ABU DHABI, United Arab Emirates — President Joe Biden is making no secret of his frustration with high gas prices and the oil companies making record profits as a result. With the support of Democratic allies in Congress, he is threatening to levy windfall taxes on energy firms, a prospect that’s prompted backlash from the industry.

The president on Monday tweeted: “The oil industry has a choice. Either invest in America by lowering prices for consumers at the pump and increasing production and refining capacity. Or pay a higher tax on your excessive profits and face other restrictions.”

The language sets up what looks like a standoff between the U.S. oil industry and the Biden administration at a time of high energy prices, soaring inflation and worries of a global crude supply shortage after years of under-investment in the industry and several months of sanctions on Russian commodities for its war in Ukraine.

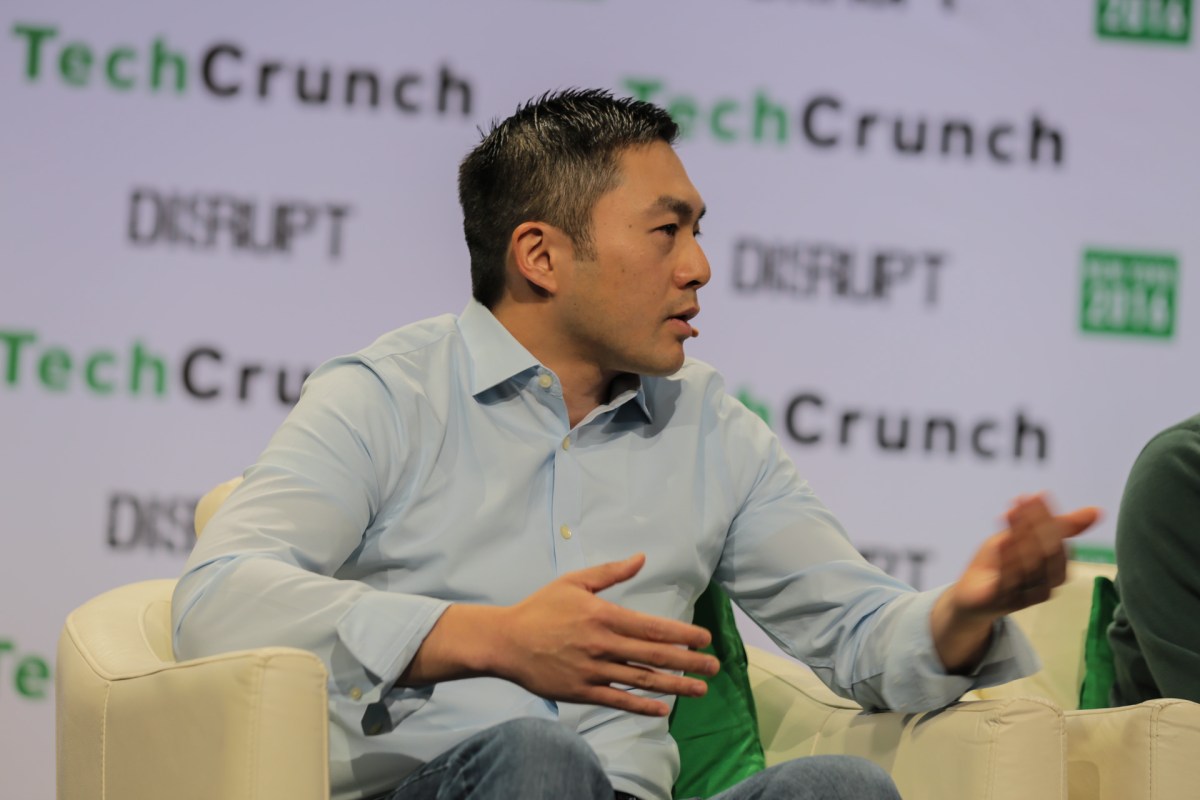

But reports of animosity between the White House and America’s energy giants are overhyped, says Amos Hochstein, Biden’s special presidential coordinator, who liaises closely with energy industry leaders domestically and around the world.

The Biden administration is not anti-profit or anti-free market, he stressed; rather, it wants to see oil companies reinvest their profits in improving crude production and the country’s energy security.

“I talk to the CEOs, other senior members of the administration talk to the CEOs on a regular basis,” Hochstein told CNBC’s Hadley Gamble Monday, when asked about the administration’s relationship with industry executives.

