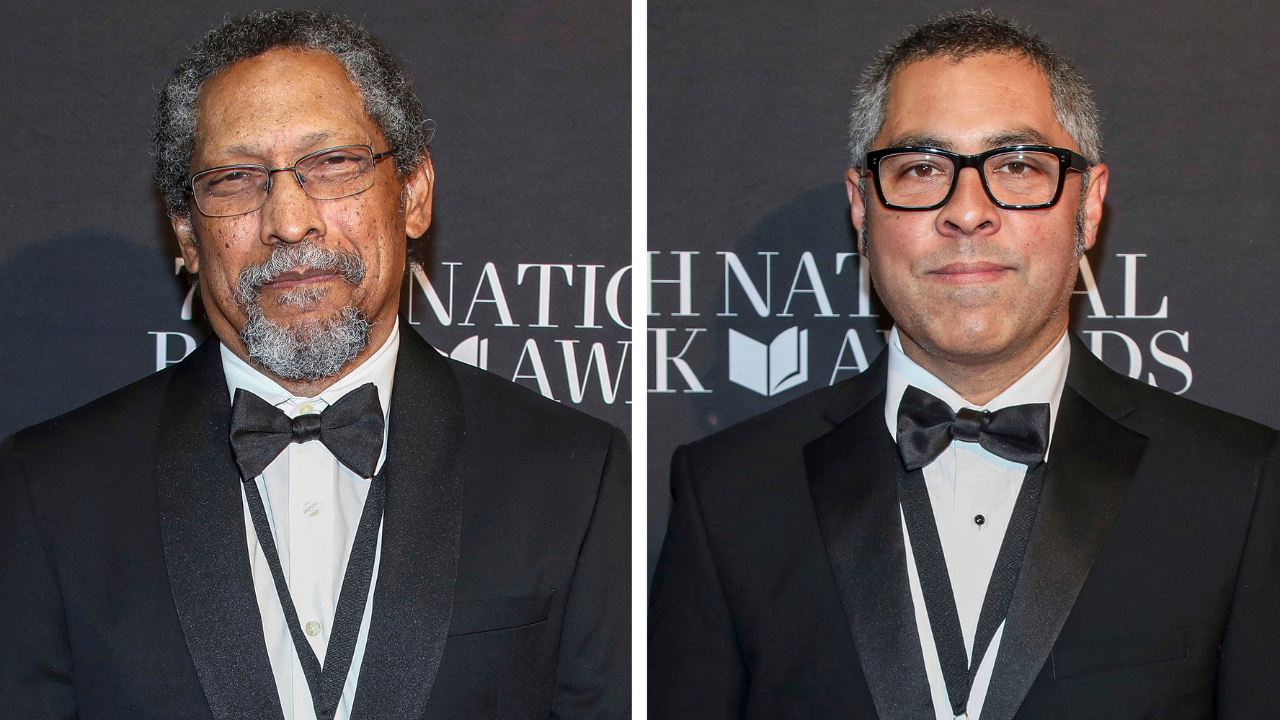

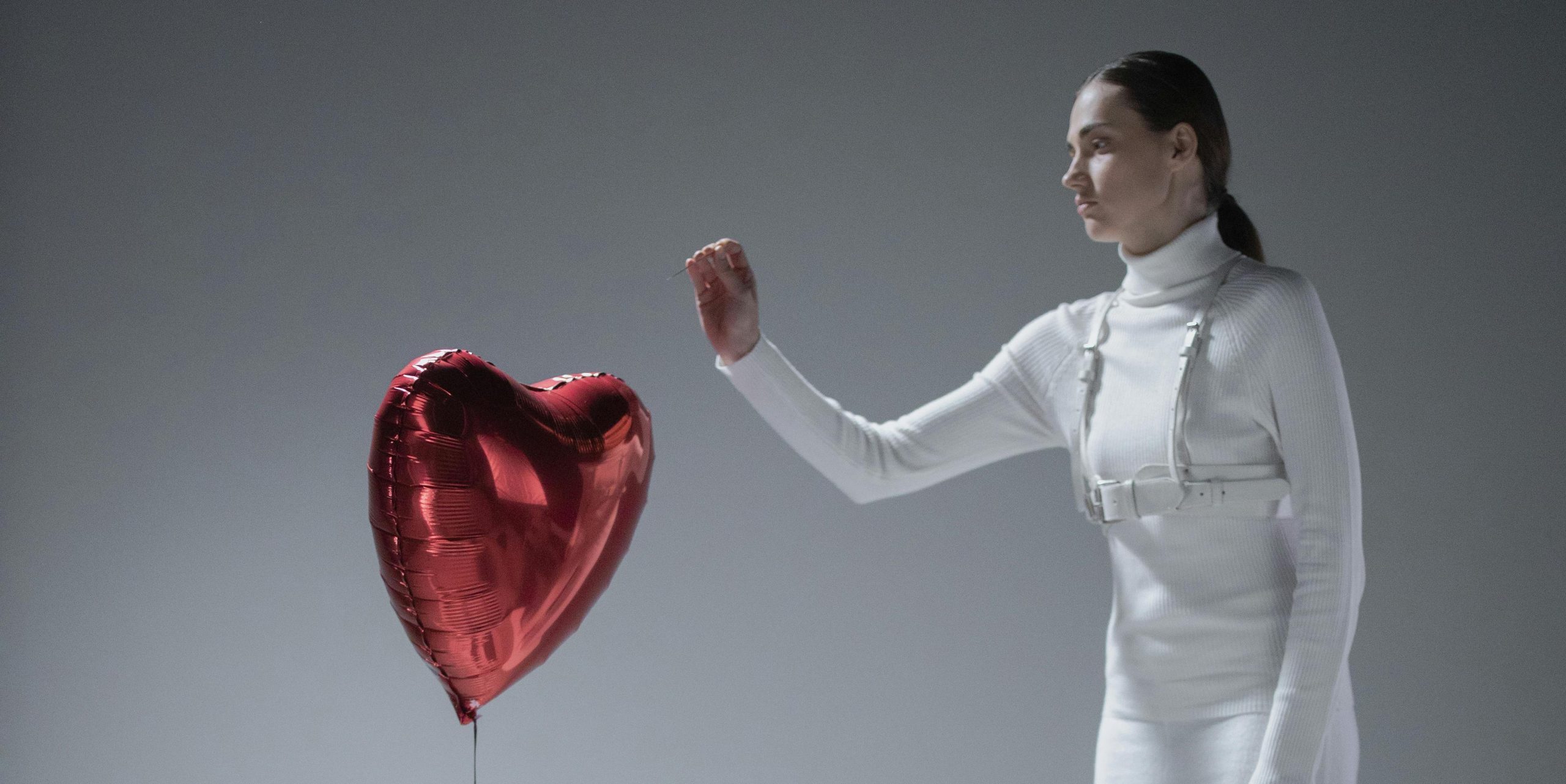

A residential complex constructed by Evergrande in Huai’an, Jiangsu, China, on July 20, 2023.

Future Publishing | Future Publishing | Getty Images

BEIJING — China’s housing ministry has announced plans to make it easier for people to buy property.

The news, out late Thursday, indicates how different levels of government are starting to act just days after Beijing signaled a shift away from its crackdown on real estate speculation.

The planned measures include easing purchase restrictions for people wanting to buy a second house, and reducing down payment ratios for first-time homebuyers, according to an article on the Ministry of Housing and Urban-Rural Development’s website.

In an effort to reduce speculation in its massive property market, China has made it much harder for people to buy a second house.

Mortgage rates for the second purchase can be a full percentage point higher than for the first, while the second-home down payment ratio can skyrocket to 70% or 80% in large cities, according to Natixis.

The housing ministry article referred to comments from its minister Ni Hong at a recent meeting with eight state-owned and non-state-owned companies in construction and real estate.

Since it was a meeting at the central government ministry level, it did not discuss policies for individual cities, said Bruce Pang, chief economist and head of research for Greater China at JLL.

But he expects Beijing will encourage local governments to announce real estate policy changes that fit their specific situation. Pang also pointed out that including construction companies at the meeting emphasized their role in promoting investment and stabilizing growth.

