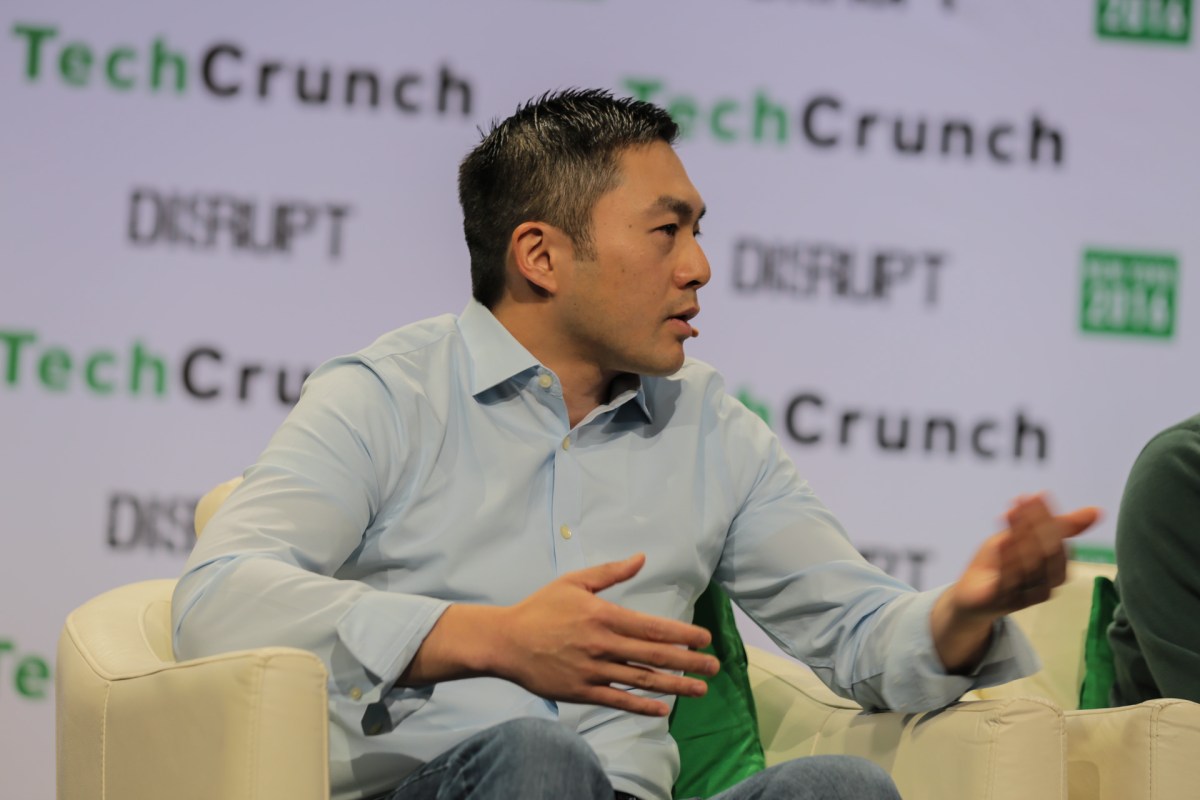

The market turmoil has many investors on edge, but Wall Street analysts said this week there are a raft of companies that offer a high level of portfolio protection. These stocks have unique characteristics that analysts believe can weather almost any amount of volatility. CNBC Pro looked through the top Wall Street research to find analysts’ top picks for navigating the market uncertainty. They include Fox, BJ’s Wholesale Club , T-Mobile , Highwoods Properties and Synopsys. Fox “Still a good place to hide,” MoffettNathanson analyst Robert Fishman said in a recent note to clients. Shares of the company are down 3.9% this year, and while Fishman acknowledged traditional media has had its struggles, he urged investors to stick with the stock. “Fox Corporation has a strong and unique hand with its sports and news portfolio mix that should allow the company to continue to outperform its peers by growing revenues and taking a greater share of a smaller pie,” he said. MoffettNathanson sees acceleration into next year and is particularly bullish on Fox’s sports offerings, which include the Super Bowl, the World Cup, and a likely influx of political advertising as the November midterm elections draw near. Add in the company’s news portfolio and Fishman sees Fox taking share from competitors. The stock is also undervalued and if that continues, the analyst says the board could re-consider Fox’s future as a standalone company. “As investors look for safe investments in this challenging market environment beset with macro headwinds, we continue to recommend FOXA…” he added. BJ’s Wholesale Club “BJ continues to prove itself as a ‘beyond the pandemic’ winner,” according to Jefferies analyst Stephanie Wissink. The firm said earlier this week there is a lot to like about BJ as management continues to strike the right balance between sales and profits. “The club channel continues to extend reach & engagement with member counts growing and spend levels rising atop significant 2YR growth stacks,” she said. Gas prices, inflation and the pandemic have all contributed to positive growth at BJ, and Wissink expects that to continue. The company also has a stable supply chain, she wrote in addition to a number of “self-help initiatives,” like digital and merchandise expansion. Still, Wissink says BJ’s total addressable market is markedly underappreciated and there are no signs of a slow down. Shares are down 12.4% this year, and investors looking for safety should look no further, the analyst said. “Hide here,” she said succinctly. T-Mobile “In volatile markets where sentiment has turned decidedly negative against companies and sectors that were once easy longs, TMUS is proving to be an increasingly safe place for investors to hide,” investment firm RBC said. Shares of T-Mobile are up 15.6% this year, and analyst Kutgun Maral says he expects the stock to keep delivering for investors. The wireless giant is coming off a mixed earnings report in late April and competition remains fierce, but the analyst says clients need to consider