PLC said Tuesday it would pay at least $1.2 billion and two business units would plead guilty to bribery in the U.K. and to conspiracy to violate U.S. anticorruption laws, resolving criminal probes into its global mining and trading business that have hung over the company for years.

Glencore International AG will pay about $700 million to resolve a U.S. Justice Department foreign-bribery investigation and $39.6 million to settle bribery claims in Brazil, according to the company. Another unit has agreed to pay $485 million to settle U.S. criminal and civil investigations into manipulation of fuel-oil prices, Glencore said.

Britain’s Serious Fraud Office charged another unit, Glencore Energy UK Ltd., with seven counts of bribery in connection to payments of $24 million for preferential access to oil in Africa, according to the U.K. law-enforcement agency.

As part of its settlement of the U.S. investigations, Glencore International pleaded guilty to one count of conspiracy to violate the Foreign Corrupt Practices Act, the company said. In the separate criminal market-manipulation case, a further unit, Glencore Ltd., pleaded guilty to one count of conspiracy to rig commodity prices.

The Brazil fine stems from Glencore’s part in a corruption probe dubbed Operation Car Wash, which involved payments related to state-owned Petróleo Brasileiro SA, or Petrobras.

The guilty pleas and fines amount to a reckoning over commercial conduct over several years in the often-risky developing countries where trading powerhouses such as Glencore go to obtain and ferry minerals and other resources around the world.

The company declined to comment further on the SFO charges, having said earlier that it would appear in court in the U.K. and U.S. on Tuesday.

The Anglo-Swiss company has disclosed that it has set aside $1.5 billion to cover the costs of settlements in the U.S., U.K. and Brazil. Glencore has told shareholders that it faced criminal and civil investigations from the Justice Department, U.S. Commodity Futures Trading Commission, U.K. SFO and the Brazilian Federal Prosecutor’s Office. Glencore said Tuesday that it still expects to pay no more than $1.5 billion, including any additional penalties tied to the resolution of its U.K. case.

The settlement of the investigations removes a distraction for Glencore as it seeks to portray itself as the best-positioned among large mining companies to capitalize on a global push to decarbonize transport and energy. Though still a significant competitor in coal, the company has a large business in metals such as cobalt, copper and nickel that are seen as vital to electric-vehicle batteries and the transmission of electricity.

The SFO said it had exposed bribery and corruption across Glencore’s oil operations in Cameroon, Equatorial Guinea, Ivory Coast, Nigeria and South Sudan. There, Glencore’s agents and employees paid bribes for preferential access to crude with the approval of the company, the SFO said in a written statement.

The London court is set to sentence Glencore on June 21, the SFO said.

In addition to the allegations of bribery, Glencore has also faced a U.S. market-manipulation probe. A former Glencore oil trader pleaded guilty last year to conspiring to manipulate a fuel-oil benchmark.

Another former Glencore trader pleaded guilty last July to conspiring to launder money and pay millions of dollars in bribes to officials in Nigeria and elsewhere in exchange for favorable contracts with a state-owned oil company, in violation of the U.S. Foreign Corrupt Practices Act.

Anthony Stimler, a U.K. citizen, was involved from 2013 to 2015 in funneling hundreds of thousands of dollars to intermediaries to smooth Glencore’s access to Nigerian oil, according to court records. Authorities alleged that Mr. Stimler worked with co-conspirators including other former Glencore traders.

Several executives, including Glencore’s former chief executive, who were in their roles during the period scrutinized by authorities, have already left the company.

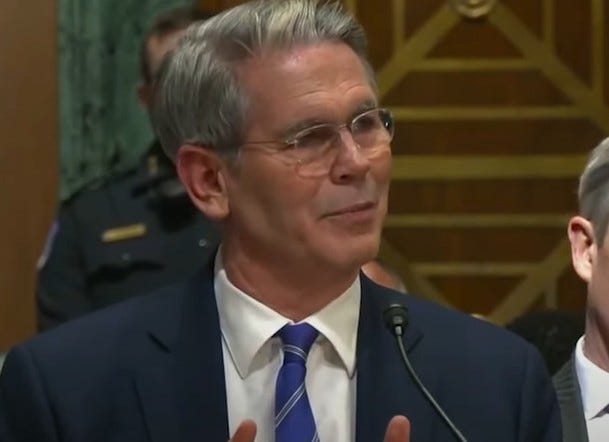

Former CEO

Ivan Glasenberg

declined to comment.

The investigations weighed down Glencore’s share price for several years and racked up legal costs for the company. For instance, legal costs for the first half of 2020 hit $56 million.

Glencore is still subject to investigations from Brazilian, Swiss and Dutch authorities.

Glencore’s share price rose 1.25% in London on Tuesday.

In the past year, the company’s share price has risen 70% amid a sizable rally in the price of the commodities it digs up, such as coal, cobalt and nickel, and as market volatility reaps profits for its large trading division.

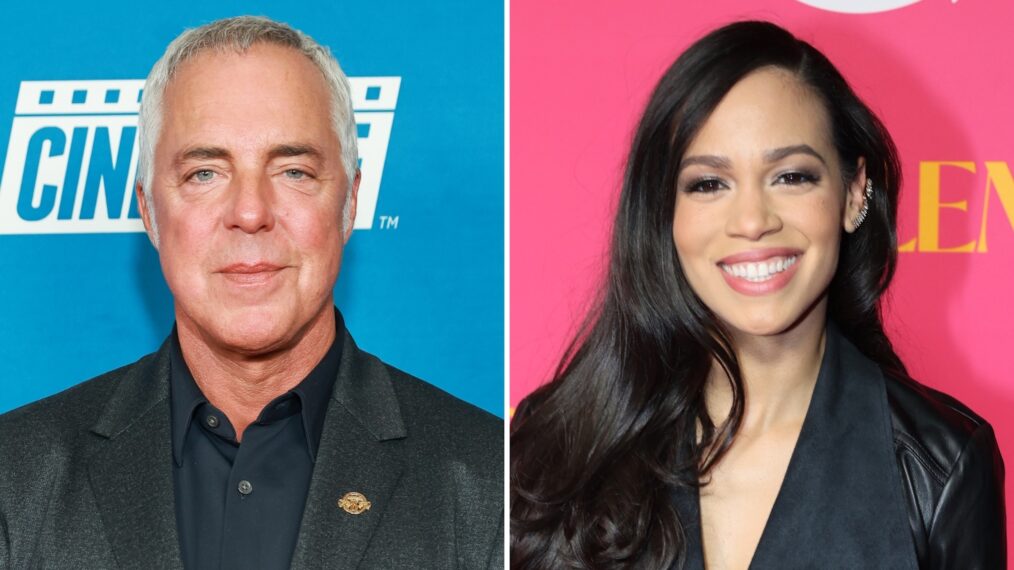

New CEO

Gary Nagle

has sought to simplify the sprawling company, selling off smaller assets.

The settlements are “good news for Glencore, but there are still overhangs on the stock,” said

Ben Davis,

an analyst at Liberum. Those include the company gradually winding down its coal division, which is currently extremely profitable, Mr. Davis said.

—Ben Foldy contributed to this article.

Write to Dave Michaels at dave.michaels@wsj.com and Alistair MacDonald at alistair.macdonald@wsj.com

Copyright ©2022 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8