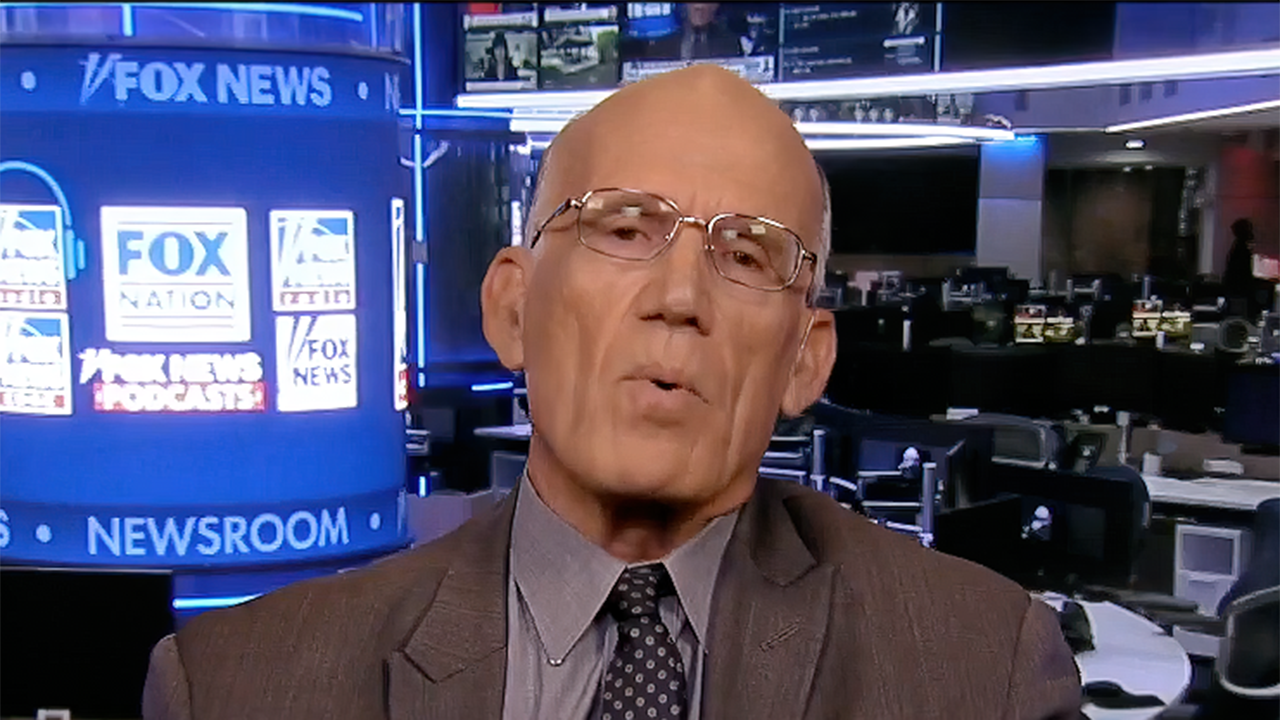

The logo of Alphabet Inc’s Google outside the company’s office in Beijing, China, August 8, 2018.

Thomas Peter | Reuters

With an ugly September in the rear-view mirror, it’s tempting for investors to make impulsive decisions.

The three major indexes ended the month with sizeable losses, rocked by spiking bond yields and a Federal Reserve that will do whatever it takes to bring down inflation.

As frightening as these times may be, it’s key for investors to take a long-term perspective and look closely for stocks that have potential beyond these tumultuous times.

Here are five stocks picked by Wall Street’s top professionals, according to TipRanks, a platform that ranks analysts based on their track record.

GXO Logistics

Pure-play contract logistics provider GXO Logistics (GXO) focuses on leveraging technology to manage supply chains and warehousing. This firm addresses a highly underserved corner of e-commerce: reverse logistics, or the movement of goods from customers back to sellers. In the second quarter, 40% of the company’s new business wins came from reverse logistics.

Since it debuted in the public markets in 2021 — a spin-off from XPO Logistics — GXO has managed to close a billion-dollar deal to acquire reverse logistics leader Clipper Logistics. This acquisition also solidified GXO’s stronghold in the reverse-logistics market. (See GXO Logistics Risk Factors on TipRanks)

However, macroeconomic headwinds from Europe and the U.K. are weighing on the company’s financials. After pricing in the headwinds that are expected to remain an overhang for some more time, Cowen analyst Jason Seidl recently reduced his near-term price target on GXO to $62 from $67.

Seidl noted that about 70% of GXO’s sales are in foreign currencies, primarily in pounds and euros. Sustained currency headwinds from Europe due to the Russia-Ukraine war had led GXO to guide a $30 million impact on revenues in 2023. However, the sliding pound has led the analyst to expect further impact.

Nonetheless, the analyst remains firm on his buy rating, saying that GXO’s variable cost structure is capable of mitigating adverse margin impacts. For those who can stomach the near-term worries, Seidl recommends buying the stock. “Given where GXO is trading, we see an attractive entry point for long-term investors who are looking for quality transportation/logistics exposure that can weather the systematic storm in Europe,” said the analyst, who has been ranked No. 8 among almost 8,000 analysts tracked on the platform.

