In 1936, social scientist Robert Merton proposed a framework for understanding different types of unanticipated consequences—perverse results, unexpected drawbacks, and unforeseen benefits. Merton’s choice of words (“unanticipated” rather than “unintended”) was by no means random. But the terms have, over time, become conflated.

“Unanticipated” gets at our inability or unwillingness to predict future harmful consequences. “Unintended” suggests consequences we simply can’t imagine, no matter how hard we try. The difference is more than semantics—the latter distances entrepreneurs and investors from responsibility for harmful consequences they did not intend. I like the term “unconsidered consequences,” because it puts the responsibility for negative outcomes squarely in the hands of investors and entrepreneurs.

Merton outlined five key factors that get in the way of people predicting or even considering longer-term consequences: ignorance, short-termism, values, fear, and error—assuming habits that worked in the past will apply to the current situation. I’d add a sixth: speed.

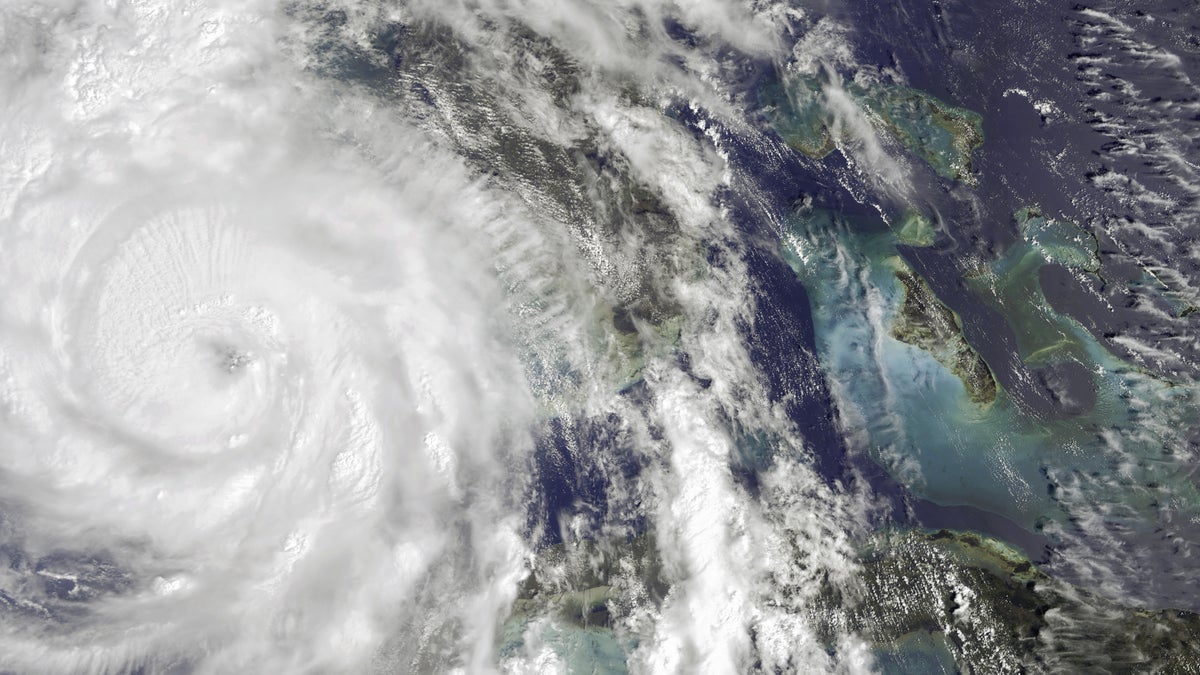

Speed is the enemy of trust. To make informed decisions about which products, services, people, and information deserve our trust, we need a bit of friction to slow us down—basically, the opposite of infinite, easy swiping and scrolling. And speed is a two-pronged problem.

According to Our World in Data, it took more than 50 years for more than 99 percent of US households to adopt the radio for listening to programs in their homes and cars. It took 38 years for the color TV to reach similar mainstream adoption. In comparison, it took Instagram just three months to reach a million users when it launched in 2010. TikTok landed its billionth user in 2021, just four years after its global launch—half the time it took Facebook, YouTube, or Instagram to achieve the same milestone, and three years faster than WhatsApp. When the time frame of consumer adoption is compressed from decades to months, it’s easy for entrepreneurs to ignore the deeper and often subtle behavioral changes those innovations are introducing at an accelerated rate.

Entrepreneurs will often tell themselves the story that they’re still in the “novelty” or “sandbox” phase, when in reality millions of people are using their product. It’s reflected in the fact that big tech companies’ original mission statements, such as “Don’t be evil” (Google) or “Give people the power to build community and bring the world closer together” (Facebook), are used well beyond their expiration date—sometimes even years after the founders have been forced to acknowledge not only the severe shortcomings of their innovations, but the serious consequences of those shortcomings.

Simultaneously, most entrepreneurs are largely focused on accelerating the speed of their growth. I’ve only ever once seen in a pitch deck a “slow growth” strategy. “The old mantra of ‘Move fast and break things’ is an engineering design principle … it’s not a society design principle,” writes Hemant Taneja, a managing partner at the venture firm General Catalyst, in his book Intended Consequences. Taneja argues that VCs need to screen for “minimum virtuous products” instead of just “minimum viable products.” A powerful question for determining the virtues of a product over time is this: If you were born in a different era or different country, how would you feel about this idea?

.jpg)