China has shown signs of easing its crackdown on the technology sector which has wiped billions of dollars of value from its most prominent companies.

But analysts said Beijing’s recent positive rhetoric should not be mistaken for a reversal of policy.

“I think the big tech companies will have a grace period for maybe the next six months,” Linghao Bao, tech analyst at Trivium China, told CNBC’s “Squawk Box Europe” on Tuesday.

“However, this is a really not a U-turn on the tech crackdown, the long-term outlook hasn’t changed yet. Because Beijing has already come to the conclusion that it is a bad idea to let big tech companies to run wild because it creates unfair market competition … wealth will be concentrated at the top and it will start to influence politics,” he said.

“So the tech crackdown are really here to stay over the long term.”

Since end of 2020, Beijing has introduced stricter regulation on its domestic technology sector in a bid to rein in the power of some of its biggest companies.

Since late 2020, China has increased scrutiny on the technology sector and introduced a slew of new regulation that has tried to rein in the power of its domestic giants. Analysts say that while there appears to be sign of this crackdown easing, there will not be a complete U-turn in policy.

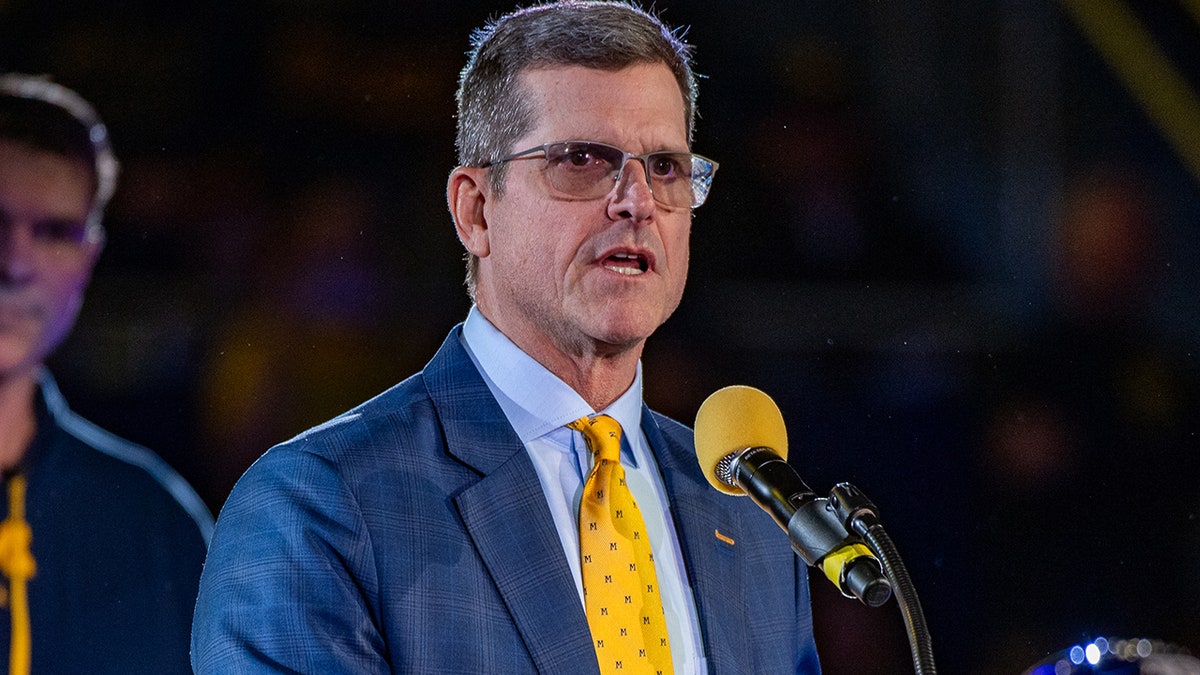

Kevin Frayer | Getty Images News | Getty Images

Rules in areas from antitrust to data protection have come into effect in a swift manner in the past 16 months. The moves have caught international investors off guard and sparked a dramatic sell-off in the stocks of domestic titans from Tencent to Alibaba.

But Beijing has signaled some of the scrutiny on the tech sector may ease as its economy faces pressure from a resurgence of Covid and subsequent lockdowns.

On Tuesday, Chinese officials met with some of the country’s top technology executives in further signs of easing.

Following the meeting, China’s Vice-Premier Liu He pledged support for the technology sector and plans for internet companies to go public.

It comes after Chinese President Xi Jinping in April chaired a meeting of the Politburo, a top decision making body. The Politburo pledged to support the “healthy” development of the so-called platform economy, which includes internet companies in areas from social media to e-commerce.

Even if there are some reversals, it may be too late to reverse the damage.

Charles Mok

Charles Mok, visiting scholar at the Global Digital Policy Incubator at Stanford University

Despite these more soothing tones from Beijing, experts doubt there will be a huge shift in policy.

“I don’t believe that the regulatory actions will really stop. Various ministries still have a mandate to enforce all the regulations that have been amended and strengthened,” said Charles Mok, visiting scholar at the Global Digital Policy Incubator at Stanford University.

“Even if there are some reversals, it may be too late to reverse the damage. For example, even if they allow more listings overseas, the investor confidence is already lost, and the scrutiny and hostility from the foreign market also cannot be reversed.”

Mok said that because the regulatory scrutiny has been driven by the top of China’s political hierarchy, it will be difficult to make a U-turn.

“This seems very similar to the debacles they’re facing with zero-Covid. You know it’s wrong but you can’t admit it, can’t reverse course, and you can only pay some lip service and hope for the best,” Mok said.

Zero Covid is China’s policy of eliminating the coronavirus from the mainland through tough measures including city-wide lockdowns and mass testing. The economic and financial powerhouse city of Shanghai has been in a lockdown since late March. China’s zero Covid policy has weighed on its economy.

Mok added that the motivations behind China’s regulatory tightening have not changed either.

“Much of the ‘tech crackdown’ campaign was genuinely rooted in the motivation to increase state control of the digital economy and all the data in the trade, and there is no way that under the current crisis that the party would think these controls are now less important,” he said.