More than two years into the most aggressive Federal Reserve monetary tightening in four decades, the big surprise is that the world hasn’t fallen over.

While US interest rates at 23-year highs are causing pockets of pain, there’s nothing like the systemic problems that so often wrecked expansions in the past. The Fed has held the policy rate at 5.25% to 5.5% for about a year and is expected to leave it unchanged at their two-day policy meeting this week.

With Friday capping a run of steady economic data, investors have rolled back their expectations for rate cuts again, with only one — or maybe two — now expected by the end of the year.

Financial markets continue to digest what Chair Jerome Powell calls “restrictive” policy very well. The three US regional-bank failures of spring 2023 are most notable for how little they affected the economy and how quickly regulators were able to halt any contagion. Credit spreads remain tight, even among riskier bonds, and volatility is low.

In other words, something different is afoot this time, and it is catching the attention of the Federal Open Market Committee — the Fed panel that sets interest rates — and they are likely to take up the topic of easy financial conditions again this week. Here’s a look at a trio of unusual features that help explain why policy may have less bite:

Privatization of Risk

When tech stocks started falling in 2000, and subprime-mortgage related assets tumbled in 2007, it was visible to all. As fears of losses spread, fire-sales affected more and more assets, causing wider contagion — ultimately walloping the economy.

What’s different today is that an increasing share of financing has come from private, not public, markets. Part of that is because of tighter regulation of publicly listed financial institutions. Pension funds, endowments, family offices, ultra-wealthy individuals and others are now more directly involved in lending through non-bank institutions than in the past.

Nonbank lenders have been particularly active with mid-size firms, but they’re also involved with large corporations. There’s an oft-cited estimate of private credit totaling $1.7 trillion, but the lack of transparency means there’s no precise official tally.

Because this lending is outside the visibility of public markets, problems that do develop have less chance of causing contagion. Missed interest-payments aren’t the subject of public news headlines, startling investors into herd-like behavior.

Pension funds and insurance companies investing in private-credit funds are unlikely to ask for their money back tomorrow, reducing the risk of sudden stops in funding.

The Caveat:

Just because nothing in this area has produced a major blow-up yet doesn’t mean it won’t happen. A recent incident where a company shifted assets away from the reach of its lenders — part of a move to raise fresh financing — was an eye-opener for many on Wall Street.

The IMF dedicated an entire chapter to private credit in their April financial stability report, and their assessment was mixed. The market’s size and growth mean “it may become macro-critical and amplify negative shocks,” the fund said. Pressure to do deals may lead to “lower underwriting standards.”

Fabio Natalucci, a deputy director at the fund who oversees the report, said in an interview the private credit “eco-system is opaque and there are cross-border implications” now if the market goes through a convulsion.

He worries about “layers of leverage” in the chain of investors, the funds and the companies they own.

Government Debt Powers Growth

The 1990s expansion ended in a crash after companies overextended, besotted with dreams of dot-com riches. In the 2000s, it was households that leveraged themselves, borrowing against expected gains in home equity. This time around, it’s the federal balance sheet that has played an unusually large role in the expansion.

Government spending and investment contributed its highest share to GDP growth in 2023 in more than a decade, and of course it’s been financed with debt — which stood at 99% of GDP in fiscal year 2024, according to the Congressional Budget Office.