the bigger picture. Trends are very positive, he wrote, adding that T-Mobile is actively gaining share in broadband, rural areas and business enterprises. The company is also well positioned to resume buybacks in the near future as T-Mobile works to “deliver on its credible subscriber and financial growth outlook,” he said. Maral praised the company’s strong management noting that T-Mobile has one of the “longest track records of beat-and-raises.” Taken together, RBC sees more upside as T-Mobile rolls out more of its 5G network. “We expect T-Mobile to outperform its peers based on favorable risk/reward characteristics,” he said. Fox – MoffettNathanson, Buy rating “Still a good place to hide. … As investors look for safe investments in this challenging market environment beset with macro headwinds, we continue to recommend FOXA as our only Buy-rated stock in traditional media. … Fox Corporation has a strong and unique hand with its sports and news portfolio mix that should allow the company to continue to outperform its peers by growing revenues and taking a greater share of a smaller pie. ” BJ’s Wholesale Club – Jefferies, Buy rating “BJ continues to prove itself as a ‘beyond the pandemic’ winner. … The club channel continues to extend reach & engagement with member counts growing and spend levels rising atop significant 2YR growth stacks. … Hide here. … A number of self-help initiatives (e.g., gen merch expansion, SKU simplification, digital), unit growth, and participation in ongoing club industry share gains provide further secular catalysts.” Highwoods Properties – Baird, Outperform rating “We think Office provides investors a place to hide with long lease durations, corporate tenants providing diversification against a weakening consumer, a fully-functioning Class A investment sales market, and meaningful discounts to underlying replacement cost. We believe HIW remains a strong option for investors looking to achieve the above criteria while also avoiding excess exposure to technology.” Synopsys – Needham, Buy rating “No Place to Hide in a Bear Market? SNPS May Prove You Wrong … After a sudden decline of 20%+ in January, EDA (electronic design automation) stocks appear to have found the bottom and avoided major draw-downs despite significant deterioration in the macro environment. In a bear market, where investors lament they have ‘nowhere to hide,’ we think EDA stocks like SNPS are the right places to be. We raise our PT to $380 to reflect higher estimates and our strong conviction. T-Mobile – RBC, Outperform rating “In volatile markets where sentiment has turned decidedly negative against companies and sectors that were once easy longs, TMUS is proving to be an increasingly safe place for investors to hide. … T-Mobile continues to deliver on its credible subscriber & financial growth outlook that should inflect upwards yet again in 2H22 as it laps network shutdown disruption & accelerated merger integration efforts, setting the stage for buybacks. … We expect T-Mobile to outperform its peers based on favorable risk/reward characteristics.”