“People know that. I don’t think that’s the issue. The issue is this: we want them to increase their capex, increase investment,” he said. “The price environment for the last year, over a year now, lends itself to investment. So take those profits that you’re making. We’re not against profits. What we do want, and the president said this last week — take those profits and invest them.”

Congressional Democrats argue that oil executives are prioritizing shareholder returns over reinvesting profits toward boosting production that could lower consumer prices. Hochstein held the position that shareholder returns are not an issue in themselves, but that increasing America’s energy supplies should be the priority.

“You want to pay some back to shareholders? Some is fine,” he continued. “But not excessively. You want to take these profits, that’s fine too. But not excessively. We’re in a war and you can do more to increase production.”

Record-breaking oil company profits

Several major oil companies have raked in record profits this year as consumers grappled with soaring gas and energy bills. ExxonMobil reported a record $19.7 billion net profit for the third quarter, and Biden this week accused the Texas-based company of using that to reward shareholders and buy back its own stock rather than investing in production improvements that could ease prices at the pump.

California-based Chevron made $11.23 billion in profits in the third quarter, just shy of the record it hit in the previous quarter. In the last two quarters, Chevron, ExxonMobil, ConocoPhillips and Britain’s BP, Shell and France’s TotalEnergies reportedly made over $100 billion in profits — more than they earned in the entirety of 2021.

Exxon Mobil CEO Darren Woods, speaking to CNBC last week, said his company was committed to addressing both shareholder returns and improving production, regardless of who was in the White House.

“We don’t really look to satisfy one administration or the other. We look to make sure we’re doing the best we can using our shareholders’ money appropriately, finding advantaged projects that allow us to grow production and grow value. We’re also looking at reducing our emissions,” he told CNBC’s “Squawk Box.”

But Hochstein says he doesn’t see sufficient investment on a broad scale.

“All I see is record profits that are not translating to sufficiently increased investment and where investments are not keeping up with average ratios of investment-to-price increase,” he said.

Many in the oil industry argue that a windfall tax is counterproductive and would harm production and investment. Still, the threat of such taxes from the Democratic leadership is likely more of a pressure tactic than a plausible policy proposal in the near-term since Congress is not in session. And it could even become impossible to carry out if Republicans, who largely oppose such a move, win one or both houses in the November midterm elections.

A changing White House tone on fossil fuels

Biden came into office campaigning hard for an end to fossil fuel use and a transition to renewables as part of his climate-focused agenda, laying out a bevy of regulations on oil and gas exploration and production. Supporters of Biden’s green energy goals say this aggressive push was needed to reverse what they describe as damage done by former President Donald Trump, who rolled back years of work on environmental protections and pulled the U.S. out of the Paris Climate Accords.

But it was that policy push, those in the fossil fuel industry argue, that helped throttle investment in oil and gas production and subsequently led to the energy supply shortages and higher prices we see today. Now, faced with a tightening global oil and gas market, climbing demand, and a war in Europe, the administration is taking a different tone.

“Look, it’s no secret that the Biden administration and oil industry do not see eye-to-eye on the long term role that oil will play in the economy,” Hochstein said. “However, we have to do two things. We need more investment in oil production and refining, now.”

The longtime energy policy veteran pointed out that much of the initial regulations and restrictions have eased — and noted that under this administration, the U.S. is approaching pre-pandemic highs in oil production levels, even despite what he says is insufficient activity from oil companies.

Figures released by the U.S. Energy Information Administration on Monday revealed domestic crude oil production hitting 11.98 barrels per day in August, the highest since March 2020 and nearing the U.S.’s all-time record of 12.3 million barrels set in 2019.

Occidental Petroleum CEO Vicki Hollub contradicted the narrative that the Biden administration was ignoring oil companies. Speaking to CNBC in Abu Dhabi, she said she indeed communicates with U.S. Energy Secretary Jennifer Granholm, a vocal climate policy advocate.

“I do hear from Secretary Granholm — she is focused on tech, she’s enthusiastic about the climate transition, she listens, she [communicates with] the National Petroleum Council and has sent us requests for studies to be conducted to help her in making her decisions” concerning clean energy investments, Hollub said.

Whatever the disagreements on the longer-term role of the fossil fuel industry in the U.S., oil executives and White House officials appear to agree on one thing — they will need to communicate properly to ensure future energy security for the country at a time of severe economic and geopolitical risk.