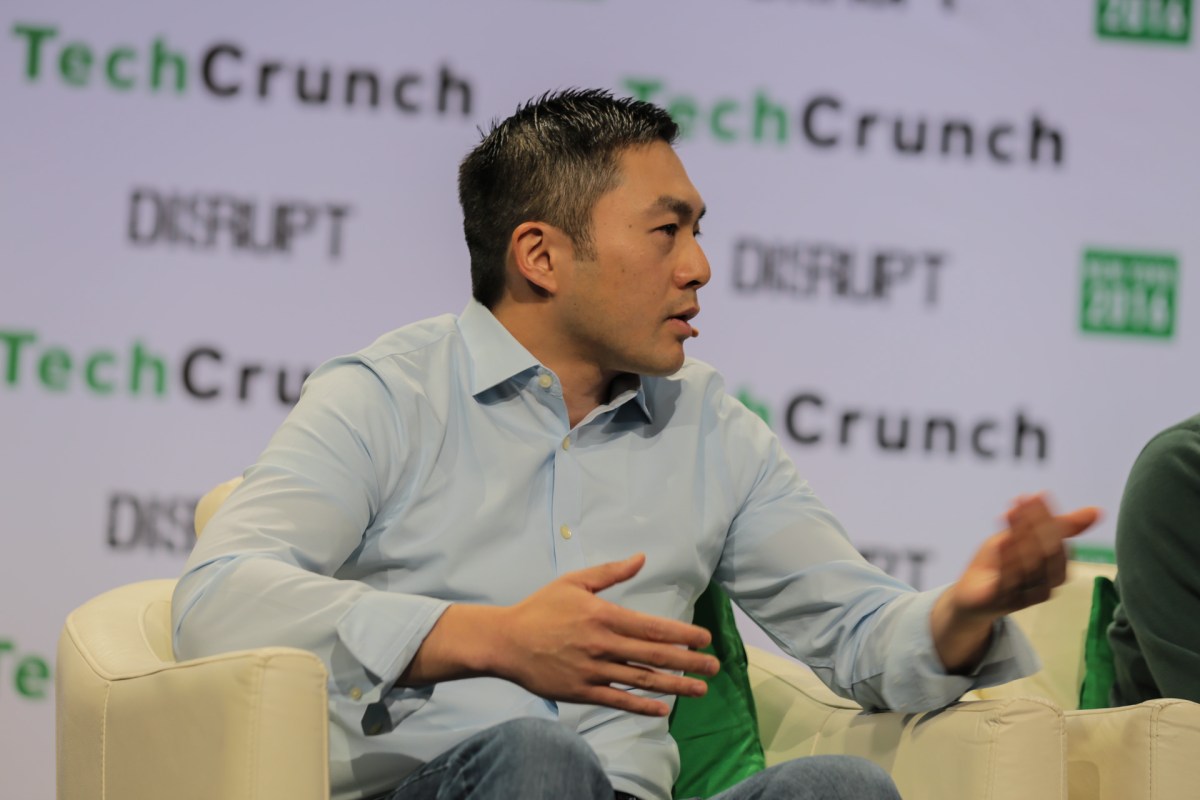

Covid cases have soared in China’s capital city of Beijing, where many communities have been recently locked down or under tighter health monitoring as the country maintains its zero-Covid policy.

Kevin Frayer | Getty Images News | Getty Images

BEIJING — Three indicators on China’s economy in October missed expectations and marked a slowdown from September, according to data released by China’s National Bureau of Statistics on Tuesday.

Retail sales fell by 0.5% in October from a year ago — the first decline since May — and industrial production grew by 5%, the data showed.

related investing news

Analysts polled by Reuters expected retail sales would slow to 1% year-on-year growth in October, and that industrial production would also slow to 5.2% growth.

Fixed asset investment for the first 10 months of the year grew by 5.8%, a touch below expectations for maintaining the same pace as September, with a 5.9% increase year-on-year, according to the Reuters poll.

Investment in real estate declined further in October on a year-to-date basis, while that in manufacturing slowed slightly from September. Investment in infrastructure picked up mildly, to 8.7% year-on-year for 2022 as of October.

The unemployment rate in cities was unchanged from September, at 5.5% in October. That of young people ages 16 to 24 was also unchanged, at 17.9%.

October’s drop in retail sales dragged down the year-to-date figure to just 0.6% growth. Home appliances, catering and apparel saw some of the greatest sales declines last month from a year ago.

Car sales held up with 3.9% growth. Online sales of physical goods surged by 22% year-on-year in October, to account for more than a quarter of retail sales overall, according to CNBC calculations of the data.

China’s economic recovery has slowed, said Fu Linghui, spokesperson for the National Bureau of Statistics, pointing to a slowdown in global growth and domestic Covid outbreaks.

He also said that the so-called three pressures on growth have intensified.

Nearly a year ago, Beijing warned the domestic economy faces “triple pressure” — from shrinking demand, supply shocks and weakening expectations. Consumption has been one of the weakest spots.

Fu noted signs of improvement in real estate, but said the sector remained on a downward trajectory.

Over the last few days, authorities have announced measures to support the struggling property market, according to financial media and official notices.

It’s uncertain whether the changes are enough, “but it’s clear that policymakers now have the courage to take more decisive actions,” Larry Hu, chief China economist at Macquarie, said in a report.

Broad slowdown in October

Data released ahead of Tuesday’s announcement revealed a negative turn in trade and domestic demand last month.

Exports dropped in October for the first since May 2020, while the producer price index fell for the first time in nearly two years. The core consumer price index, excluding food and energy, showed no change from September with muted 0.6% year-on-year growth in October.

Credit data disappointed, mainly due to the slump in the property market, Hu pointed out. He noted that household loans for the first 10 months of the year are less than half what they were a year ago.