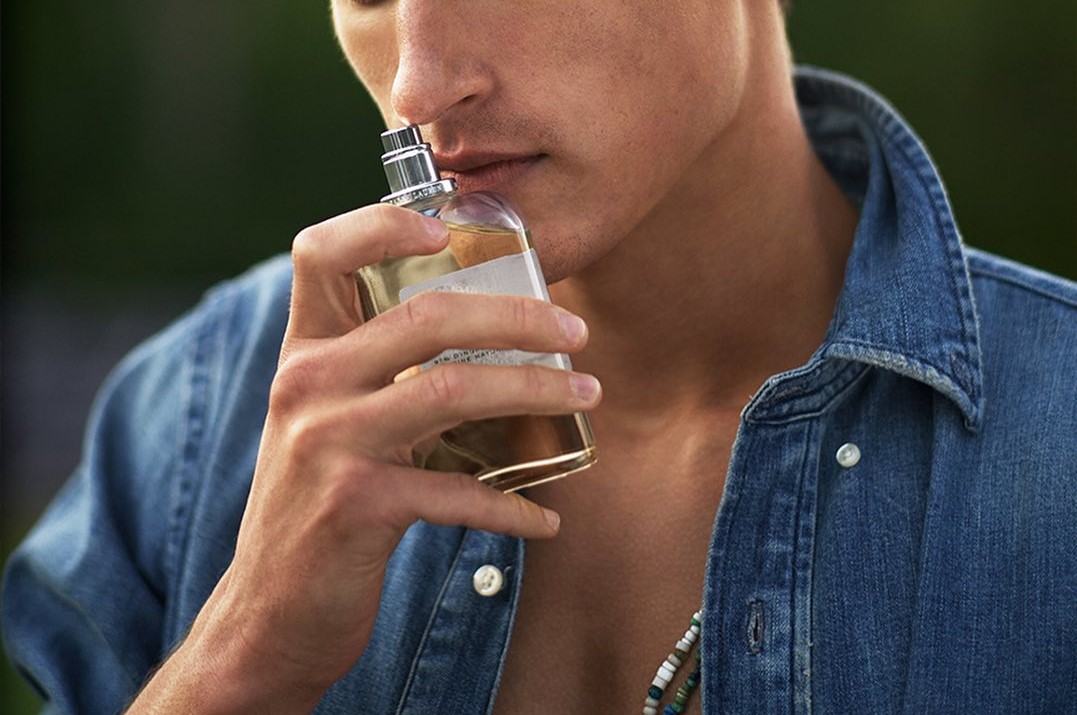

Walgreens and VillageMD

Source: Walgreens

Primary care provider VillageMD, which is backed by Walgreens Boots Alliance Inc, is buying urgent care provider Summit Health in a deal valued at nearly $9 billion, as the No. 2 U.S. pharmacy chain expands its health-care footprint.

Private equity firm Warburg Pincus-backed Summit Health runs an independent physician-run medical groups, and also operates CityMD, which acts as alternatives to hospital emergency department visits.

Walgreens said on Monday will invest $3.5 billion through an even mix of debt and equity to support the acquisition, which is expected to close in the first quarter of 2023. The company will remain the largest and consolidating shareholder of VillageMD with about 53% stake.

The deal will also feature investments from health insurer Cigna Corp’s healthcare unit Evernorth, which will also become a minority owner in VillageMD.

Walgreens also raised its fiscal year 2025 sales goal for U.S. health-care business to $14.5 billion to $16.0 billion, from $11.0 billion to $12.0 billion previously to account for the deal.

The company had invested $5.2 billion last year to raise its stake in VillageMD to 63% from 30%.

The announcement is the latest consolidation in the U.S. health-care sector. It follows the $4-billion acquisition of primary-care operator 1Life Healthcare Inc and CVS Health Corp‘s $8 billion buyout of Signify Health .

Together, VillageMD and Summit Health will have a presence in more than 680 locations.

Summit Health and CityMD had merged in August 2019, with the company now having over 13,000 employees and operating in over 370 locations.

![Mandy Patinkin as [Spoiler], What’s Next for Oliver and Josh in Season 2 (Exclusive) Mandy Patinkin as [Spoiler], What’s Next for Oliver and Josh in Season 2 (Exclusive)](https://www.tvinsider.com/wp-content/uploads/2025/01/brilliant-minds-113-oliver-mandy-patinkin-1014x570.jpg)