WeWork founder Adam Neumann is back, and he’s starting another real estate company.

Flow, which will focus on making residences into workspaces, already raised $350 million from billionaire Andreessen’s a16z. Neumann said the new venture will either compete with WeWork or partner with it at Fortune’s Brainstorm Tech conference in Deer Valley, Utah.

Given the spectacular fall of WeWork—and Neumann’s departure—many are surprised he received such a huge investment for a very similar-sounding company.

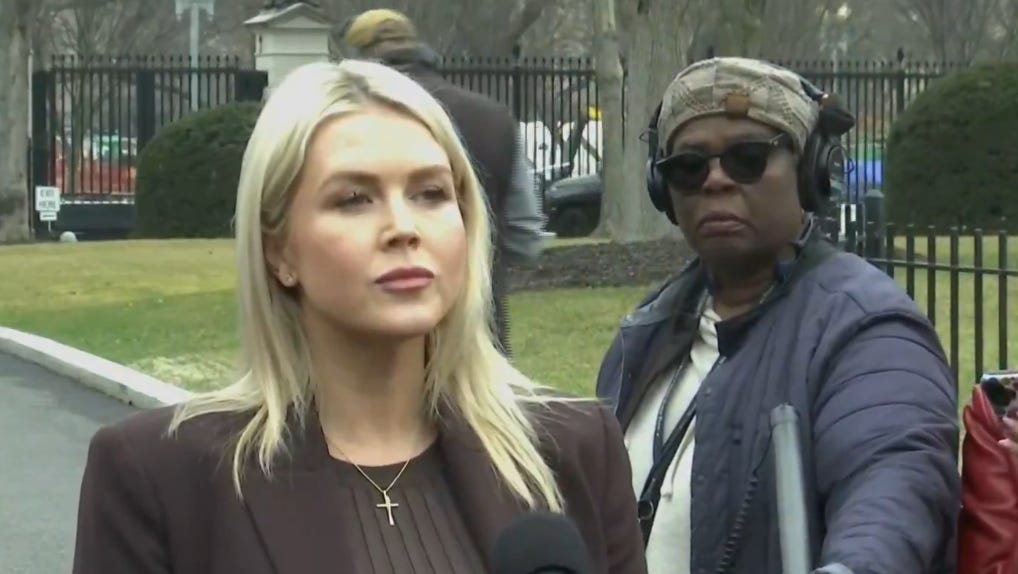

But in an interview with Fortune’s Michal Lev-Ram, Neumann insisted he has learned from his mistakes.

Watch the full video interview or read the transcript below.

Michal Lev-Ram: Why are you here? You know, obviously we invited you to come speak, that’s part of the reason. But I want to know, why are you back in front of this particular audience? And why are you at it again with another company?

Adam Neumann: I think, first of all, thank you for having me. And always nice to see a great face and audience. And Park City is beautiful. I’ve never been here in the summer. It’s unbelievable, very nice to see. I think in life, we go through many journeys. And as we go through these journeys, we, we have different lessons that we learn. But if we learned our lessons, and we don’t get a chance to do it again, then I don’t think you can really apply it. And I think when things happen in your life, if you took time to think about it, and learn from it, and then you apply it, that’s a great journey. But if you actually didn’t learn from it, and you stopped, and something happened, it becomes a tragedy. So I’m here because I love entrepreneurship. And I think this category, and this problem is real. And we’re excited to do our part in trying to solve it.

Michal Lev-Ram: So we’re gonna get into Flow and what you’re doing with it today, what your hopes are. But I want to talk about those lessons learned, first of all, and just ask you, you know, you’ve had quite a bit of distance and time now from WeWork. Looking back with the space that you have, and the perspective, what do you think were the biggest mistakes? What are the biggest learnings that you take with you today?

Adam Neumann: So when I stepped down in 2019, I actually took the time to think a lot and had a great team around me that were able to talk and discuss all the different things. And there are many lessons. But first of all, I would say I’m extremely proud in what we did in WeWork. I’m proud of the team. Today WeWork has over 700 locations, it’s in 39 countries, it’s in over 70 languages. And I don’t think there’s a person on the planet who’s building new office space today who’s not thinking what would or wouldn’t WeWork think. So I think that part was great as far as the lessons, there are many, and we don’t have enough time today. This is a short interview. But I’ll focus on two that come to mind right now. One, as an entrepreneur, there are many things you don’t control. One of the only things you control is who you surround yourself with, and not just who you surround yourself with, but exactly what kind of people they are, I think and WeWork, we’re surrounded by very smart people. But moving forward, what I surround myself is not just very smart people, but also people who are very comfortable telling me what they think. And when you need to tell someone, what do you think, and they don’t agree with you, you need to have the courage and you need to be empowered to go back again, and say it again, and again. And again. So my first lesson, surround yourself, not only with the best people and the smartest people, but also the ones who are going to tell you what they think. And it means if you don’t listen, they’re going to keep at it until you either never see them again or until you agree. That’s one. The second one is listening. The first lesson doesn’t work without the second one. When I stepped down from WeWork, I had the opportunity to become an investor. And our family office invested in over 50 different companies. And I got to be the investor giving the entrepreneur advice and seeing that the entrepreneur is not listening, and getting a little frustrated, until I realized that maybe this is part of how I used to act. And I realized that part of being a great entrepreneur is not just listening, but listening to the hard truth. Listening to the things you don’t want. So If I had to choose two, choose who you surround yourself with, and become a great listener. And great listeners like to listen to what they don’t want to hear, not what they want to hear.