Importantly, 67% of Seidl’s ratings have been profitable, with each rating generating returns of 23.9% on average.

Nova

Nova (NVMI) provides some heavy-duty metrology solutions to the semiconductor manufacturing market. The company’s balanced revenue mix between foundry and memory has helped it hedge its business against exposure to a single end market.

Recently, Needham analyst Quinn Bolton weighed in on Nova, reiterating a buy rating and $120 price target on the company. “We like Nova for its strong foothold in the foundry and memory markets and its consistent focus on developing new technologies to meet the need for metrology in semiconductor manufacturing,” said the analyst. (See Nova Measuring Stock Chart on TipRanks)

Unlike many other types of process control equipment, optical critical dimension solutions do not face the risk of diminishing demand with growing wafer capacity. In fact, they scale linearly with it. Now, Nova has about a 70% share in the OCD market, which gives it a strong runway for growth as wafer capacities expand with the proliferation of advanced technologies.

Bolton is also upbeat about Nova’s prospects in the X-ray technology market. The analyst expects the X-ray tech market to “grow in both front-end metrology and in advanced packaging applications.”

“We believe Nova will be a metrology supplier of choice for the foreseeable future, and believe Nova will easily reach the $1 billion target even with extremely conservative assumptions,” said Bolton.

Bolton is ranked at No.3 of nearly 8,000 analysts on TipRanks’ database. Notably, 62% of his ratings have successfully returned an average of 38% per rating.

TD SYNNEX

IT business process services provider TD SYNNEX (SNX) is benefiting from the high demand for remote working and learning software, as well as hardware solutions. Moreover, rapid digital transformation has kept the IT spending environment favorable for the business.

The company recently released its quarterly results, beating the top and the bottom lines. However, like its other tech peers, economic headwinds are not sparing TD SYNNEX. Barrington Research analyst Vincent Colicchio reduced his price target to $98 from $106 to reflect the headwinds impacting the business in the coming few months.

Nonetheless, Colicchio believes that the combined powers of SYNNEX and Tech Data (with which it merged last year) will help the company realize solid revenue and cost synergies. This will aid earnings growth over the next few years. (See TD Synexx Corporation Blogger Opinions & Sentiment on TipRanks)

“The company’s revenue should grow faster than overall IT spending as it increases its investment in fast-growing technologies. We are confident in management’s ability to achieve or exceed its targeted cost synergies of $200 million given a solid track record of execution on acquisitions,” weighed in Colicchio.

The analyst reiterated his buy rating on the stock, saying that the shares are trading at an attractive discount.

Colicchio has placed at No. 581 among the almost 8,000 analysts followed on TipRanks. The analyst has a success rate of 52%, and each of his ratings has garnered average returns of 8.5%.

Alphabet

As the tech sector grapples with multiple economic blows, Alphabet (GOOGL) has been working on new devices to launch at its upcoming “Made by Google” event. (See Alphabet Class A Stock Investors sentiments on TipRanks)

Ahead of the releases, Monness Crespi Hardt analyst Brian White, who is a Google bull, maintained his buy rating on the stock. “We believe Alphabet is well positioned to capitalize on the long-term digital ad trend, participate in the shift of workloads to the cloud, and benefit from digital transformation,” said White, justifying his long-term bullish view on Alphabet.

Additionally, Alphabet’s strong capabilities in AI give the company the upper hand to enhance the experiences of consumers. Also, White is encouraged by the fact that in the second quarter of the year, Apple held only 15.6% of global smartphone shipments. This means Android has the higher share in the operating system market.

White, who holds the 470th position among nearly 8,000 analysts rated on TipRanks, maintained his target price of $145 on GOOGL stock. The analyst has a 56% success rate and 9.6% average returns on each of his ratings.

Edison International

Energy company Edison International (EIX) has been winning its own battles amid the growing macroeconomic headwinds roiling every sector. The company has been skillfully addressing the recent heat waves across the United States.

Also, RBC Capital analyst Shelby Tucker is confident that the electricity consumption load, which is likely to remain flat till 2030, is expected to grow after that. Management forecasts around 60% increase in load between 2030 and 2045, as demand for electrification grows. (See Edison International Dividend Date & History on TipRanks)

“Higher consumption from electrification will likely be offset by distributed generation, batteries, and energy-efficiency measures,” said Tucker, before adding that Edison has more opportunities on the storage side than on the generation side.

Moreover, subsidiary Southern California Edison’s wildfire mitigation plan has reduced the parent company’s wildfire risk by 65% to 70%, which is a boon for Edison. “We continue to believe that EIX is undervalued relative to the sector despite a number of steps taken by the utility, and by California, to address wildfire challenges to the system,” said Tucker, underscoring the attractive opportunity for investors to scoop up EIX shares.

Importantly, Edison’s solutions profile is electric-only, which makes it an “attractive pure-play option for investing in the electrification of society.”

Tucker reiterated a buy rating on the stock with a price target of $82.

The analyst, who stands at No. 140 out of the nearly 8,000 analysts tracked on TipRanks, has been successful in his ratings 67% of time. Moreover, each of his ratings has generated an average return of 9.8%.