Waiting on details

China has not yet announced formal measures for supporting real estate. However, top level leaders on Monday signaled a greater focus on housing demand, rather than supply.

On Tuesday, China’s State Taxation Administration announced “guidelines” for waiving or reducing housing-related taxes. It was not immediately clear what implementation would look like for home buyers.

We continue to expect the property sector rally to continue and advise investors to focus on beta names within the property sector.

The readout of Monday’s Politburo meeting also removed the phrase “houses are for living in, not speculation,” which has been a mantra for Beijing’s tight stance and efforts to rein in developers’ high reliance on debt for growth.

“It seems to us that [the housing ministry] is quick in response this time and also gets bolder on relaxing property policies,” Jizhou Dong, China property research analyst at Nomura, said in a note Friday.

Given such speed, Dong expects markets are anticipating specific policy implementation in cities such as Shanghai or Guangzhou.

Hong Kong-traded Chinese property stocks such as Longfor, Country Garden and Greentown China traded higher Friday, on pace to close out the week with gains after plunging on Monday over debt worries.

“We continue to expect the property sector rally to continue and advise investors to focus on beta names within the property sector,” Nomura’s Dong said.

Those stocks include U.S.-listed Ke Holdings, as well as Hong Kong-listed Longfor and China Overseas Land and Investment, the report said, noting Nomura has a “buy” rating on all three.

“We still advise investors to stay away from weaker privately-owned developers.”