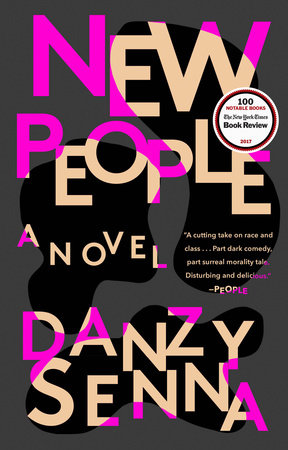

A worker heats the seal of a joint between two segments of pipe during construction of a section of an interconnector gas pipeline, linking the gas networks of Bulgaria and Serbia, on the outskirts of Sofia, Bulgaria, on Friday, Feb.24, 2023. Bulgaria has begun work on a new pipeline to neighboring Serbia that will enable gas supplies from other countries to reduce dependence on Russian flows. Photographer: Oliver Bunic/Bloomberg via Getty Images

Bloomberg | Bloomberg | Getty Images

A feared European winter gas shortage has yet to materialize for the second year in a row — but consumers are set to stay stuck paying significantly higher rates than they used to.

A crisis situation was averted last winter, following a scramble to find new suppliers, reopen old storage facilities and roll out initiatives to reduce consumption in some energy-intensive areas, as flows from Russia dried up in the wake of its full-scale invasion of Ukraine in February 2022.

According to research published by Moody’s this month, the EU had record high gas stocks of around 97.5% at the end November 2023, meaning both very low risk of energy shortages this winter and a strong position for the next cold season, analysts found.

“Europe’s improved energy reserves going into this winter are the result of the effectiveness of government actions on the supply and demand side, and consistent energy savings by both households and companies,” the Moody’s report stated, citing greater supplies of liquefied natural gas (LNG) in 2023, a higher availability of nuclear and hydropower plants and a mild winter as improving the situation.

Lower consumption has also been helped by economic stagnation in the continent, the report said.

Moody’s expects gas storage to be higher than previously anticipated at 55% at the end of March 2024.

Household and business bills

Yet, “European gas prices will remain high and volatile,” the report finds.

Energy has been one of the strongest forces pulling down inflation in recent months, after being a chief driver in hikes in consumer prices suffered in the immediate wake of Russia’s invasion of Ukraine. Annual headline inflation was 2.4% in November in the euro zone, with energy showing disinflation of 11.5% year-on-year, even as the extent of price rises simply moderated in all other sectors.

In the U.K., gas price inflation has plunged by 31% in the year to November, figures from the Office for National Statistics showed.

But all that is a fall off the back of a very large spike.

Using Factset data, Moody’s found that European gas prices are well above their 2015-2019 average — and sees them remaining above this level until at least 2031. In 2020 and 2021, prices were below the average.

“The tariffs paid by households and industries are still historically very high,” James Waddell, head of European gas and global LNG at Energy Aspects, told CNBC by email.

“Movements in these prices generally follow movements in the wholesale gas market with a lag of several months, because of supplier hedging. So the fall in European wholesale gas prices from last year has not fully been passed through yet.”

Wholesale prices are overall around four times lower than they averaged over 2022, but still more than double what they were historically, Waddell said.

“This means that there are still price pressures on households and industries and in the case of the latter, increasingly we see interest in these firms relocating production outside of Europe.”

He also said that, despite healthy supply in the short term, concerns remain about the ability for European gas storage capacity to set itself up for the years ahead, since “stocks can be drawn down quickly in the event of cold weather.” That can also be the case if an increase in Asian demand pulls a lot of LNG away from Europe, he said.

Moody’s says gas prices will stay volatile primarily because of “increased geopolitical risks, which reflect their intrinsic vulnerability to supply disruptions.”

It cites various downside risks to its gas market outlook, including a further cut in Russian pipeline supply and episodes of supply disruption, as seen in the strikes at Australian LNG facilities earlier this year.

Additional volatility has arisen following the Israel-Hamas war, which has lifted risk premiums and driven spot gas prices higher despite Europe’s relative distance from the conflict, researchers say.

According to Moody’s, “Under the unlikely adverse scenario where the conflict could escalate to the broader region with the direct involvement of Iran, European gas prices could spike to similar levels seen following Russia’s invasion of Ukraine. This scenario would hurt economic activity and add further challenges for energy-intensive sectors.”

![[Spoiler] Shot, Wes vs. Csonka [Spoiler] Shot, Wes vs. Csonka](https://www.tvinsider.com/wp-content/uploads/2024/12/fbi-international-408-vo-wes-1014x570.jpg)