The jump in share price follows the firm’s IPO, raising $454 million in Japan’s biggest IPO yet for the year. Socionext’s listing dwarfs the country’s second-biggest offering from outsourcing firm Bewith, which raised $55 million in October. Globally, IPOs are in a slump as companies postpone listing due to concerns about geopolitical tensions and a looming economic slowdown driven by inflation and interest rate hikes.

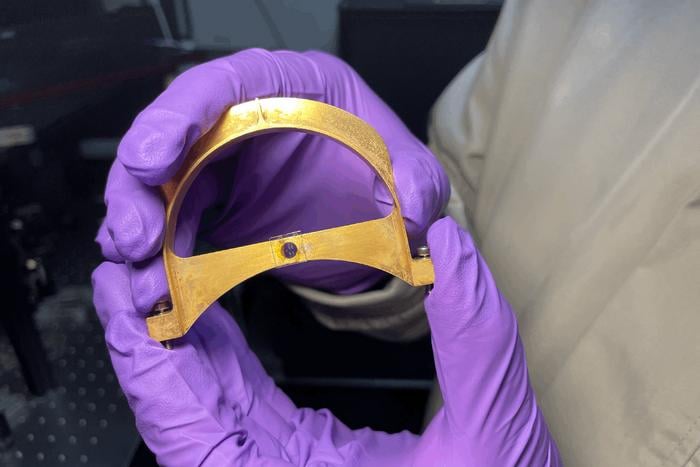

Socionext was formed in 2015 from the semiconductor divisions from Fujitsu and Panasonic Holdings. The firm designs “systems-on-chip”, which combine multiple functions—like computer processing, graphics processing, Wi-fi, memory, and other important functions—on a single chip. Due to their smaller size and greater power efficiency, such chips are primarily used in mobile devices, like smartphones and tablets, and “internet-of-things” devices.

Socionext serves companies working in the automotive sector, as well as providers of 5G technology.

Socionext shares dipped slightly on Thursday, falling 0.5% by 3:00 p.m. Japan time, matching a similar 0.6% decrease in the Tokyo Stock Price Index.

Deflating chip market

Socionext’s strong debut is a rare bright spot for the semiconductor industry.

Semiconductor companies have lost a combined $240 billion in market value since the Biden administration announced tough new export controls on chip sales to China. Chip companies that use U.S. equipment can no longer sell the most advanced chips to any Chinese company, and are barred from selling even less-advanced chips to almost 30 major Chinese technology firms. Sales of chipmaking equipment are also blocked.

The Philadelphia Semiconductor Index, which tracks major semiconductor companies like Nvidia and Advanced Micro Devices, is down 6.7% since Monday. Asian chip stocks are down too. Shares in Taiwan Semiconductor Manufacturing Corporation, the world’s largest contract chipmaker, have fallen 9.5% since the weekend, while China’s Semiconductor Manufacturing International Corporation, the country’s largest chip manufacturer, is down 11.4% over the same period.

On Thursday, TSMC said it would slash its capital spending target for the year by 10%.

Chip companies were already struggling due to a downturn in consumer electronics sales. Intel is planning to cut thousands of jobs in its sales and marketing divisions due to slowing personal computer sales, Bloomberg reported on Tuesday.

PC sales are down almost 20% compared to a year ago, according to a Gartner report released Tuesday.

Sign up for the Fortune Features email list so you don’t miss our biggest features, exclusive interviews, and investigations.