Homebuilders have a housing downturn playbook that’s proven to be effective time and again. They start by offering incentives like mortgage rate buydowns. If that doesn’t work, then builders begin to mark down home prices communities until their unsold inventory has been moved.

Fast-forward to 2022, and homebuilders have clearly returned to their housing downturn playbook, only there’s a new wrinkle: institutional investors. In the years following the 2000s housing bust, institutional investors like Blackstone saw an opportunity to buy more directly from distressed builders. The expansion in this so-called “build-to-rent” category means that builders, this time around, are already floating big-time markdowns to Wall Street buyers.

Last week, Bloomberg reported that homebuilding giant Lennar would begin to shop 5,000 unsold properties—an amount greater than the entire total active inventory in Kansas City—to institutional investors. In some of these Southwest and Southeast communities, investors would have the opportunity to buy entire subdivisions at a discount.

“What’s an interesting dynamic with the institutional investors is a lot of them have been sitting on the sidelines waiting for that moment to strike… [they’re thinking] ‘Hey, I want to buy these homes from you [the builder], but I want to have a discount to do so.’” Ali Wolf, chief economist at Zonda tells Fortune.

These institutional investors don’t just want markdowns in the 10% ballpark, they’re hoping for “20% and 30%” price cuts, says Wolf.

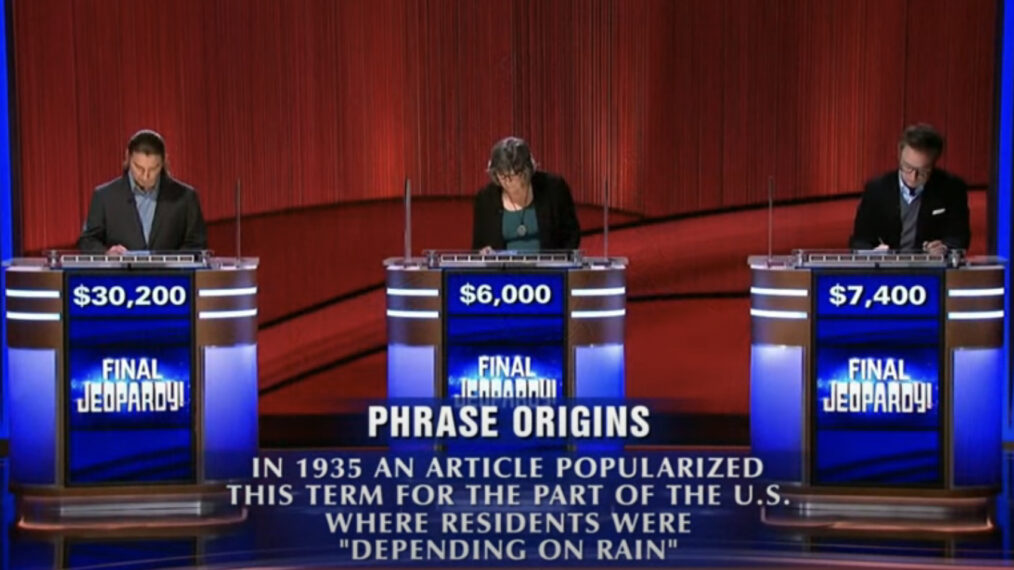

On one hand, the current average 30-year fixed mortgage rate (6.28%) means the housing market downturn is still very much alive. On the other hand, the decline in the average 30-year fixed mortgage (down from 7.3% in early October) means the bottom for housing demand might be in the rearview mirror. That’s why, Wolf says, some institutional investors might be ready to pull the trigger.

“What we’re hearing now is that some investors, because mortgage rates have come down, they’re afraid that primary buyers are going to come back into the market. So some of the institutional buyers are trying to rush in now because they’re afraid that there will be a pop in demand from primary buyers and they’re going to lose their opportunity,” Wolf says.

Why are homebuilders like Lennar going to investors now? There are two big reasons.

First, the ongoing housing correction has sharpened in recent months. As mortgage rates floated around 7% in October, the homebuilder cancellation rate (i.e. the percentage of buyers who back out of their contract) tracked by John Burns Real Estate Consulting spiked to 26%. That elevated cancellation rate—coupled with a weak 2023 spring housing market on the horizon—means builders are discounting faster and making sweeter deals to investors who can buy in bulk.

Second, homebuilders still have a tremendous amount of inventory—both single-family and multi-family—in the pipeline. A pandemic housing demand boom coupled with supply chain issues pushed the number of U.S. housing units under construction to a record high this year. Now, with cancellation rates spiking, builders are eager to get this backlog sold before they finish construction.

In the future, Wolf expects the historic pipeline of unfinished homes to continue to depress new home prices through the first half of 2023. But once standing inventory has been cleared and the pipeline is under control, the pressure on new home prices should ease up.

Just how many of these homes will go to institutional investors? It’s hard to say.

While firms like Blackstone have made it clear they’d like to continue to grow their real estate portfolios, some institutional buyers have also temporarily moved to the sidelines in the face of the ongoing housing correction. Look no further than Blackstone-owned Home Partners of America, one of the nation’s largest private landlords, which announced in August that it would halt single-family home purchases in 38 U.S. regional housing markets.

There’s also the fact that firms like Blackstone and Starwood announced plans earlier this month to limit withdrawals from their real estate funds. It’s unclear how the ongoing surge in redemption requests from investors will affect their plans for future real estate investments.

While the housing downturn certainly has homebuilders scrambling to move standing inventory, it doesn’t mean we should pencil in doomsday for builders.

Just look at the stock market.

While major homebuilders are all down from their 2022 highs, they’re still well above their January 2020 share price. That includes builders like D.R. Horton (+72.9% since January 1, 2020 ), Lennar (+67.4%), Toll Brothers (+30.2%), NVR (+28.5%), and PulteGroup (+21.8%). During the same period, the S&P 500 Index rose 22.5%.

Want to stay updated on the housing correction? Follow me on Twitter at @NewsLambert.

Our new weekly Impact Report newsletter examines how ESG news and trends are shaping the roles and responsibilities of today’s executives. Subscribe here.