Ryanair planes are seen at Dublin Airport, following the outbreak of the coronavirus disease (COVID-19), Dublin, Ireland.

Jason Cairnduff | Reuters

Check out the companies making headlines in midday trading Monday.

Newmont — Newmont shares tumbled 11.9% after the mining company reported a disappointing second-quarter profit. The company reported earnings of 46 cents per share, compared to a Refinitiv consensus forecast of 63 cents per share.

World Wrestling Entertainment — Shares of World Wrestling Entertainment jumped more than 7% after Loop Capital upgraded and raised its price target on them “based on a greater likelihood that the company is sold with Vince McMahon stepping down.” McMahon, WWE’s top shareholder, is being investigated for sexual misconduct claims and stepped down as CEO on Friday.

JD.com — The Chinese e-commerce company climbed 2% after Morgan Stanley named JD.com a “catalyst-driven idea.” The Wall Street firm said it’s particularly bullish on JD.com heading into earnings in August, as revenue growth is expected to accelerate from June’s level.

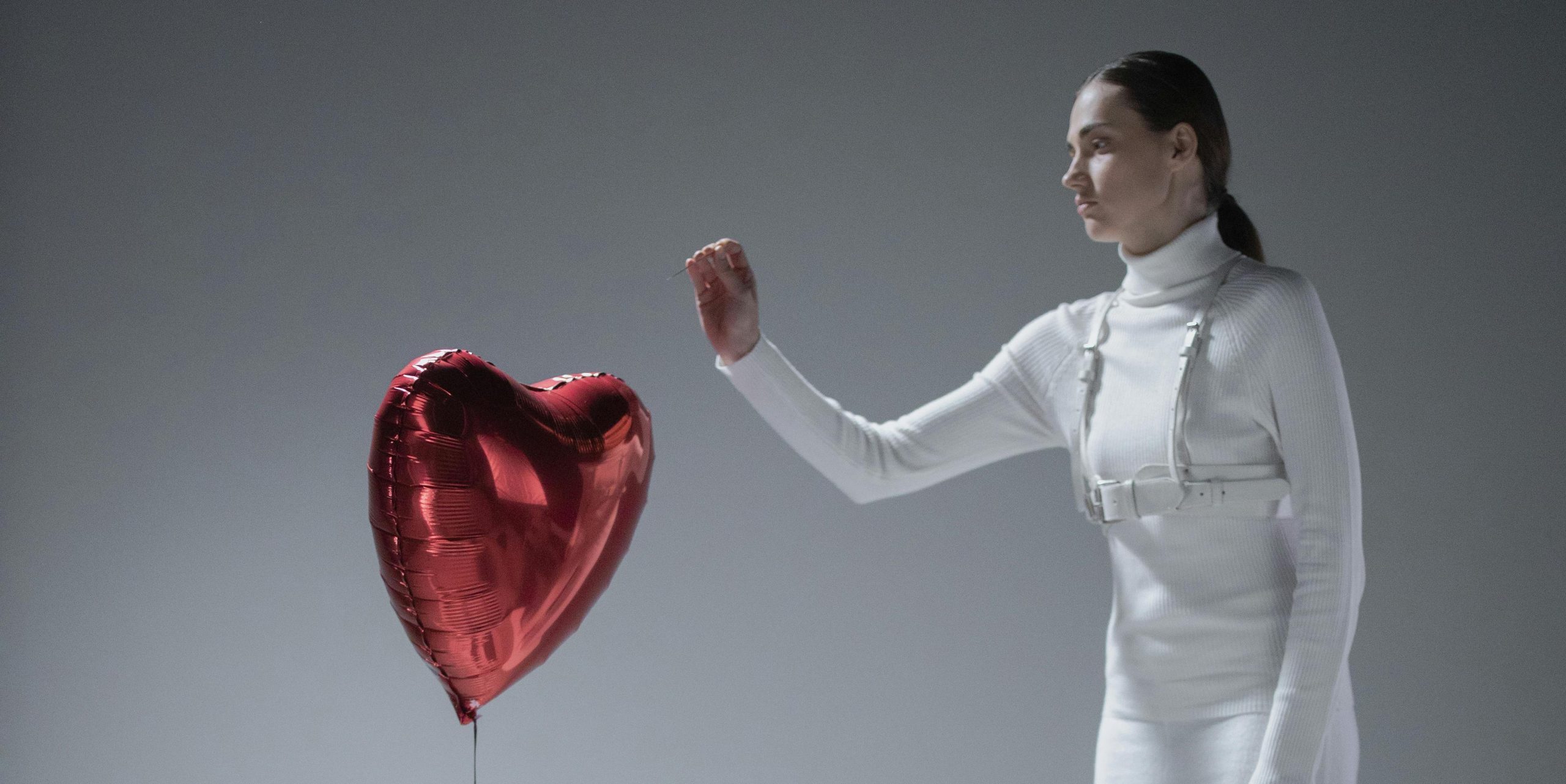

Ryanair — Shares of Ryanair surged more than 4% after the budget airline reported quarterly earnings that beat Wall Street’s profit estimates. The company also expects to return to pre-Covid profit levels this year or next, even though the recovery is fragile.

Philips – The Dutch medical equipment maker’s shares fell nearly 7% after the company reported weaker-than-expected quarterly earnings, citing lockdowns in China and supply chain issues. It also cut its estimate for full-year sales growth to between 1% and 3%, down from 3% to 5%.

Lam Research — Shares of the semiconductor equipment company slipped nearly 2% after Barclays downgraded the stock to equal weight, saying in a note to clients that, despite a recent bounce, the semiconductor industry is due for a correction.

Diamondback Energy — Energy stocks surged on the back or rising oil prices Monday. Diamondback Energy jumped 5.7%, while Marathon Oil advanced 5.1%. Valero and Hess each gained more than 4%.

Travelers — Shares jumped 2% after Raymond James upgraded Travelers to a strong buy. Raymond James believes the insurance stock, which is up 2% this year, will continue to outperform.

— CNBC’s Yun Li, Tanaya Macheel, Samantha Subin and Carmen Reinicke contributed reporting

![[VIDEO] A Capitol Fourth Livestream — Watch July 4 PBS Fireworks Show [VIDEO] A Capitol Fourth Livestream — Watch July 4 PBS Fireworks Show](https://tvline.com/wp-content/uploads/2022/07/a-capitol-fourth-2022.jpg?w=620)