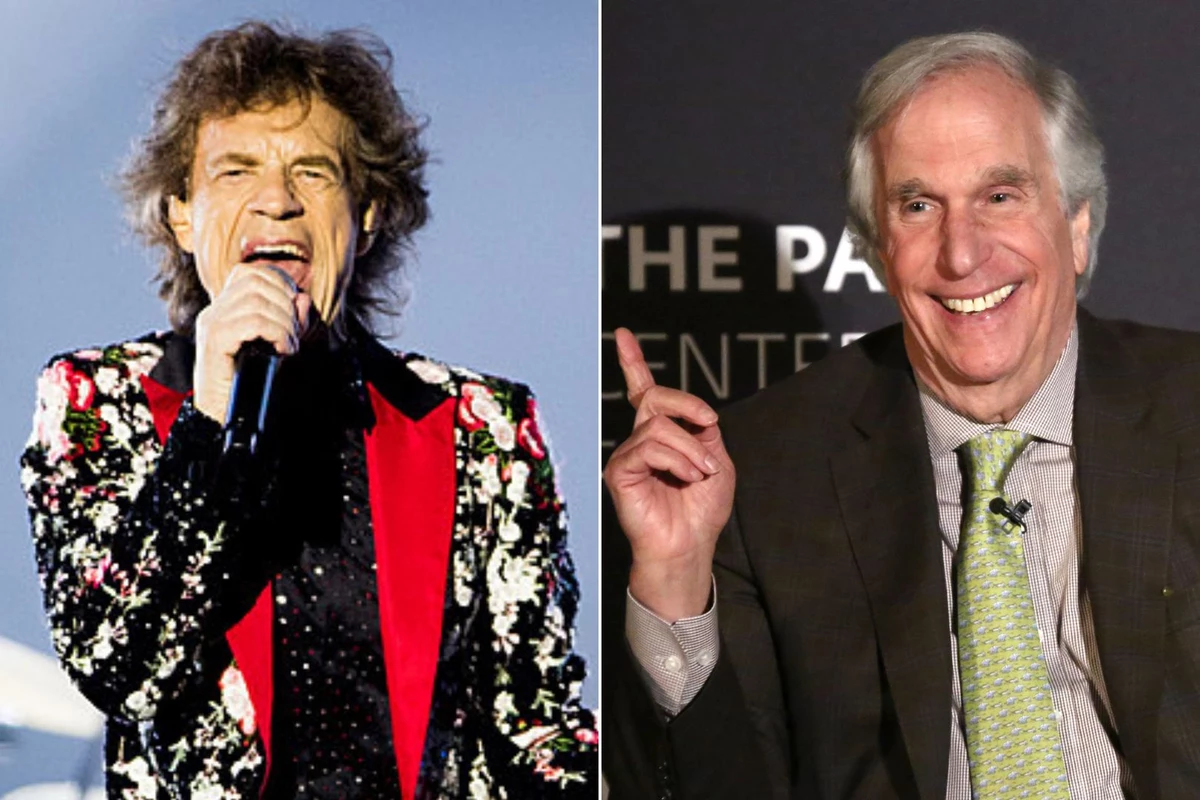

Jamie Dimon, chief executive officer of JPMorgan Chase & Co.

Christophe Morin | Bloomberg | Getty Images

JPMorgan Chase CEO Jamie Dimon on Thursday summarized the state of the U.S. economy in one paragraph, and it’s not all good.

On the one hand, Dimon said the U.S. “economy continues to grow and both the job market and consumer spending, and their ability to spend, remain healthy.”

He then rattled off a number of warning signs, saying: “But geopolitical tension, high inflation, waning consumer confidence, the uncertainty about how high rates have to go and the never-before-seen quantitative tightening and their effects on global liquidity, combined with the war in Ukraine and its harmful effect on global energy and food prices are very likely to have negative consequences on the global economy sometime down the road.”

Dimon’s comments, which were made in JPMorgan Chase’s latest quarterly release, come as investors and economists try to make out whether the economy is headed for a recession — and the recent spate of economic data isn’t providing much clarity.

The good

For the moment, there aren’t any signs the U.S. economy is entering a recession, according to comments JPMorgan executives made on their earnings call.

As Dimon said, the labor market seems to be in solid footing. Last month, the U.S. economy added 372,000 jobs, topping a Dow Jones estimate of 250,000. Meanwhile, average hourly wages grew last month at 5.1% year-over-year pace.

Consumer spending also seems to be chugging along, albeit at a subdued pace. Spending in May rose 0.2%, below a Reuters estimate for a 0.4% gain.

Even within JPMorgan’s own business there were signs of consumer strength. Consumers are still spending on discretionary areas like travel and dining. At its consumer and community banking division, combined debit and credit card spending was up 15% in the second quarter. Card loans were up 16% with continued strong new account originations.

However, the good news may end there.

The bad

The consumer price index — a widely followed measure of inflation — rose last month by 9.1% from the year-earlier period. That topped a Dow Jones forecast of 8.8% and market the fastest pace for inflation going back to 1981.

A big driver for that increase is a surge in energy prices. West Texas Intermediate, the U.S. oil benchmark, is up more than 28% in in 2022, as the war between Ukraine and Russia raises concern over already tight supply in the market.

Higher prices have also dented U.S. consumer sentiment. The University of Michigan’s consumer sentiment index hit a record low last month, tumbling to 50.

These inflationary pressures have pushed the Federal Reserve to tighten monetary policy this year more quickly than investors anticipated. Last month, the central bank hiked rates by 0.75 percentage point, and some economists on Wall Street expect the Fed to hike by as much as a full point later in July.

Inflation has also had massive political ramifications in the U.S.

According to a poll conducted by the Pew Research Center, President Joe Biden’s approval rating has slumped to 37% — with a majority of Americans saying his policies have made the economy worse. Pew also found that just 13% of Americans rate U.S. economic conditions as “excellent/good.”

Dimon’s remarks follow comments he made last month in which he warned investors to brace themselves for an economic “hurricane.”

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.