Michal Lev-Ram: So do you, if I’m to put like put all that together, do you think that your investor at the time at WeWork could have played a larger role in not helping to create what was a spectacular rise and then a spectacular fall? I mean, what was your role there? And what was your investor’s role?

Adam Neumann: Again, as I said before, I am so proud of what we did. And Monday night quarterbacking, is that what you call? And doing that now with the investors and what they should have done… I can tell you one thing, no one from the outside ever knows what happens in the inside. And again, I think very few people disrupt categories and very few companies reinvent categories. Office is the second largest category in the world. And I’m very proud of what was achieved.

Michal Lev-Ram: Okay, I want to ask you about – my understanding is that there were there were several components of your exit package, which was controversial at the time. But one of those components was also a non- compete agreement. And when does that expire?

Adam Neumann: Our non-compete expires – it’s actually a non-compete and a non-solicit, and that expires October 30th of this year.

Michal Lev-Ram: Okay. So what happens then? Does this mean that you with your new company, which we will get to in a second, compete with WeWork?

Adam Neumann: To answer that question, I will have to explain what Flow is because I think the answer is slightly more complex. So for those of you who don’t know, Flow is building your – I heard the mission you said before, I’m not sure that is actually our mission, but sounded interesting. But Flow is building a consumer-facing residential brand. And we’re doing it through integrating technology, community and a world class operating team that puts the resident first. And just some numbers. For those of you who don’t know, 66% of young adults in this country are renters. And they spend 34% of their total income on rent. And yet there is no brand, no promise, no elevated experience. In the past, Howard Schultz was a great entrepreneur, and also a company that I really admire, came up with the concept of the third place. He would say the first place was the home. The second place was the office. And the third place was Starbucks, where you could get a cup of coffee, meet someone, and be surrounded by other people. I think in a pre-Corona world, that was amazing. I think in a post-Corona world, what Flow is observed is that it’s not anymore the first place, or the third place, it’s the one place. And in the one place, you have to integrate everything. Our residents, which we survey regularly, 70% of them spend between two to five days working from home. In a reality where work from home and living has become one, a place where our home has changed, and our relationship to our home has changed. I don’t think a lot of us think there’s anything more important than that. The new solution for the future of living needs to be more the one place as opposed to the first or the third. And that is what Flow is going to do. To answer your question you said is Flow, I think what you’re asking is, what’s Flow gonna do?

Michal Lev-Ram: Well, and does Flow, where does WeWork end? And where does fFow begin? And where do they dovetail?

Adam Neumann: So you’re asking, is Flow going to compete?

Michal Lev-Ram: Yes.

Adam Neumann: I think, not I think I know, in a world where the one place is the new solution, where work and living has been integrated, we’re not ready actually, for these solutions, because these buildings have not been designed for that. The operating systems are not there. The tech is not there, the teams are not there to run it. I think Flow has only two choices, compete, or partner.

Michal Lev-Ram: Okay, so compete is one of the choices.

Adam Neumann: Compete or partner.

Michal Lev-Ram: All right, well, maybe it would help if you you know, I think we get kind of the philosophy and the need in the market that you see for Flow. But give us a bit more of a concrete breakdown of what is the business model? Do you own these buildings or not necessarily? And how does the company make money?

Adam Neumann: So I’m going to add one more thing and then I’m going to answer that. In May, the Surgeon General came up with a study defining loneliness as an epidemic in the United States. He was saying that it’s going to cause loneliness is going to cause mental illnesses, is going to cause early death, he was giving all these different definitions and quoting tremendous amount of study. We live in a world where we’re so connected, we’ve never been more disconnected. Even though we love technology, and Flow is tech first and product first, we use technology as the tool to achieve the mission and the goals that we have, not as the end goal. And with that in mind, it has to all be brought together perfectly. So we think the best way to do that business model, we own 3000 apartments that we’re running, we have over 150 employees, a majority of engineers, product designers, both digital and physical, we’re actually looking for a lot more great employees. And the business model that we have is a vertically integrated system. We own the buildings, we operate the buildings, we build the technology, we build a community, and we build the teams that running them. And when you bring all of that together, the moment a resident is happier, more fulfilled and stays longer, the building’s churn goes down churn is the amount of times people leave a building. And the building is immediately more profitable. Happier residents, more fulfilled residents equals more profitable buildings. We’ve already proven this on our first two buildings. And this is something that in real estate, you don’t see often because real estate is not treated as a consumer product, even though it really is. The reason it’s not treated as a consumer product is because it’s a supply challenge, not a demand challenge.

