European fintech Klarna has confirmed that it has raised $800 million at a pretty hefty valuation drop.

Rumors have been circulating for at least the past month that Sweden-based Klarna, best known as a “buy now, pay later” service provider, was seeking to raise new funds. Initial reports suggested this valuation would be in the region of $15 billion, representing a sharp decline on its $45.6 billion valuation exactly a year ago. Then earlier this month, leaks suggested that the valuation may be closer to $6.5 billion — and that, as things have transpired, is pretty much the size of it.

Klarna confirmed today that it’s now valued at $6.7 billion off the back of its new investment, representing a 85% drop on the corresponding figure reported in June, 2021.

The round included a slew of new and existing investors, including Sequoia, Silver Lake, Commonwealth Bank of Australia, the UAE’s sovereign fund Mubadala Investment Company, and Canada Pension Plan Investment Board (CPP Investments).

A positive spin

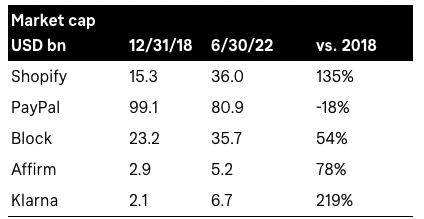

Keen to put something of a spin on the announcement, Klarna highlights the “worst stock downturn in 50 years” in its own press release headline, while further down it also tries to paint a prettier picture by showing how its stock today looks against 2018 — and it uses well-known publicly-traded fintechs for comparison. It perhaps is no surprise to learn that Klarna looks pretty decent with this hand-picked dataset.

Klarna’s valuation comparisons since 2018

The insinuation here is that while Klarna’s valuation may have fallen off a cliff when taking a short-term view, it’s actually performing not too badly on the grand scheme of things.

While many companies have undergone something of a “correction” following pandemic-induced crazy times, it’s worth looking at Klarna’s valuations from each of the years between 2018 and 2022 to get a little more perspective on things. In 2019, Klarna was valued at $5.5 billion, followed by $10.6 billion in 2020 and $31 billion in March 2021, before hitting the giddy heights of $45.6 billion just a few months later.

So Klarna hasn’t just dipped from its previous valuation, it’s still markedly down on its valuation in 2020, and only marginally up on its valuation from the year before that. But hey, compared to 2018, things are great.

That all said, there probably is something to Klarna’s spin. Its valuation is a reflection of what its investors think and doesn’t necessarily reflect what customers think, and it’s far from the only company to see such a downfall. Roughly a year-and-a-half on from its big IPO, Klarna’s rival Affirm has also endured turbulent times, with its shares plummeting over the past year — it too is now valued at roughly the same amount as Klarna, after its market cap peaked last year at around $47 billion.