product benchmarked against the MSCI World Index. Speaking to CNBC on Monday , he noted that beating inflation over time has been “a hallmark” of what the Foord International Fund does. “We are not necessarily aiming to deliver inflation +5[%] in any given quarter or any given year, but certainly through the cycle.” The fund has delivered annualized returns of 6.7% since its inception 25 years ago, comfortably beating the annualized inflation rate of 2.4% over the same period. “We focus a lot on cash flow and the quality of the management team and how much earnings the business can generate, and in particular, earnings based on cash flow,” Arcese added. Commodities as an inflation hedge Around 20% of the Foord International Fund is directly exposed to commodities, through a mix of commodity-linked equities and physical commodities. “In any type of inflation, it’s the real assets that protect against capital erosion. And so, owning equities that own real assets is the primary reason that these are really the best hedges,” Arcese told CNBC Pro. He acknowledged that soaring commodity prices this year meant some commodity stocks could look expensive, but insisted that commodities will remain a “meaningful” part of his portfolio. “We agree with many in the market that commodity prices in certain pockets have probably gotten ahead of themselves. We have started to slowly trim [our holdings], but we are still very comfortable investing in many of these names for the long term,” he said. Stock picks Within the mining sub-sector, Arcese said the firm only invests in “high quality” mining companies with the “highest-calibre” management, as well as those who return a significant portion of cash generated to shareholders. One of his top picks in this space is copper miner Freeport-McMoran , which he described as “one of the lowest cost copper producers globally” and a payer of dividends. “The return that we are trying to provide our investors is really a total return. So, it can be a combination of capital appreciation and dividends that companies pay back to shareholders. We aim to invest in companies that are very happy to return a significant amount of that cash to shareholders,” he said. Other mining stocks that Arcese likes include mines operator Pan American Silver , precious metals streaming company Wheaton Precious Metals , Australian rare-earths miner Lynas and Irish mining firm Kenmare Resources . Within the wider commodities space, he also likes chemicals manufacturers FMC and Livent , Canadian fertilizer company Nutrien and Bayer .

A dump truck unloads ore into a crusher in the underground area at Freeport McMoRan’s Grasberg copper and gold mining complex in Papua province, Indonesia.

Dadang Tri | Bloomberg | Getty Images

Real returns are being eroded as inflation soars — but fund manager Brian Arcese has a number of stock picks he thinks are effective inflation hedges.

.jpg)