Michal Lev-Ram: You raised $100 million from Marc Andreessen. Correct? No, no, sorry, how much?

Adam Neumann: $350 million.

Michal Lev-Ram: Excuse me, I should have looked at my notes. $350 million. That’s even more mind boggling. I want to hear about, just very briefly, tell us about just why you think this is a good match – Andreessen Horowitz and you – and also curious to hear, you know, not everybody gets a second chance and not on this kind of level, of course, $350 million. Why do you think Marc believed in you and wanted to put his money in you?

Adam Neumann: So a few things. First, we spoke about lessons learned. And we said one of them is surround yourself with the right people. Marc and Ben and a16z are unbelievable investors. They’re actually investors who started as entrepreneurs, they’ve run multiple businesses and created multiple businesses. When they’re in the boardroom, and we’re discussing, not only is noone holding anything back, the kind of advice we’re getting has a lot to do with building a long-term business. Also, and this is something amazing about Marc, after our first board meeting, Marc calls me the next day. And he goes Adam, I wanted to give you some feedback about something I heard in the board meeting. And I said, of course, and then he gave me the list of all the things he disagreed with. Not the things he said in the board meeting but there were a lot of other things that he thought about afterwards. And he said, I don’t want to come too hard. But that’s what I think. And I said, Marc, the deal we made when we did this deal, is that you will always tell me exactly what you think. And I will do my best to be a great listener. And that’s been the relationship ever since. They’ve turned out to be even greater partners then I would imagine. Specifically to what you’re asking, I am sure there are people who deserve to get investments more than me. I’m sure there’s a lot of people deserve who who don’t get it. And I hope because I really believe in entrepreneurship, that the people who deserve to get this investment will get it because I also think that to build the future, we need startups and we need innovation. And that’s what this conference is all about. I think it shouldn’t matter what race they come from, what gender they come from, where they come from, nothing should matter. And everybody should get the opportunity. Specifically why I got the second chance, that you should ask a16z.

Michal Lev-Ram: Okay, question from the audience, please raise your hand. We’ll bring a mic over to you quickly. We’ve got one right here.

Audience Member: Mark Johnson, CTO,Stand Together. What’s your regulatory barriers do you think you’re gonna face in building Flow?

Adam Neumann: So great question. There’s a lot of basic things in residential real estate that are in effect. So we have to follow all the rules that exist. It’s actually a very advanced category when it comes to that. But a very early category when it comes to actually innovation, or technology, or giving, in your experience. Whatever they are, we take them extremely seriously. But they change between state to state, and it depends if you’re owning the building, building the building, operating the building, and then Flow starts there. But over time probably grows outside of these multifamily buildings. There’s tremendous opportunity to where this brand can go to

Michal Lev-Ram: Do you, by the way, I know, one of the knocks, after this, one was published, was in how you describe the company and earlier on too, you know, the fact that the valuation was where it was, and that, you know, there was yes, there was tech involved, but it was real estate. Are you comfortable today describing Flow as a real estate company? Or what is it? What category is it in?

Adam Neumann: So I can’t answer the end without answering the beginning. I’m a little bored of talking about the past. But if we must. Our valuation was given by the most sophisticated valuers in the world, it was Goldman Sachs and JP Morgan and Morgan Stanley. It was Softbank and Benchmark and all the other investors that are considered the best investors in the world. So when people knock our valuation, they’re really knocking all the people that gave that valuation. Valuation is something that’s given by a person that wants to actually invest the money. Putting that aside, we used to describe WeWork in many different ways. Flow is very comfortable being a residential consumer-facing real estate company. It is the largest asset class in the world. It has no brand that we know of. And prop tech in that category is still very early. Because whenever you solve these problems, everyone is solving them as a single point problem, as opposed to actually solving them as a vertical integration problem. So the way we’re going after it is going to take longer, we’re going to have to build a very solid foundation. But when we do, I think our solution is going to actually help solve problems like loneliness, community. And I’ll say one more thing. And I think we live in this world today where I’m not sure we need more followers. I think we need more friends. And I think we can all appreciate a lot more face-to-face interaction, and maybe a little less FaceTime.

Michal Lev-Ram: Well, Adam, we appreciate you coming getting dressed up for us no t-shirts today. But thank you so much for coming. And looking forward to seeing what you do with Flow.