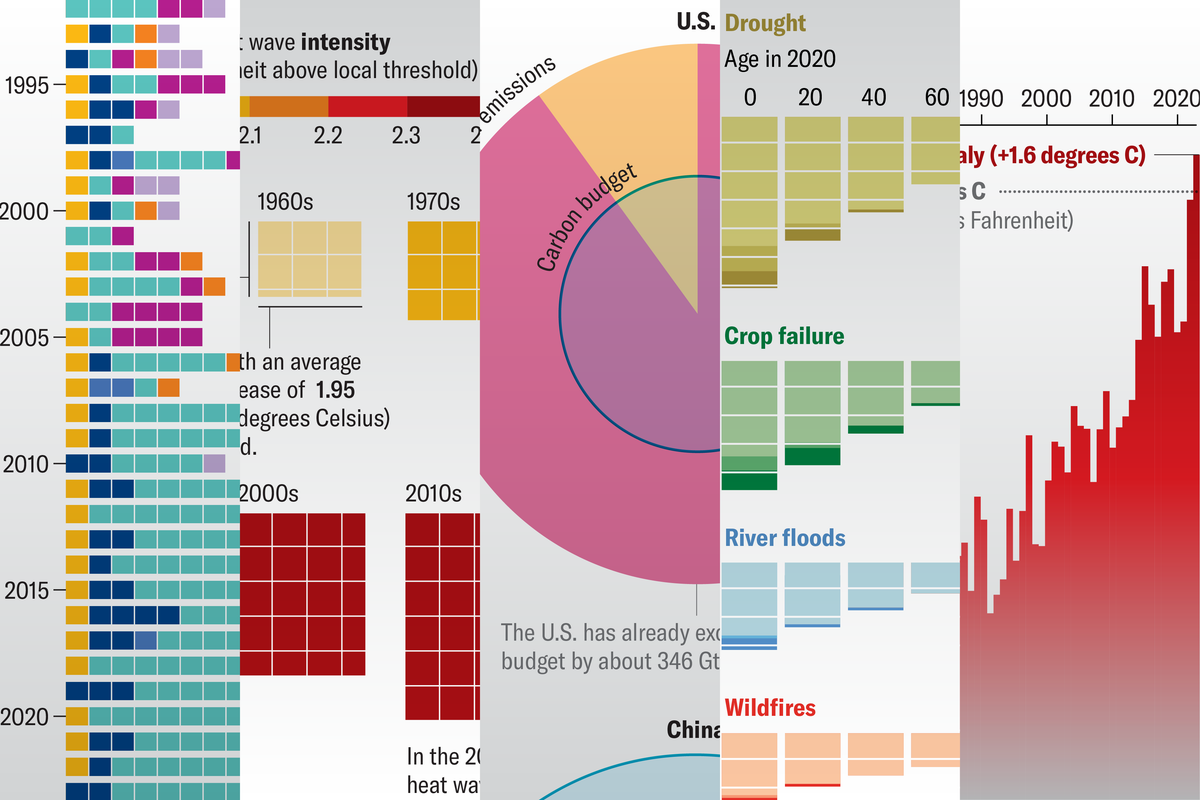

The chart below shows how dramatic the role reversal has been between households and the government:

Government debt is referred to as a risk-free asset, because it’s safer than a household or company, since federal authorities have the power to tax. That means leveraging up the federal balance sheet for growth is inherently less dangerous than a surge in borrowing by the private sector.

The Caveat:

Even governments can get into trouble, as the UK found out in 2022 when investors balked at plans for large, unfunded tax cuts. Rising interest rates are inflating US borrowing requirements, and warnings are cropping up that the US is on an unsustainable fiscal path.

“There is almost surely a limit to how much debt outstanding there can be without the market driving yields up,” said Seth Carpenter, chief global economist at Morgan Stanley. Still, “if there is a tipping point, it is hard to believe we are at it right now.”

The Fed Is Balancing Risks

While the Fed has jacked up interest rates and is shrinking its bond portfolio, Powell and his colleagues have been particularly alert to downside risks. The central bank swooped in with emergency funding when Silicon Valley Bank collapsed in March 2023, even as it was battling inflation.

Powell and his lieutenants also have effectively taken further rate hikes off the table in the face of a still-strong economy and an inflation rate that remains above policymakers’ target. There’s even a stated bias to cut borrowing costs, in a nod toward trying to avoid acting too late and driving the economy into a recession.

Fed communication is helping to limit volatility, and contributes to an easing in financial conditions generally. It appears strategic and intentional on the Fed’s part, suggesting Powell and his team are attuned to the potent threat of the so-called financial accelerator, where a rise in unemployment or a drop in earnings recoils into markets and amplifies negative shocks, risking a rapid descent into recession.

The Fed is trying to keep its “tight” monetary policy several notches below boil. This has given rise to a paradox. Fed officials say their policy is restrictive, but financial conditions are still easy.

The Caveat:

Fed policymakers cannot micro-manage all aspects of the financial system and the economy. There are real pockets of pain, and risks are concentrated in areas with less visibility. High interest rates for a long period do start to bite.

“Behind the scenes, there is a lot more stress,” said Jason Callan, head of structured asset investing at Columbia Threadneedle Investments. “The real linchpin is the labor market.”

Much of the lending to low-income households is done by fintech firms beyond the oversight of regulators. The resiliency of the shadow banking system and consumers in a downturn without paycheck protection and stimulus checks remains to be seen.

“The more inequality, the more financial instability,” Karen Petrou, co-founder of Federal Financial Analytics, a financial-sector analysis firm, said in a recent speech. “It’s more and more likely that even small amounts of macroeconomic or financial-system stress can quickly turn toxic.”