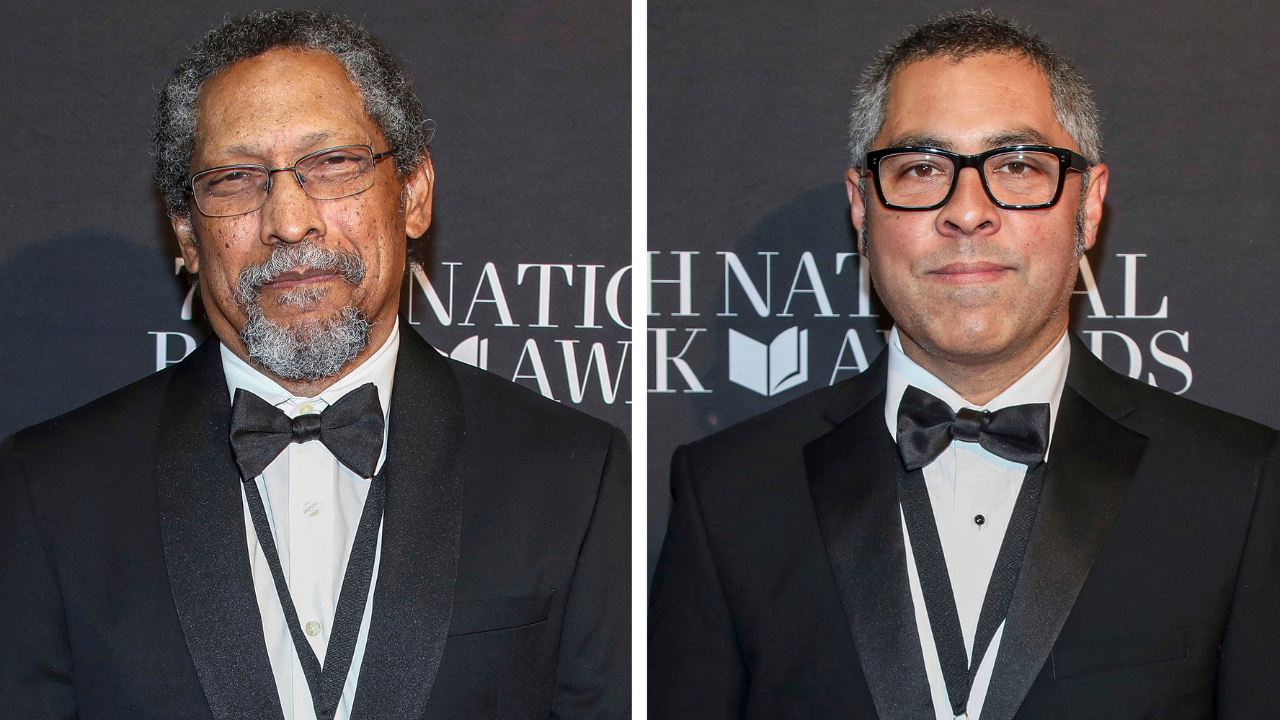

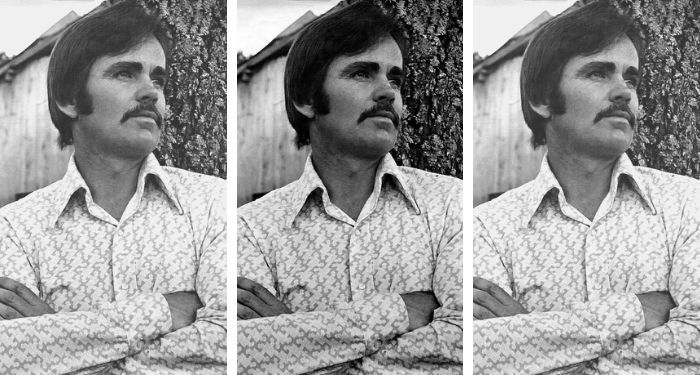

Gecko Capital’s Maunakea Emerging Markets Debt Recovery Fund has delivered an impressive 74% return over the past year, and its fund manager is particularly bullish on two South American economies looking ahead. The fund aims to make double-digital returns annually on a U.S. dollar basis and currently yields around 10%, which is “conservatively” estimated, according to Jean-Jacques Durand, the fund’s manager. It generates these returns by investing in bonds where the borrower is typically facing difficult financial circumstances and may need a restructuring or bailout — known in the trade as a “special situation.” Where’s the fund invested? Maunakea’s two largest positions are in Venezuela and Argentina, which Durand considers among “the most attractive and compelling” trades he has ever placed. Venezuela presented what he calls “the case of the century” when bonds issued by its state oil company, PDVSA, were trading between 13-18 cents on the dollar due to the threat of U.S. sanctions until October last year. Instead, the U.S. government partially lifted sanctions after the Venezuelan government began talks with the opposition party. “So that was the first boost to the price, and they almost doubled [in price] in a couple of days,” Durand, who previously ran an emerging market bond portfolio at Edmond de Rothschild, said. The investor believes that Venezuela’s long-term potential, coupled with the likelihood of softening sanctions and the country’s geopolitical importance, makes it an “attractive asymmetric” investment. However, he emphasizes the need for patience in these situations, as the timeline for the investment thesis can be lengthy. Elections are expected to be held on 28 July which will be a key moment for investments in the country, according to the fund manager. “Do we end up with a government, whoever wins, that is legitimized, and further sanction lifting is done by the EU or the U.S., or do we have a regime that shuts itself and obviously becomes more and more undemocratic? That’s the question,” he added. ‘Very simple’ factors Durand’s approach to calculating upside potential in these markets is straightforward. For situations like Venezuela, the return — or recovery value — is determined by the country’s long-term capacity and willingness to pay, according to Durand. For instance, Venezuela depends on foreign capital to develop its oil and gas fields. The country has also previously negotiated with bond investors in “good faith,” according to Durand. “Usually, it’s very simple,” he explained. “They cannot afford to be shut from the market for many years if they want their oil business and the whole economy to function.” This contrasts with the situation in Argentina, where the country has a history of defaults, leading to severe losses for bondholders. Durand said Argentina is not as dependent on foreign investors for capital as much of its economy is driven by private businesses that can function even if the country is shut out from capital markets. “They’ve been serial defaulters. When they have the opportunity, they will default,” Durand said of Argentina. “They will try to get as much as possible from the bondholders and pay back as little as possible.” However, the fund manager is optimistic that Argentina will reverse its economic woes. He pointed to the country’s first quarter of government surplus as green shoots to his thesis. The next trade Durand said he is eyeing Bolivia, once a market darling that has recently experienced significant problems, for opportunities as its bonds start to trade at discounted levels. The country’s government has had to tackle a worsening dollar scarcity that has left shelves empty in supermarkets and left workers unpaid. Earlier this year, Fitch downgraded the country to CCC — or junk rating — meaning a “default is a real possibility” over the worsening currency crisis. Bond prices have fallen sharply as investors question the government’s ability to keep up with interest payments. “We don’t have it in the fund yet. That might be a next position,” he added.