A video sign displays the logo for Roku Inc, a Fox-backed video streaming firm, in Times Square after the company’s IPO at the Nasdaq Market in New York, September 28, 2017.

Brendan McDermid | Reuters

Roku has $487 million of cash and cash equivalents in uninsured deposits at failed Silicon Valley Bank, the streaming media company said in an filing on Friday with the Securities and Exchange Commission.

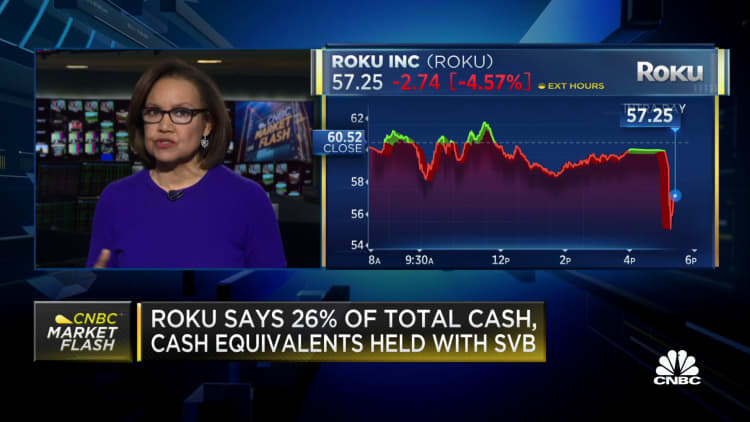

About 26% of Roku’s $1.9 billion in cash was deposited with SVB, which was placed into receivership by the Federal Deposit Insurance Corp. midday Friday.

Roku shares fell over 4% in extended trading on the news.

“At this time, the Company does not know to what extent the Company will be able to recover its cash on deposit at SVB,” Roku said in a press release.

Nonetheless, Roku said it believed it would be able to meet its capital obligations for the “next twelve months and beyond” with its unaffected $1.4 billion in cash reserves at other “large financial institutions.”

“As stated in our 8-K, we expect that Roku’s ability to operate and meet its contractual obligations will not be impacted,” a Roku spokesperson said in a statement to CNBC.

The collapse of SVB jarred both large and small companies alike. As the favored lender and banker for many Silicon Valley startups and venture capital firms, the company’s receivership has alarmed founders, who worry about meeting payroll and critical obligations with limited cash available.

FDIC insurance only covers the first $250,000 in deposit accounts, a fraction of the cash that Roku and many other companies had vaulted with SVB.