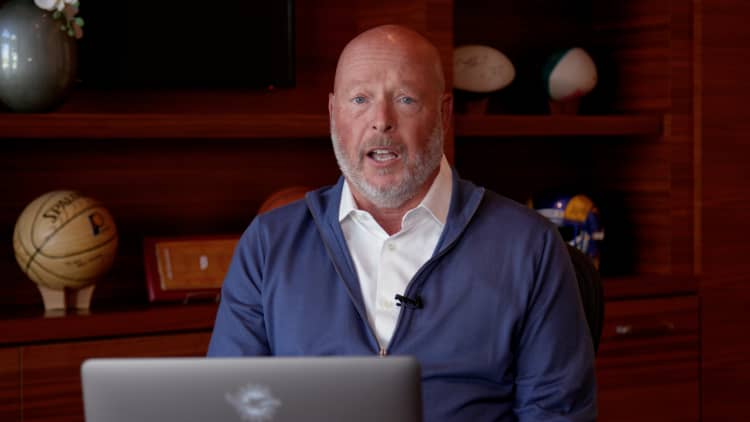

Bob Chapek, chief executive officer of Disney, speaks at the 2022 Disney Legends Awards during Disney’s D23 Expo in Anaheim, California, Sept. 9, 2022.

Mario Anzuoni | Reuters

In his first public comments since Disney fired him as CEO in November 2022, Bob Chapek told CNBC he sees no reason for Disney-owned ESPN to add minority partners.

“Strategically, I don’t really see a benefit in bringing on yet another minority partner into ESPN,” Chapek said as part of the CNBC documentary “ESPN’s Fight for Dominance,” which chronicles the network’s digital strategy, published Thursday.

Disney CEO Bob Iger told CNBC’s David Faber in July that he’d consider selling a minority stake in ESPN to strengthen the sports network’s content or technology as it plans a new direct-to-consumer offering, which he later said would launch by fall 2025.

The company hasn’t yet announced a deal to sell a stake in ESPN. CNBC reported in August that the network had held talks with the major American professional sports leagues, including the National Football League and the National Basketball Association, about potential partnerships or investments.

Disney owns 80% of ESPN and Hearst owns the other 20%, a structure that’s been in place since 1996. By searching for a partner, Disney wants to enhance the content, distribution and marketing of the direct-to-consumer ESPN, which hasn’t yet been priced, Iger said during Disney’s August quarterly earnings call.

Striking a partnership with one of the professional sports leagues could help secure future live rights, though it may irritate other media companies that bid against Disney for packages of games. Bringing on a technology or telecommunications company such as Verizon or Apple could give ESPN broader distribution options by reaching larger customer bases.

Still, it’s unclear selling equity in ESPN is needed to strike an arrangement. ESPN President Jimmy Pitaro, who also spoke with CNBC as part of the documentary, downplayed the need for the sports network to sell a stake in its business to build a partnership with a league or another company.

“It’s not about equity,” Pitaro said. “It’s not about these partners taking an ownership interest in ESPN. That is something, as Bob [Iger] has said, that we are very much open to, but this is about partnership and accelerating the launch or the adoption of ESPN flagship.”

Chapek’s first interview since his 2022 firing

Chapek’s remarks are his first public statements since Disney’s board fired him and brought back Iger as CEO about 16 months ago. He and Iger, who had stayed on as Disney’s executive chairman, had a strained relationship that got progressively worse through Chapek’s tenure as CEO, which ran nearly three years from 2020 to 2022, as documented by CNBC in September. Chapek declined to comment on anything other than ESPN’s future for the CNBC documentary.

While Chapek said he didn’t agree with the need to bring on a partner for strategic reasons, he did acknowledge Disney might do it to bring in cash to pay for Comcast’s one-third stake in Hulu, which Disney has committed to buy for at least $8.6 billion.

“There’s already one minority strategic partner in Hearst. So this would be bringing on a second minority strategic partner,” Chapek said. “Obviously, the benefit of doing that is that you make available some cash. And given some of the conversation that’s been happening between Comcast and Disney in terms of needing to buy the final share of Hulu to make it wholly owned by the Disney company, it’s possible that maybe that cash itself is what they’re after.”

ESPN Chairman James Pitaro at a New York Yankees baseball game at Yankee Stadium in New York City, June 19, 2019.

The Washington Post | The Washington Post | Getty Images

Hub for all sports

Chapek also discussed the vision he had as CEO of turning ESPN into a centralized hub to direct consumers to where a game is streaming, no matter which company owns the rights to air it — a concept CNBC first reported in March 2023.

“If I’m on my Apple TV and I want to watch a movie, I have no idea whether it’s on Prime or Netflix or Disney+ or Hulu or wherever it’s at,” Chapek said. “The way I find out is I go to Apple TV, I plug in the movie that I’m looking to watch, and they direct me exactly to where that movie is. And then they connect me seamlessly without me then having to exit and go to another app to go find the show on that app. I think ESPN should be that source for a central clearinghouse.”

Adding one-stop navigation can help ESPN become the first place sports fans go to when they want to watch a game, even if Disney doesn’t own the rights to certain sports, Chapek said.

“How do you make yourself indispensable to the sports viewer so that they stay on with you as you evolve over to a streaming world? I think solving that problem would be one big way to do it,” Chapek said.

WATCH: Bob Chapek discusses ESPN’s future

![‘Survivor 47’ Finale Recap Part 2, [Spoiler] Wins ‘Survivor 47’ Finale Recap Part 2, [Spoiler] Wins](https://tvline.com/wp-content/uploads/2024/12/survivor-finale-part-2-cbs.jpg?w=650)