DAVOS, Switzerland — Crypto-related technology companies are out in force at the annual World Economic Forum in Davos, even after a recent market crash that has wiped off billions of dollars of value from the digital currency market.

The Promenade, a main strip where companies and governments take over shops and bars during the week of the forum, are dominated by crypto companies, nestled between major firms like Salesforce and Facebook-owner Meta.

“It’s a big step for the crypto industry, they were always anti-Davos,” one delegate told CNBC.

On Sunday, Tether, the company behind the stablecoin USDT, set up a stand giving away free pizza on the Promenade for Bitcoin Pizza Day. On May 22, 2010, a programmer bought pizza using bitcoin and it is widely seen as the first transaction using the cryptocurrency. The day is celebrated every year by the crypto community.

Another delegate remarked that crypto companies were “splashing the cash.”

Non-fungible tokens is a big topic during discussions around the World Economic Forum. RollApp, which runs an NFT store, set up a location in Davos to promote the digital collectibles.

Arjun Kharpal | CNBC

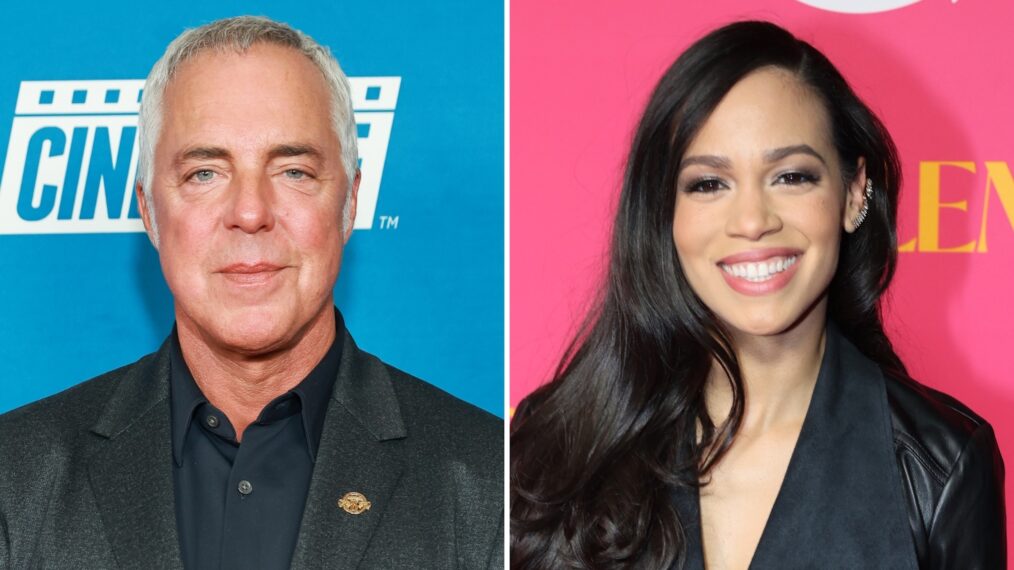

Fernando Verboonen, co-founder of RollApp, a non-fungible token (NFT) store, which took over a shop on the Promenade, estimated about 60% of the venues on the street were crypto-related companies.

“They are basically taking over Davos,” he said.

Non-fungible tokens are digital collectibles. RollApp is trying to turn real-world assets such as cars into NFTs.

‘Crazy few weeks’

The industry’s strong showing at Davos comes despite a recent market crash. More than $500 billion has been wiped off the crypto market in the last month, as the collapse of stablecoin terraUSD sent shockwaves across the industry.

Those who are at Davos likely committed to taking over a space on the Promenade in the Alpine ski resort before the recent market fall.

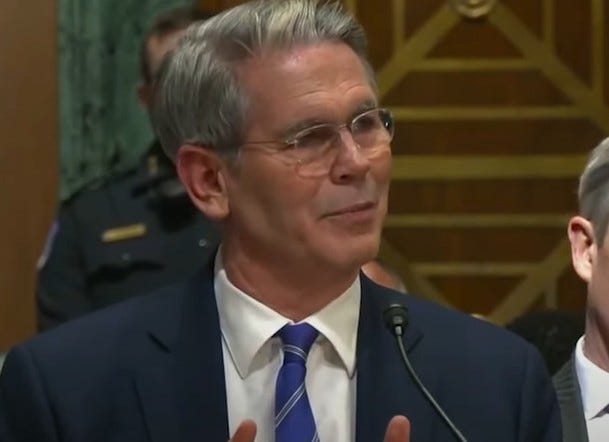

“It’s been a crazy few weeks in crypto. We committed to coming here a long time ago but that wasn’t going to change. We are in a position that we are going to withstand the bear market and there will be a bull run again,” Clifford Sarkin, the COO at blockchain start-up Casper Labs, told CNBC.

Circle, which is one of the companies behind the USDC stablecoin, took over one of the shops on the Davos Promenade.

Arjun Kharpal | CNBC

Casper Labs has a blockchain product aimed at businesses. Blockchain came to prominence with bitcoin but its definition has expanded. It is effectively a shared ledger of activity that could underpin applications in business such as cross-border money transfers, proponents say.

Sarkin said the crash had been positive for company’s like his that are focused on selling blockchain to business customers, rather than consumers.

“It’s easier to do business in a bear cycle. A lot of the people who came last year and were trying to make money in crypto that are now leaving because they’re saying crypto is dead, are now out of the space for a while and we are going to get to do real business,” he told CNBC.