The legal fallout from the collapse of FTX took a new twist on Wednesday night as the Justice Department and the Securities and Exchange Commission announced charges against cofounder Sam Bankman-Fried’s sometime girlfriend, Caroline Ellison, with the SEC alleging she manipulated the price of the failed exchange’s FTT token.

Ellison was for years a close lieutenant of Bankman-Fried and served as CEO of his hedge fund, Alameda Research, which is accused of raiding FTX customer funds to paper over its trading losses. The New York Times confirmed recent speculation that she is cooperating as a witness with the Justice Department over its investigation into Bankman-Fried’s alleged criminal activities, and reported Ellison has pled guilty.

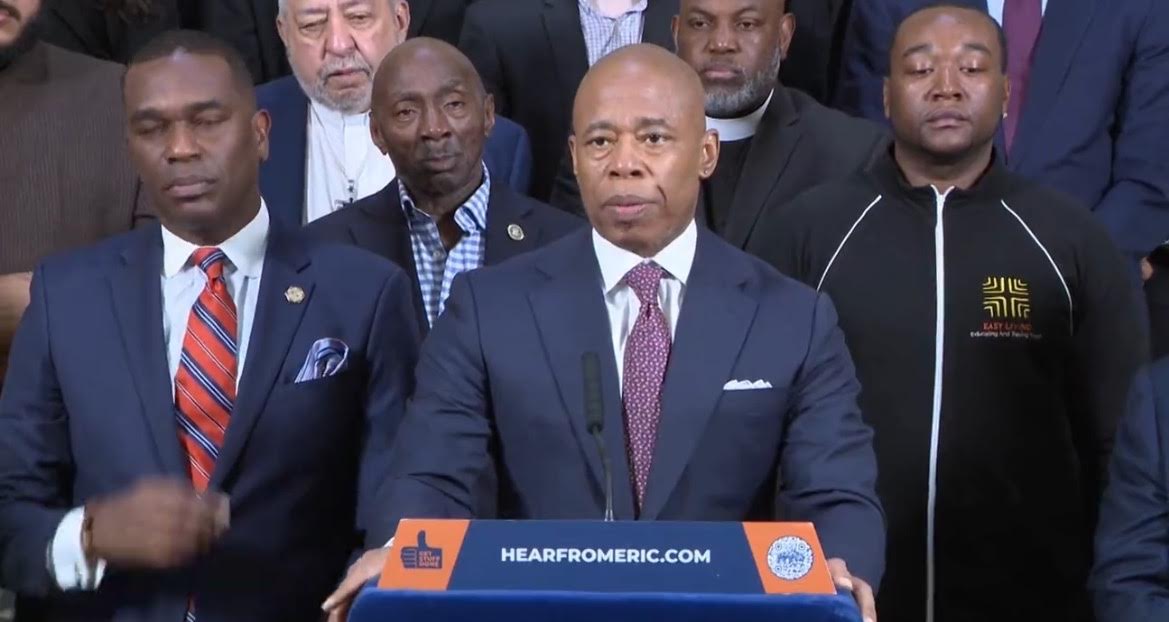

In a press conference, a Justice Department prosecutor announced the agency had filed criminal fraud-related charges against Ellison and FTX’s chief technology officer, Zixiao (Gary) Wang.

According to the SEC, Ellison participated in a scheme to prop up the price of the FTT token—which FTX used as collateral for unsecured loans—on the open market.

“The complaint alleges that, by manipulating the price of FTT, Bankman-Fried and Ellison caused the valuation of Alameda’s FTT holdings to be inflated, which in turn caused the value of collateral on Alameda’s balance sheet to be overstated, and misled investors about FTX’s risk exposure,” said the SEC in a press release about the charges.

In case of the FTX executive Wang, the SEC claims he improperly diverted customer assets to Alameda.

The SEC lacks the power to impose criminal penalties on individuals, meaning the charges carry no risk of prison time. Instead, the agency is seeking to bar Ellison and Wang from trading securities and is seeking to recover any gains they obtained from the alleged scheme.

Meanwhile, Bankman-Fried—who is facing a litany of criminal charges—was being transferred from prison in the Bahamas to a Brooklyn jail as of Wednesday evening.

The news about Ellison come two weeks after she was spotted at a New York City coffee shop, which have fueled rumors that she is a cooperating witness—though the agency or Ellison have not confirmed this.

In its announcement, the SEC said both Ellison and Wang have been cooperating with the agency and entered a settlement in relation to certain of the allegations.

This story was updated from the original to provide additional details.

Our new weekly Impact Report newsletter examines how ESG news and trends are shaping the roles and responsibilities of today’s executives. Subscribe here.